1. Forex Market Insight

EUR/USD

The euro fell 1.5% to $0.9689, after hitting its lowest since October 2002.

The decline was triggered in part by a further decline in the S&P Global Eurozone Composite Purchasing Managers’ Index (PMI), which is considered a good indicator of overall economic health, in September.

The slump in German business activity deepened as higher energy costs hit Europe’s largest economy and companies saw a drop in new business; the euro posted its worst weekly performance since March 2020.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9770-line today. If EUR runs steadily below the 0.9770-line, then pay attention to the support strength of the two positions of 0.9701 and 0.9559. If the strength of EUR breaks above the 0.9770-line, then pay attention to the suppression strength of the two positions of 0.9810 and 0.9879.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD touched a new 37-year low of $1.0840, the biggest weekly drop in two years.

The British pound was the day’s biggest loser against the dollar, down 3.4% at $1.0874, the biggest one-day percentage drop in two years.

As prices sank, U.K. Treasury yields also soared. The U.K. 10-year indicator yield spiked to 3.829%, a level not seen since April 2011.

Previous surveys have shown that business activity across the U.K. is declining at an accelerated rate and the economy may be entering a recession.

Also putting pressure on the pound was the announcement of tax cuts and household and business support measures by Britain’s new Chancellor of the Exchequer, as the Government Debt Office laid out plans to issue an additional 72 billion pounds ($79.74 billion) this fiscal year to fund stimulus measures.

Technical Analysis:

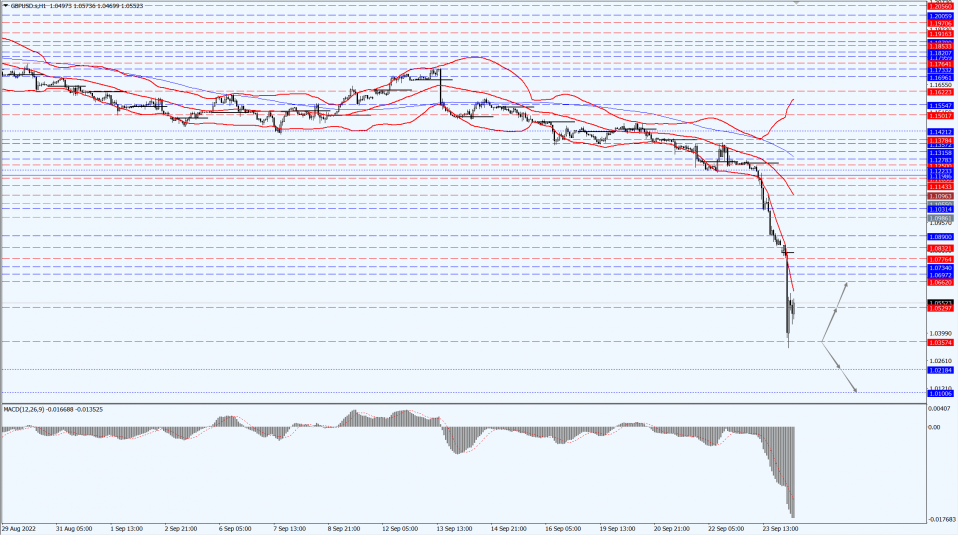

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.0357-line today. If GBP runs below the 1.0357-line, it will pay attention to the suppression strength of the two positions of 1.0218 and 1.0100. If GBP runs above the 1.0357-line, then pay attention to the suppression strength of the two positions of 1.0529 and 1.0662.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell more than 1.5% on Friday, 23rd Friday 2022, to their lowest point since April 2020, weighed down by a sharp rally in the dollar and Treasury yields as the Federal Reserve adopted a more aggressive stance to curb soaring inflation.

Gold prices have fallen about 1.8% last week, their second straight weekly decline.

Technical Analysis:

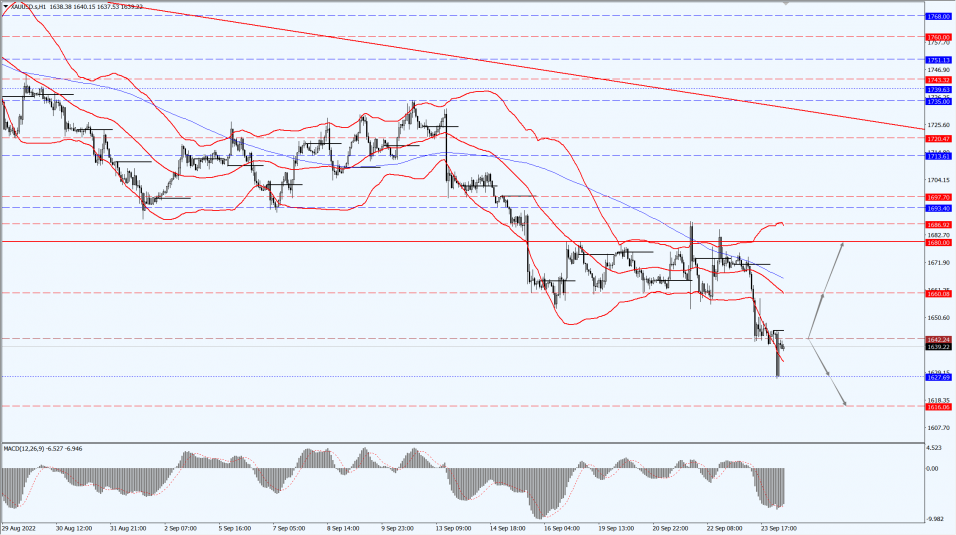

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1642-line today. If the gold price runs steadily below the 1642-line, then it will pay attention to the support strength of the 1627 and 1616 positions. If the gold price breaks above the 1642-line, then pay attention to the suppression strength of the two positions of the 1660 and 1680.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices tumbled about 5% on Friday, 23rd September 2022, to an eight-month low.

That’s as the dollar hit a more than 20-year high and there are concerns that rising interest rates will tip major economies into recession, slashing demand for oil.

Technical Analysis:

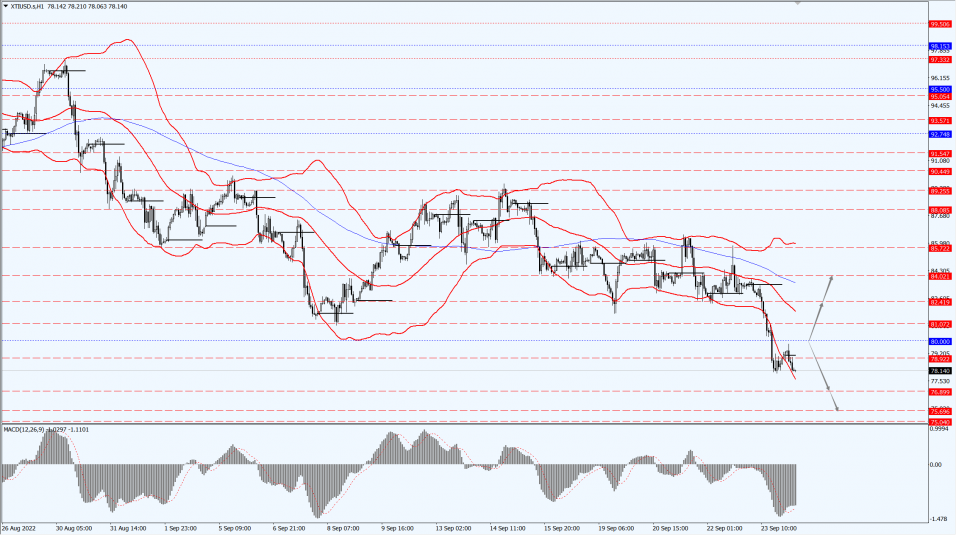

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 80.00-line today. If the oil price runs above the 80.00-line, then focus on the suppression strength of the two positions of 82.41 and 84.02. If the oil price runs below the 80.00-line, then pay attention to the support strength of the two positions of 76.89 and 75.69.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.