1. Forex Market Insight

EUR/USD

The euro outperformed most currencies yesterday, rising by 0.35% against the dollar to 1.1279. The euro rebounded yesterday, thanks to safe-haven buying and lower U.S. bond yields.

The euro has led the rise of major currencies with a 0.3% gain since Friday, despite the spread of the virus that may cause the eurozone to further implement stricter restrictions and face an economic downturn.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the suppression of the 1.1338-line. If the euro runs stably below the 1.1338-line, then pay attention to the support at 1.1226 and 1.1198 below. If the euro breaks through the 1.1338-line, then pay attention to the suppression at 1.1359 and 1.1378.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England entered the interest rate hike cycle ahead of the Federal Reserve and the ECB will provide strong support for the pound in the short term.

The pound and the euro are heading in roughly the same direction relative to the dollar, and the pound continues to outperform the euro.

Raising interest rates before the United States is also conducive to slowing the flow of funds out of the United Kingdom, and even part of the return to the United Kingdom.

The recent market attitude towards the central bank has shown that a more hawkish attitude is beneficial to the (UK) stock market-reducing the risk of out-of-control inflation.

Technical Analysis:

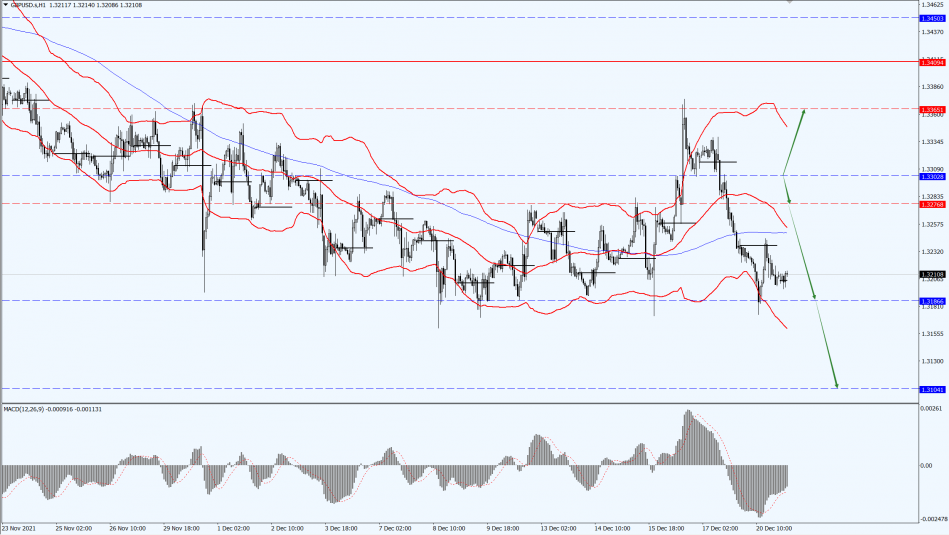

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3302-line. If the pound runs below the 1.3302-line, then pay attention to the support of the 1.3186 line. If the pound strength rises above the 1.3302-line, then pay attention to the suppression of the 1.3365 and 1.3409 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices eased slightly yesterday as the market tried to gauge the impact of a spike in Omicron infection cases and how effective a Fed rate hike could be in curbing a surge in inflation.

Separately, trials show that Moderna’s booster shots can increase antibody levels against Omicron by 37 times, have slightly weakened market risk aversion. However, the decline in the dollar and U.S. stocks brought some support to gold prices. Intraday focus on the U.S. third-quarter current account and Biden’s speech on the Covid-19 outbreak.

Technical Analysis:

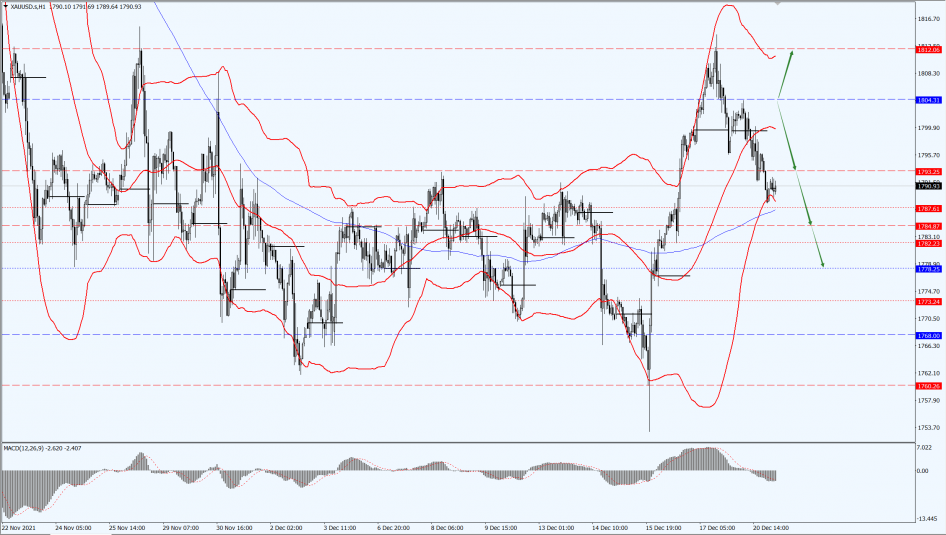

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the 1804-line. If the price of gold runs below the 1804-line, then pay attention to the support of the 1784 and 1778 positions. If the gold price breaks through the 1804-line again, it will open up a further upward space. At that time, pay attention to the suppression of 1812 .

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, the futures of Brent oil fell by $2, or 2.7%, to settle at $71.52 per barrel. With the Omicron virus variant rampaging and the Biden economic plan going sour, pessimism spread throughout the financial markets, sending oil prices deeper down by about 6% at one point.

However, it should be noted that the implementation rate of the OPEC+ production cut agreement increased in November, which may bring support to oil prices. Two sources from the Organization of the Petroleum Exporting Countries (OPEC) and the OPEC+ coalition of its allies said on Monday, 20th December 2021, that the implementation rate of the production cut agreement increased to 117 percent in November from 116 percent a month ago, indicating that production levels are still well below the previously agreed target.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices today focus on the 68.57-line. If oil prices run below the 68.57-line, then pay attention to the 66.33 support strength. If oil prices run steadily above the 68.57-line, then pay attention to the two positions of suppression strength at 69.37 and 70.49.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.