1. Forex Market Insight

EUR/USD

The euro fell to a lowest level against the dollar at 0.9806 on Monday, 25th October 2022 before rebounding and finally closing up 0.12% at 0.9874.

Recession fears continue to weigh on the euro. Eurozone PMI data sank in October, confirming Deutsche Bank’s assessment that the German economy will contract significantly in the fourth quarter of this year.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9852 line today. If the EUR runs below the 0.9852 line, then pay attention to the support strength of the two positions of 0.9810 and 0.9764. If the strength of EUR rises over the 0.9852 line, then pay attention to the suppression strength of the two positions of 0.9909 and 0.9999.

GBP Intraday Trend Analysis

Fundamental Analysis:

There was a lot of movement in the Pound followed by the appointment of the country’s former Chancellor of the Exchequer, Rishi Sunak, as leader of the British Conservative Party, which clearing the path for him to become the next prime minister.

On the other side of the Atlantic, a slowdown in Fed policy could help lift the pound, even more than the U.K.’s fiscal policy.

The pound ended with down 0.16% at $1.12915, off the overnight highs above $1.14.

Technical Analysis:

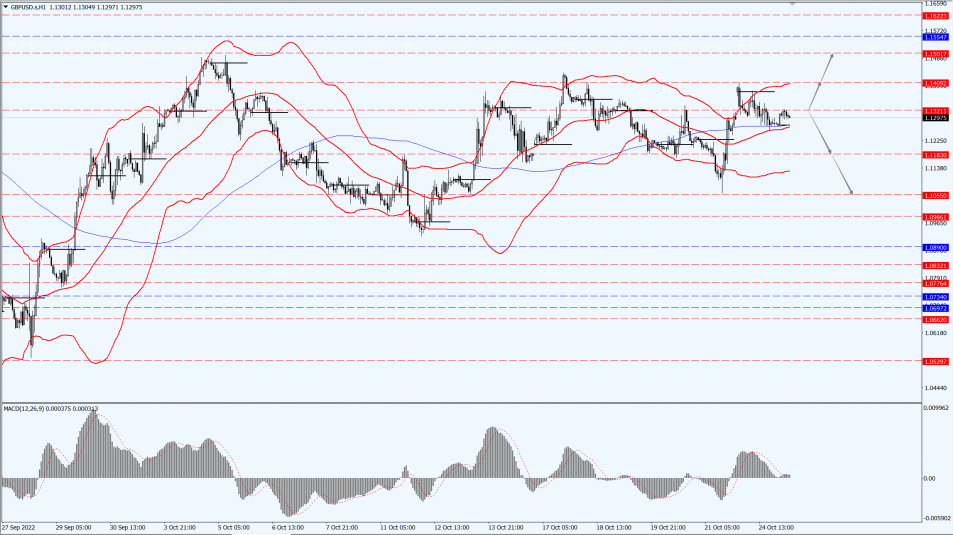

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1321-line today. If GBP runs below the 1.321 -line, it will pay attention to the suppression strength of the two positions of 1.1183 and 1.1055. If GBP runs above the 1.1321 -line, then pay attention to the suppression strength of the two positions of 1.1409 and 1.1501.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices slipped Monday, 25th October 2022 weighed down by a firm dollar and rising U.S. bond yields, while expectations of another sharp interest rate hike by the Federal Reserve kept investors on the sidelines.

The dollar rose 0.2%, making dollar-denominated gold more expensive for overseas buyers, while the yield on the index 10-year Treasury hovered near its recent peak.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1645-line today. If the gold price runs below the 1645-line, then it will pay attention to the support strength of the 1637 and 1627 positions. If the gold price breaks above the 1645-line, then pay attention to the suppression strength of the two positions of the 1654 and 1660.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed lower in choppy trading on Monday, 25th October 2022. Data showed Asian demand remained lackluster in September and a stronger dollar weighed on the oil market, but weak U.S. corporate activity data eased expectations for more aggressive interest rate hikes and limited oil price losses.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 84.08 line today. If the oil price runs above the 84.08-line, then focus on the suppression strength of the two positions of 85.53 and 86.77. If the oil price runs below the 84.08-line, then pay attention to the support strength of the two positions of 82.99 and 81.81.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.