1. Forex Market Insight

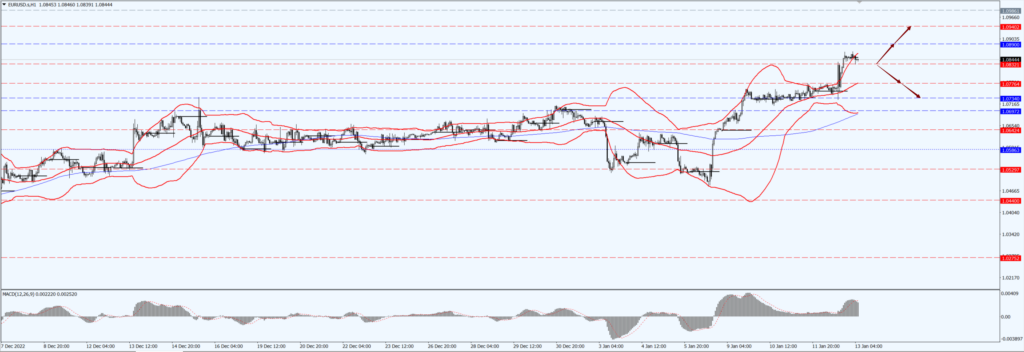

EUR/USD

The euro rose to a near nine-month high of 1.0867 against the dollar before finally settling at 1.0852, up 0.83% on the day.

The hawkish message from ECB officials continues, with four officials recently calling for continued interest rate hikes, and the ECB’s firm attitude towards rate hikes has given the euro corresponding support.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0832 line today. If the EUR runs below the 1.0832 line, then pay attention to the support strength of the two positions of 1.0776 and 1.0734. If the strength of EUR rises over the 1.0832 line, then pay attention to the suppression strength of the two positions of 1.0890 and 1.0940.

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound rose 0.51% against the dollar to 1.2210, after touching an intraday high of 1.2247. The pound rose yesterday, thanks entirely to the continued decline in the U.S. inflation rate in December.

The further decline in the inflation rate reinforced investors’ expectations that the Fed will move into a tapered rate hike phase.

This is why the dollar has fallen sharply. If there is no big negative news from the UK in the near future, the pound may continue to maintain an upward trend against the dollar.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2111-line today. If GBP runs below the 1.12111-line, it will pay attention to the suppression strength of the two positions of 1.2010 and 1.1902. If GBP runs above the 1.2111-line, then pay attention to the suppression strength of the two positions of 1.2222 and 1.2311.

2. Precious Metals Market Insight

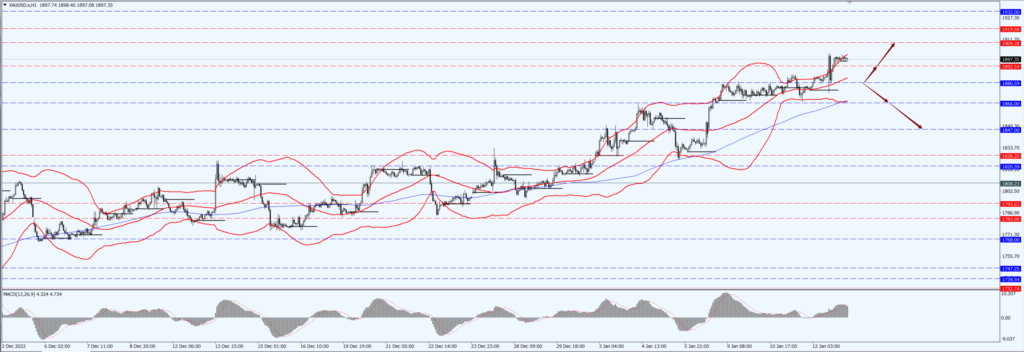

Gold

Fundamental Analysis:

Gold prices rose more than 1% on Thursday, 12th January 2023, hitting the $1,900/oz mark, as the U.S. Labor Department released December CPI data, with both headline and core inflation moving lower as expected.

However, the initial jobless claims released at the same time last week were lower than expected, showing that the labor market remains resilient.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1880-line today. If the gold price runs below the 1880-line, then it will pay attention to the support strength of the 1866 and 1847 positions. If the gold price breaks above the 1880-line, then pay attention to the suppression strength of the two positions of 1892 and 1909.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose on Thursday, 12th January 2023 benefiting from a weaker dollar and optimistic expectations for demand, with Biden not ruling out any options to keep energy prices low and not ruling out the possibility of further releases of strategic oil reserves, according to Rouse, chairman of the White House Council of Economic Advisers.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 77.76- line today. If the oil price runs above the 77.76 -line, then focus on the suppression strength of the two positions of 76.07 and 80.13. If the oil price runs below the 77.76 -line, then pay attention to the support strength of the two positions of 76.94 and 76.07.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.