1. Forex Market Insight

EUR/USD

The euro rose 0.5% against the dollar to $1.02965, buoyed by the Fed’s mega-rate hikes that have led to a stronger dollar and weaker euro so far this year as the Fed battles inflation.

But recent U.S. consumer price data came in below expectations, which has fueled investor hopes that the Fed may slow the pace of interest rate hikes. Market expectations for the Eurozone PMI data were poor, favoring the dollar.

Technical Analysis:

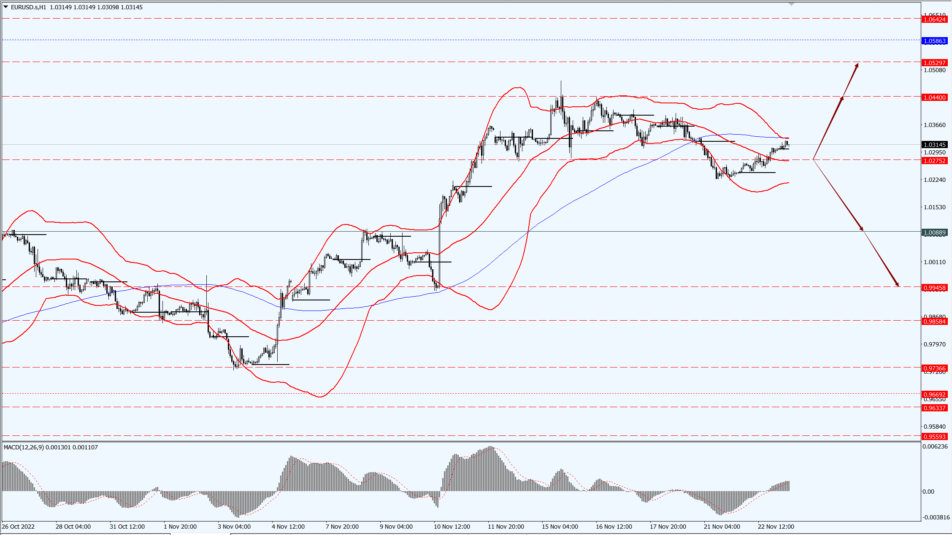

(EUR/USD 1-hour Chart)

We focus on the 1.0275 line today. If the EUR runs below the 1.0275 line, then pay attention to the support strength of the two positions of 1.0088 and 0.9945. If the strength of EUR rises over the 1.0275 line, then pay attention to the suppression strength of the two positions of 1.0440 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rose 0.52% against the dollar to close at 1.1882 on Tuesday 23rd November 2022 after data showed that the U.K. government borrowing less than expected in October, although the budget deficit is likely to balloon in coming months due to energy subsidy measures and a slowing economy.

The U.K. economy has entered recession in the third quarter and the country’s economy is expected to continue shrinking for much of 2023, with GDP falling 2.0% from peak to trough. The economy is shrinking due to a squeeze on real incomes for consumers and businesses, weaker external demand, and tighter monetary policy from the Bank of England.

UK GDP growth is expected to change to -1.3% in 2023 from 4.3% in 2022 as high inflation and high interest rates are likely to continue to squeeze consumers’ actual incomes. The U.K. government’s fiscal stimulus, particularly the freeze on energy bills, means that the extent of the recession will be less severe than it would have been without the intervention.

Technical Analysis:

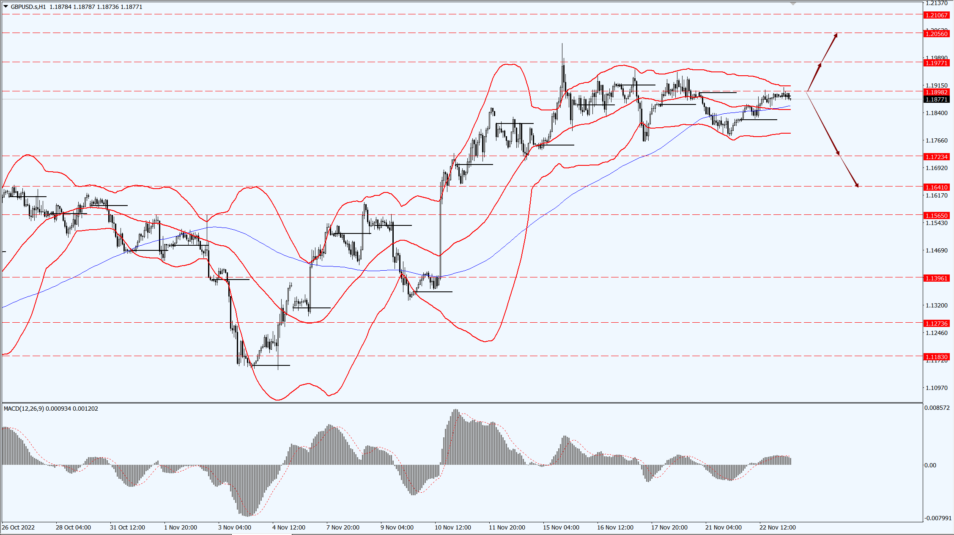

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1898-line today. If GBP runs below the 1.1898-line, it will pay attention to the suppression strength of the two positions of 1.1723 and 1.1641. If GBP runs above the 1.1898-line, then pay attention to the suppression strength of the two positions of 1.1977 and 1.2056.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices held above the lows touched in the previous session on Tuesday 23rd November 2022 as the dollar and index U.S. bond yields retreated largely offset by gains in stocks, as investors awaited clues about the path of the Federal Reserve’s monetary policy.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1727-line today. If the gold price runs below the 1727-line, then it will pay attention to the support strength of the 1717 and 1703 positions. If the gold price breaks above the 1727-line, then pay attention to the suppression strength of the two positions of 1747 and 1754.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose about 1% on Tuesday after Saudi Arabia, the world’s largest oil exporter, said OPEC+ is sticking to production cuts and may take further steps to balance the market.

However, oil prices cut gains in late trading after reports that the European Union delayed plans to fully implement a price cap on Russian oil exports and softened key transport provisions, downplaying its latest sanctions proposal. Reports said the EU proposed adding a 45-day transition period to the introduction of the price cap.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 80.10 line today. If the oil price runs above the 80.10-line, then focus on the suppression strength of the two positions of 82.78 and 84.06. If the oil price runs below the 80.10-line, then pay attention to the support strength of the two positions of 79.07 and 77.54.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.