1. Forex Market Insight

EUR/USD

EUR/USD closed up 0.18% on Thursday, 11th August 2022, at 1.0317. The risk of economic contraction continues and the euro is under pressure due to political instability in Italy. This winter, with inflation peaking, the eurozone will likely see a slight recession.

However, the analysis says that if consumers can be protected at the worst moments of the energy crisis, the eurozone may be able to escape a mild recession.

If eurozone governments provide strong support for households and businesses, as well as lower gas prices next year, the value of eurozone output is expected to contract by 0.3% in the fourth quarter and 0.2% in the next quarter, with GDP growth slowing to 3.3% in 2022 as a whole.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0277-line today. If EUR runs steadily below the 1.0277-line, then pay attention to the support strength of the two positions of 1.0190 and 1.0116. If the strength of EUR breaks above the 1.0277-line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD closed down 0.05% on Thursday, 11th August 2022, at 1.2192. Already weighed down by the poor health of the economy and public finances, the pound threatens a new round of storms as the frontrunner to become Britain’s next prime minister proposes changes to the central bank’s mandate.

Foreign Secretary Terence Truss, who is leading the race to become Britain’s next prime minister, recently made a further call for an assessment of the Bank of England’s mandate and raised the possibility of setting a new money supply target.

In response to the reactivation of the money supply target, there is concern that Truss may be suggesting that this is a way to loosen monetary policy and get the economy more fired up.

Inflation is rising at a time when the money supply has been shrinking in recent months, hinting at the risk of economic contraction.

Technical Analysis:

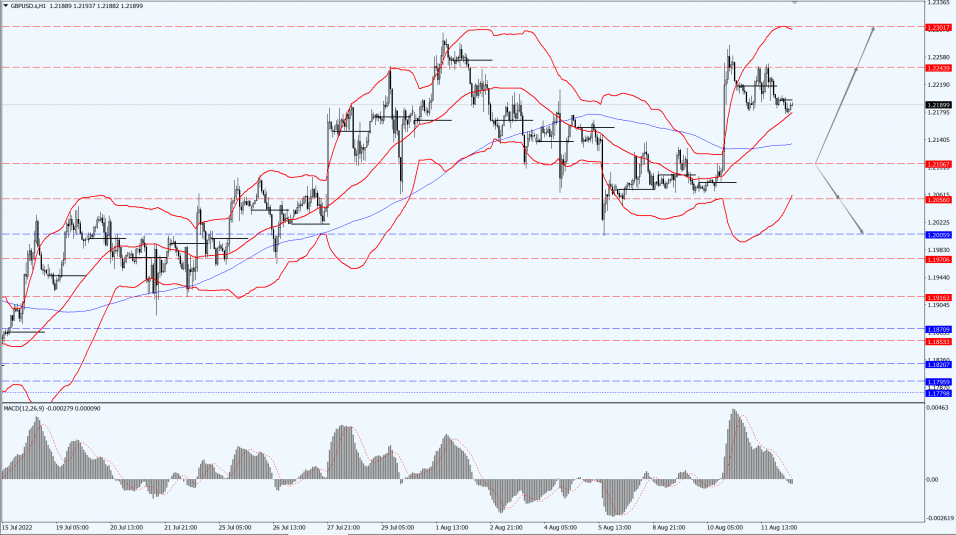

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2106-line today. If GBP runs below the 1.2106-line, it will pay attention to the suppression strength of the two positions of 1.2056 and 1.2005. If GBP runs above the 1.2106-line, then pay attention to the suppression strength of the two positions of 1.2243 and 1.2301.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell on Thursday, 11th August 2022, weighed down by the prospect that the Federal Reserve will raise interest rates further, despite data showing signs that U.S. inflation is topping out.

Data showed that U.S. producer prices unexpectedly fell in July as energy product prices retreated and core producer price inflation appeared to be on a downward trend.

The relatively dovish U.S. consumer price index (CPI) data for July released on Wednesday, 10th August 2022, pushed the market to reduce bets on aggressive interest rate hikes by the Federal Reserve, giving non-yielding gold a slight boost.

However, that optimism faded after Fed policymakers indicated they would continue to tighten monetary policy until price pressures were fully broken.

The Labor Department reported Thursday that initial jobless claims rose for a second straight week, indicating a further slowdown in the labor market.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1783-line today. If the gold price runs steadily below the 1783-line, then it will pay attention to the support strength of the 1768 and 1760 positions. If the gold price breaks above the 1783-line, then pay attention to the suppression strength of the two positions of the 1793 and 1807.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose more than 2.5% on Thursday, 11th August 2022, after the International Energy Agency (IEA) raised its forecast for oil demand growth this year as soaring gas prices caused some consumers to switch to oil.

The IEA said in its monthly oil report that soaring natural gas and electricity prices to record highs have spurred some countries to switch from using natural gas to oil, and the agency raised its demand growth forecast for 2022 by 380,000 barrels per day in the report.

In contrast, the Organization of Petroleum Exporting Countries (OPEC) cut its forecast for global oil demand growth in 2022 for the third time since April, due to the economic impact of the conflicts in Russia and Ukraine, high inflation and the continued implementation of new crown sealing measures.

OPEC expects oil demand to increase by 3.1 million barrels per day in 2022, a downward revision of 260,000 barrels per day from its previous forecast.

OPEC’s forecast for total global oil demand in 2022 remains higher than the IEA. Oil prices were also boosted by the continuation of the dollar’s decline.

The dollar subsequently fell after a report showed that U.S. inflation in July was lower than expected and traders lowered their expectations for a Federal Reserve rate. hike.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 91.54-line today. If the oil price runs above the 91.54-line, then focus on the suppression strength of the two positions of 92.66 and 95.50. If the oil price runs below the 91.54-line, then pay attention to the support strength of the two positions of 90.44 and 88.02.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.