1. Forex Market Insight

EUR/USD

The euro fell to its lowest level against the dollar since July 2020 as markets considered the risk of a resurgence of the outbreak triggering a further lockdown in Europe.

The euro fell by 0.47% against the dollar to 1.1237, with profit-taking ahead of the U.S. Thanksgiving holiday easing losses. Fears of new restrictions in Europe intensified as Austria entered another full lockdown and Germany considered following suit, dragging the euro lower. This is somewhat of a combo blow to the euro.

The surge in new cases across the eurozone, which has strengthened the outlook for an absolutely dovish ECB policy, in sharp contrast to the Fed, is under increasing pressure to accelerate the pace of policy normalization.

Technical Analysis:

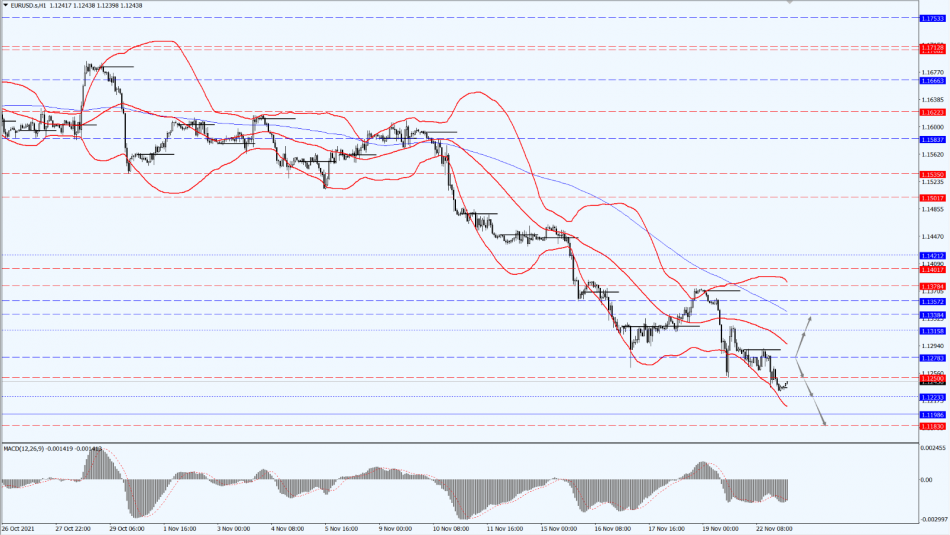

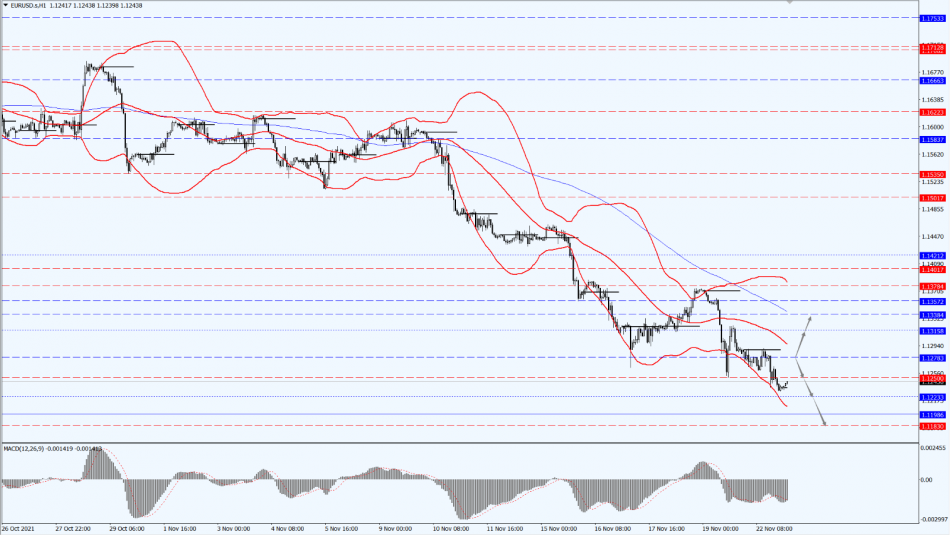

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1278-line. If the euro runs stably below the 1.1278-line, maintain the bearish trend. Below, pay attention to the support at 1.1223 and 1.1183-line. If the strength of the euro breaks through the 1.1278-line, then pay attention to the repressive strength of the location at 1.1315 and 1.1338.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound fell by 0.40% against the dollar to 1.3397 as risk aversion gripped the market. The pound fell against the dollar earlier as comments from Bank of England policymakers brought into question the certainty of a December rate hike.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3450-line. If the pound runs below the 1.3450-line, then pay attention to the 1.3302-line of support. If the pound breaks through the 1.3450-line, then pay attention to the 1.3522-line of suppression.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

The dollar index hit a 16-month high yesterday and U.S. bond yields climbed as President Joe Biden nominated Powell for re-election as the chairman of the Federal Reserve and nominated Fed Governor Brainard as the vice chairman.

Gold futures for December delivery on the COMEX fell by $45.3, or 2.45%, to close at $1,806.3 an ounce, recording the biggest one-day drop in 3 1/2 months. Against this background, the U.S. bond rates and the dollar moved higher, putting pressure on gold prices.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

As long as gold runs stably below the 1831-line today, it will still maintain a bearish stance. With this, pay attention to the support of the two positions of 1800 and 1787 in turn. Once the gold price rises above the 1831-line, pay attention to the suppression of the 1844-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

The U.S. oil futures rose by $0.81 to settle at $76.75 per barrel yesterday. According to foreign media reports, the Organization of Petroleum Exporting Countries (OPEC) and OPEC+, a group of its allies, may adjust their plans to raise oil production if major consuming countries release crude oil from their reserves or if the pandemic curbs demand again, causing oil prices to rebound and close higher.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are still paying attention to the 75.04-line. If oil prices run above the 75.04-line, then pay attention to the suppression of the 76.89 and 78.92 positions in turn. If the oil price drops below 75.04, it will open up further downside space. At that time, pay attention to the support of the 73.52-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home