1. Forex Market Insight

EUR/USD

Yesterday, the U.S. dollar index rose by 0.26% to 94.11. The market has fully digested the expectation that the Fed will release a tapering statement and will look for any clues on when to start raising interest rates. The impact of the rise in the U.S. index caused the euro to fluctuate downward.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1622-line. If the euro runs steadily below the 1.1622-line, maintain the bearish trend and focus on the support at 1.1583 and 1.1535 in turn. If the euro breaks through the 1.1622-line, then pay attention to the suppression of the 1.1666-line.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Monetary Policy Committee has been engaged in a heated debate on whether to raise interest rates this week. Financial markets believe that a rate hike is a foregone conclusion due to a series of hawkish interventions by Bank of England Governor Bailey.

Our baseline forecast is that the BoE will not raise rates this week, and if the end of the furlough program does not derail the labor market, it will raise interest rates in December.

The Monetary Committee is expected to vote 5-4 in favor of keeping rates unchanged at 0.1%. Meanwhile, the rest of the committee is likely to vote in favor of maintaining the £895 billion asset purchase target.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3712-line. If the pound runs below the 1.3721-line, then pay attention to the support at 1.3669 and 1.3574 in turn. If the pound breaks through the 1.3712-line, pay attention to the suppression of the 1.3761-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Yesterday, gold prices fell slightly, mainly because the dollar and U.S. stocks rose before the Fed resolution. However, the decline in U.S. bond yields supported the price of gold.

For intraday, focus on the Fed interest rate resolution, in addition to the “small non-farm” ADP employment, non-manufacturing PMI and factory orders need to pay close attention, gold prices may usher in a big market day.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the first line of 1782. If the price of gold runs steadily above the first line of 1782, then pay attention to the suppression of the first line of 1800. If the price of gold falls below the first line of 1782, it will open up further downside space. At that time, pay attention to the support of the two positions of 1768 and 1760.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. crude oil weakened slightly, once hitting a three-day low of $82.43 per barrel. Meanwhile, API data showed an increase in inventories in the morning, and the dollar strengthened, reducing the attractiveness of dollar-denominated commodities.

The market speculated that the Fed will scale back asset purchases. Adding to that, the market’s focus will also be on China’s October Caixin services PMI, U.S. October ADP employment, U.S. September final monthly durable goods orders, EIA crude oil inventory data and the Thursday at 2:00 the Federal Reserve announced its interest rate resolution.

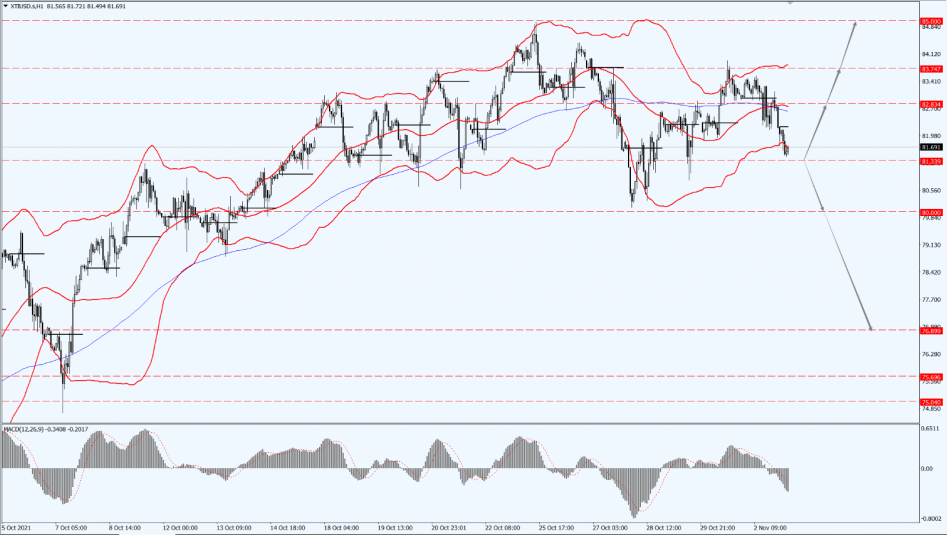

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 81.33-line. If oil prices run stably above the 81.33-line, then pay attention to the suppression of the 82.83 and 83.74 positions in turn. If the oil price breaks below the 81.33-line, it will open up further downside space. At that time, pay attention to the support strength in two positions of 80 and 76.89.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home