1. Forex Market Insight

EUR/USD

EUR/USD closed up 0.22% on Tuesday, 9th August 2022, at 1.0212. The risk of recession still limits the euro’s upside.

Analysts believe that the eurozone recession may be difficult to avoid. Even some experts predict that the eurozone will be the latest technical recession in the first quarter of 2023. The dilemma facing the eurozone is not an isolated case.

Under the influence of global inflation and geopolitical factors, the central banks of the world’s major economies have raised interest rates one after another. While addressing the challenge of inflation, they are also avoiding economic recession.

However, juggling between these matters is not an easy task. Insiders claim that the central banks of major economies around the world have lagged behind that economic performance situation in raising interest rates.

If the subsequent market faces greater volatility, the vision of a “soft landing” for the economy will not be easy to achieve.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0190-line today. If EUR runs steadily below the 1.0190-line, then pay attention to the support strength of the two positions of 1.0116 and 0.9999. If the strength of EUR breaks above the 1.0190-line, then pay attention to the suppression strength of the two positions of 1.0277 and 1.0357.

GBP Intraday Trend Analysis

Fundamental Analysis:

Bank of England (BoE) Bailey said that inflation pressures have increased significantly recently and the UK economy is expected to enter a recession later this year.

Recent polls show British Foreign Secretary Truss ahead in the election.

Market participants need to keep an eye on future polls, with the pound strengthening if Sunaq becomes the next prime minister.

Conversely, if Truss becomes the next prime minister, the pound is likely to weaken.

Technical Analysis:

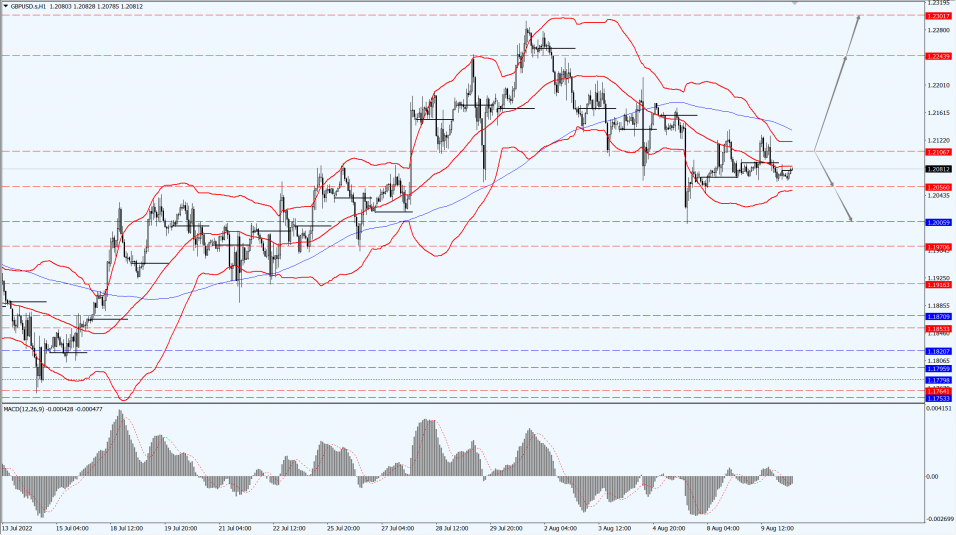

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2106-line today. If GBP runs below the 1.2106-line, it will pay attention to the suppression strength of the two positions of 1.2056 and 1.2005. If GBP runs above the 1.2106-line, then pay attention to the suppression strength of the two positions of 1.2243 and 1.2301.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose on Tuesday, 9th August 2022, helped by a weaker dollar, as market participants awaited U.S. inflation data for clues about the Fed’s tightening policy path.

U.S. CPI data for July will be released on Wednesday, 10th August 2022. A survey released by the New York Fed on Monday showed that U.S. consumers’ expectations for inflation one and three years from now fell sharply in July.

Analysts interviewed by Reuters expect the annual U.S. inflation rate to slow to 8.7 percent in July from 9.1% in June.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1783-line today. If the gold price runs steadily below the 1783-line, then it will pay attention to the support strength of the 1768 and 1760 positions. If the gold price breaks above the 1783-line, then pay attention to the suppression strength of the two positions of the 1793 and 1807.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed slightly lower on Tuesday, 9th August 2022, with intraday movements sawing as concerns that a slowing economy could cut demand and news of the suspension of some oil exports from the Russia-to-Europe pipeline through Ukraine combined to weigh on the market.

Oil prices have been under pressure for weeks due to fears that the recession could cut into oil demand.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 90.44-line today. If the oil price runs above the 90.44-line, then focus on the suppression strength of the two positions of 91.54 and 93.57. If the oil price runs below the 90.44-line, then pay attention to the support strength of the two positions of 88.02 and 85.72.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.