1. Forex Market Insight

EUR/USD

The current trend in the currency market shows that the market digested the possibility of a Fed rate hike in June next year, and then again in November.

According to the Chicago Mercantile Exchange, there is a 50% chance of a 25-basis point rate hike by July 2022. The market believes that the key interest rate will be raised in the second half of next year, while the dollar will still be “buy low” in the short term. The euro was essentially flat against the dollar, and fell by 0.5% to 1.1264 during the day.

Technical Analysis:

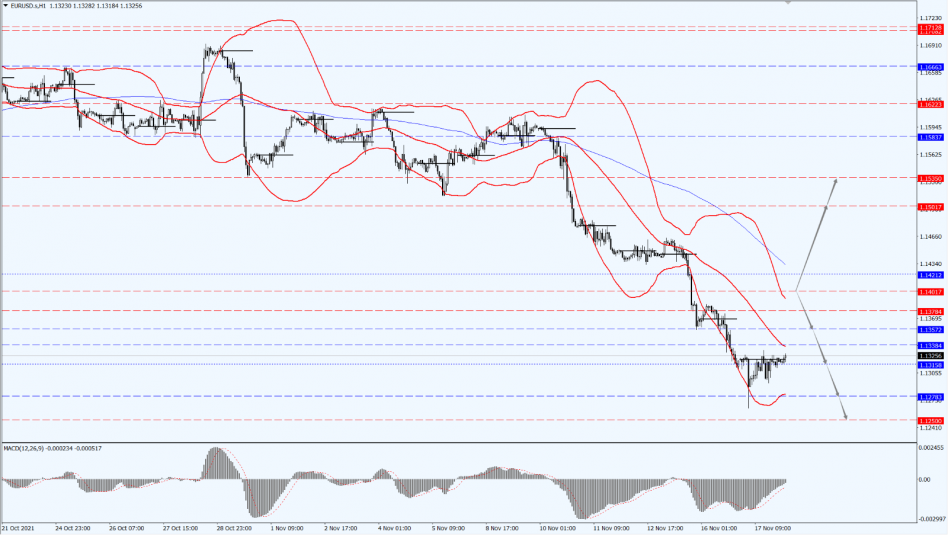

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1401-line. If the euro runs stably below the 1.1401-line, keep the bearish trend. Below, pay attention to the support at 1.1278 and 1.1250. If the strength of the euro breaks through the 1.1401-line, it will open up a further upside. At that time, pay attention to the suppression of the two positions at 1.1501 and 1.1535.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBPUSD rose by 0.48% to 1.3496 at one point, before falling back to 1.3487 in late trading. If the economic activity data shows that economic momentum is picking up, with retail sales data due out on Friday, GBPUSD will likely see a rally by the end of the month as the market begins to fully digest the Bank of England’s rate hike expectations.

Technical Analysis:

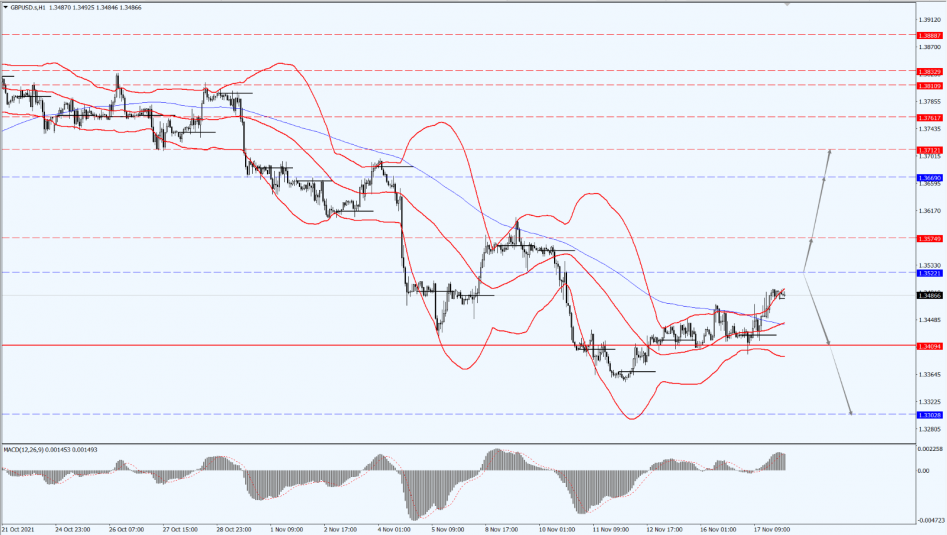

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3522-line. If the pound runs below the 1.3522-line, then pay attention to the support at the 1.3302 and 1.3186 positions in turn. If the pound breaks through the 1.3522-line, pay attention to the suppression at the 1.3574 and 1.3669 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

The underlying support for gold is still the inflationary pressures that continue to be seen in the market. If Fed policymakers hint in the near term that they may accelerate tapering of asset purchases to fight inflation, or if the market believes that interest rates will rise sooner than expected, gold prices could come under “slight pressure”.

Technical Analysis:

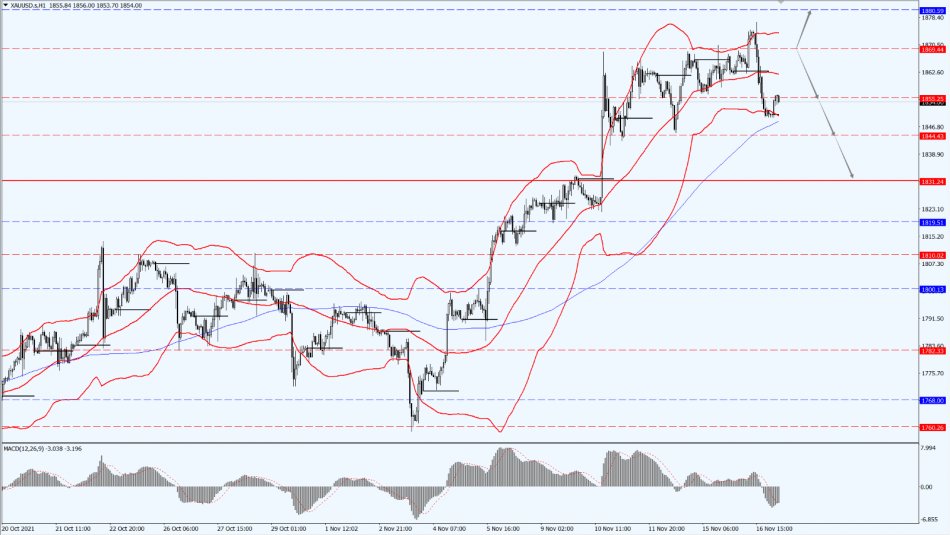

(Gold 1-hour chart)

Trading Strategies:

Gold is still paying attention to the 1869-line today. If the price of gold runs stably below the 1869-line, it will still maintain the bearish trend. At that time, pay attention to the support of the 1844 and 1831 positions. If the gold price breaks the 1869-line, it will open up a further upside. At that time, pay attention to the suppression of the 1880-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices plunged yesterday, with the U.S. oil plunging by 3.5% to a new low of $76.93 per barrel since Nov. 7, with the oil settlement price falling to its lowest level since early October, after the Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA) warned of an impending supply glut and an increase in the Covid-19 cases in Europe exacerbating downside risks to the demand recovery.

Technical Analysis:

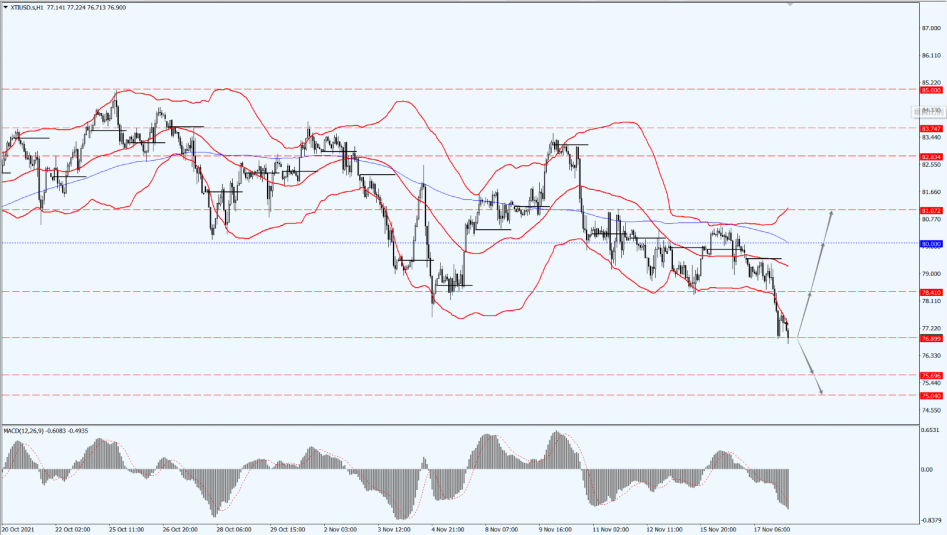

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 76.89-line. If the oil price runs above the 76.89-line, the pressure at 78.41 and 80 will be followed in turn. If the oil price drops below 76.89, a further downside space will be opened. At that time, pay attention to the strength of the two positions at 75.69 and 75.04.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.