1. Forex Market Insight

EUR/USD

The euro is under pressure due to the new wave of Covid-19 hitting Europe. In the past few days, the Covid-19 pandemic in Europe continues to worsen. The number of new confirmed cases reported in some countries on the 18th November 2021 hit a new high since the pandemic.

The World Health Organization’s weekly report on the global Covid-19 pandemic released on the 16th shows that in the past week in Europe, there were 230 new confirmed cases per 100,000 people in 7 days, the highest in the world.

Facing the new wave of the pandemic, many European countries have tightened their pandemic prevention measures and promoted vaccination.

Speaking to MEPs on Monday, 22nd November 2021, Lagarde said we can expect price pressures on goods and services to normalize as the recovery continues and supply bottlenecks ease. We expect the wage growth next year will likely to be higher than this year, but the risk of a second round of effects remains limited.

Inflation in the euro area is at its highest level since 2008, driven by higher energy prices, supply chain disruptions and other epidemic-related effects. Many economists agree with the European Central Bank (ECB) that price increases will fall back below target levels in 2023, but some areas of the region are freaking out about price spikes.

Lagarde said the ECB’s action now to curb price increases is not the appropriate response because the time span for monetary policy to exert its influence. If we take any tightening measures on the current situation, it will actually do more harm than good, as these measures will start to have an impact when inflation actually returns to lower levels.

The ECB is set to decide the future of its monetary stimulus program at next month’s meeting, when it will receive new economic forecasts. The ECB’s 1.85 trillion euro ($2.1 trillion U.S. dollars) pandemic bond purchase program will end next March, and a boost to the regular asset purchase program is also under discussion.

For the prospect of a rate hike by the ECB, Lagarde made clear that a rate hike is unlikely. She said that a rate hike next year – as recent financial markets have suggested – is unlikely to happen.

Even after the expected end of the pandemic emergency, it remains important to allow monetary policy – including appropriate fine-tuning of the asset purchase program – to support economic recovery across the euro area and a sustainable return to our target for inflation.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1338-line. If the euro runs steadily below the 1.1338-line, maintain the bearish trend. Below, pay attention to the support at 1.1250 and 1.1198. If the strength of the euro breaks through the 1.1338-line, it will open up further upside. At that time, pay attention to the suppression of the two positions at 1.1378 and 1.1401.

GBP Intraday Trend Analysis

Fundamental Analysis:

Rising expectations of a December interest rate hike by the Bank of England support the pound. After the U.K. government’s welfare program for the unemployed ended during the pandemic, the labor market strengthened, increasing the reason for the Bank of England to raise interest rates as soon as next month.

Data showed that in October, companies added 160,000 jobs and the number of job vacancies surged to a record high. The figures show that few of the 1.1 million workers on leave were unemployed when the welfare program ended in September.

A separate survey showed that the vast majority of workers who took leave at the end of September returned to work. A survey released by a British think tank late last week found that only 12 percent (about 136,000 people) were no longer employed in October, with most of them choosing to be inactive rather than unemployed.

This coincides with an ONS survey which found that only 3% were laid off. It underscores the success of the 19-month-long compulsory leave program in helping workers withstand the effects of the epidemic.

Bank of England Governor Tony Blair said the employment data is one of the last pieces of evidence the Monetary Policy Committee needs to decide when to raise interest rates for the first time since the outbreak.

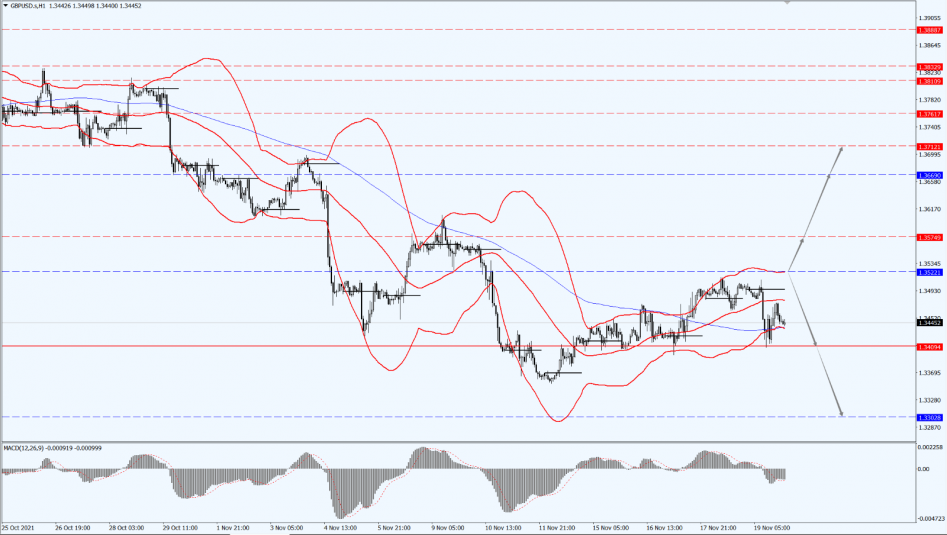

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3522-line. If the pound runs below the 1.3522-line, then pay attention to the support at the 1.3302 and 1.3186 positions in turn. If the pound breaks through the 1.3522-line, then pay attention to the suppression at the 1.3574 and 1.3669 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fluctuated lower, mainly due to a decline last week and Friday after the continuous surge, leading to increased pressure on gold prices to adjust back down.

The lower oil prices made the U.S. inflationary pressure concerns slightly eased, limiting the gold price rise. Rising expectations of a Fed rate hike also pressured gold prices, in addition to a virtual meeting between the heads of state of China and the United States that eased risk aversion, all of which were negative factors for gold prices.

However, the infrastructure bill signed by U.S. President Joe Biden, plus the high inflation and debt default concerns, limited the gold price fell sharply.

Looking ahead to this week, with the U.S. market celebrating the Thanksgiving holiday and the U.S. also entering the holiday spending season, the market’s concern about inflations are expected to remain in place, which is expected to support gold prices.

However, given the prospect that the Federal Reserve may accelerate interest rate hikes in the future, gold prices will have a more intense battle between the long and short sides.

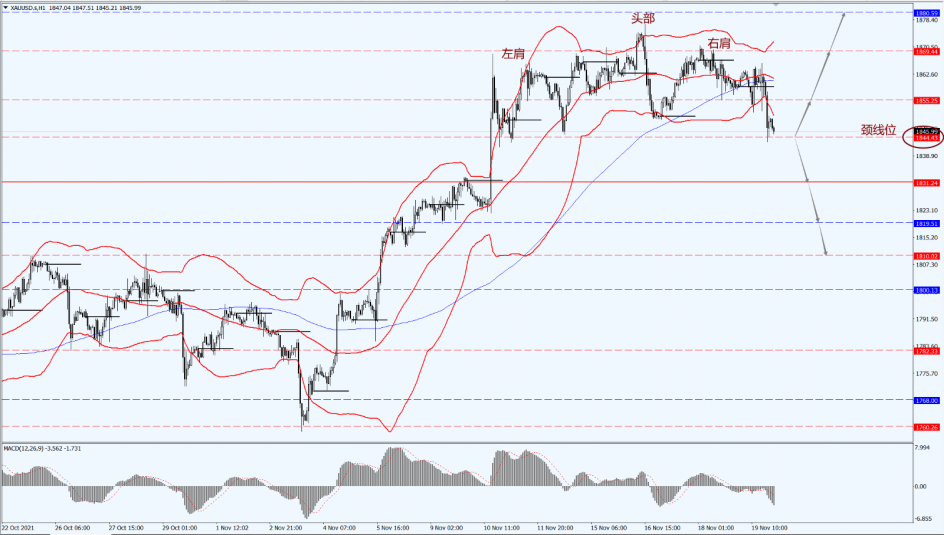

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the 1844-line. If the price of gold is supported by the 1844-line, then it will pay attention to the suppression of the 1855 and 1869 positions. If the price of gold falls below the 1844-line, it will open up a further downside space. At that time, pay attention to the strength of support for each position at 1831 and 1819.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Last week, U.S. oil prices retreated from their highs. The price of U.S. crude oil fell by $5.01 or 6.21% this week. The price of Brent crude oil fell by $3.29 or 4.01% this week.

Oil prices retreated last week, mainly by the pressure of several factors. Firstly, a new wave of pandemic came, which led to the worsening of the pandemic in Europe to put pressure on oil prices. The second is the rise of the U.S. dollar due to the expected Fed rate hike, while the dollar-denominated oil prices were under pressure to retreat.

Then, the market is worried about the news of the U.S. joining hands with several crude oil consuming countries to release crude oil reserves, and finally international organizations such as the IEA and OPEC believe that a possible oversupply of crude oil is also detrimental to oil prices.

However, although oil prices closed lower this week, oil prices are still supported by many factors, such as OPEC will not further increase production, thanksgiving holiday demand, etc.

Therefore, many organizations are still bullish on the future of the crude oil market, and even believe that the price of U.S. oil will rise to $ 100.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 75.04-line. If the oil price runs above the 75.04-line, the suppression efforts at 76.89 and 78.92 will be followed in turn. If the oil price falls below 75.04, further downside space will be opened. At that time, pay attention to the 73.52-line of support.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.