1. Forex Market Insight

EUR/USD

The euro, as a counterparty to the dollar, tends to move in a negative correlation with the dollar index. With the euro down by nearly 6% in 2021 and the ECB’s rate hike process still seemingly out of reach for now, the euro is widely viewed as bearish in 2022.

The ECB will begin rolling back supportive policy measures during the epidemic in 2022, with the emergency bond purchase program slowing in January and then ending in March.

Meanwhile, regular bond purchase operations will be temporarily expanded and the flexibility to reinvest maturing bonds will reassure investors that financing conditions will not be tightened prematurely.

Technical Analysis:

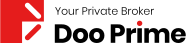

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the suppression strength of the 1.1357-line. If the euro runs steadily below the 1.1357-line, we will pay attention to the support strength of the two positions below 1.1338 and 1.1315.

GBP Intraday Trend Analysis

Fundamental Analysis:

The UK has started 2022 on a positive note, with the UK receiving more of the Covid-19 vaccine than any other Western countries, and the vaccination rates have been way ahead of the curve.

During this interval, the pound has been one of the strongest currencies in 2022. Meanwhile, the Bank of England became the first major central bank to raise interest rates since the epidemic in December as UK inflation figures hit a near 10-year high and the economy steadily recovered.

Technical Analysis:

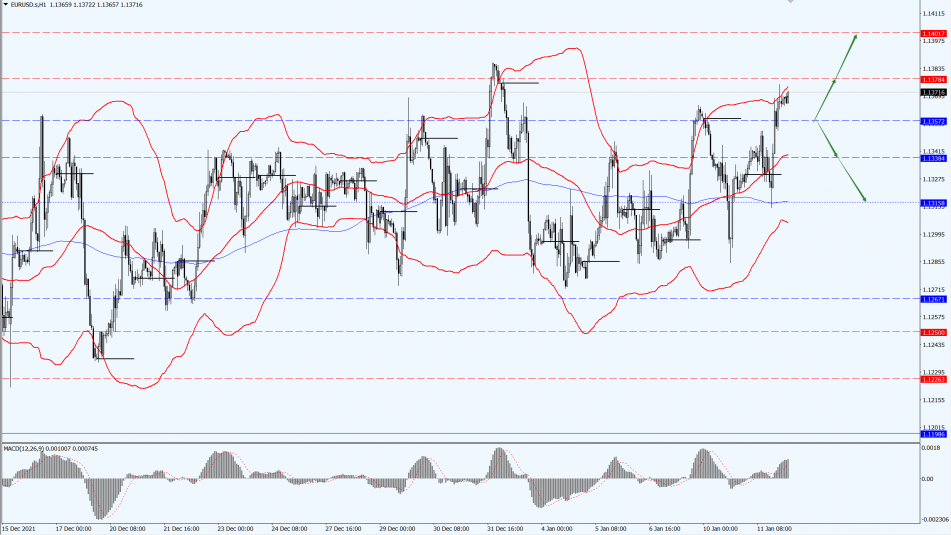

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3574-line today. If the pound runs below the 1.3574-line, it will focus on the support strength of the two positions of 1.3522 and 1.3409. If the pound runs above the 1.3574-line, it will pay attention to the suppression of the 1.3669-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose by more than 1% yesterday, 11th January 2022, refreshing the high since 5th January 2022 to $1823.31 per ounce. The dollar fell after Fed Chairman Jerome Powell testified before Congress and did not make any unexpected comments on tightening monetary policy, and the U.S. bond yields retreated to provide support.

Technical Analysis:

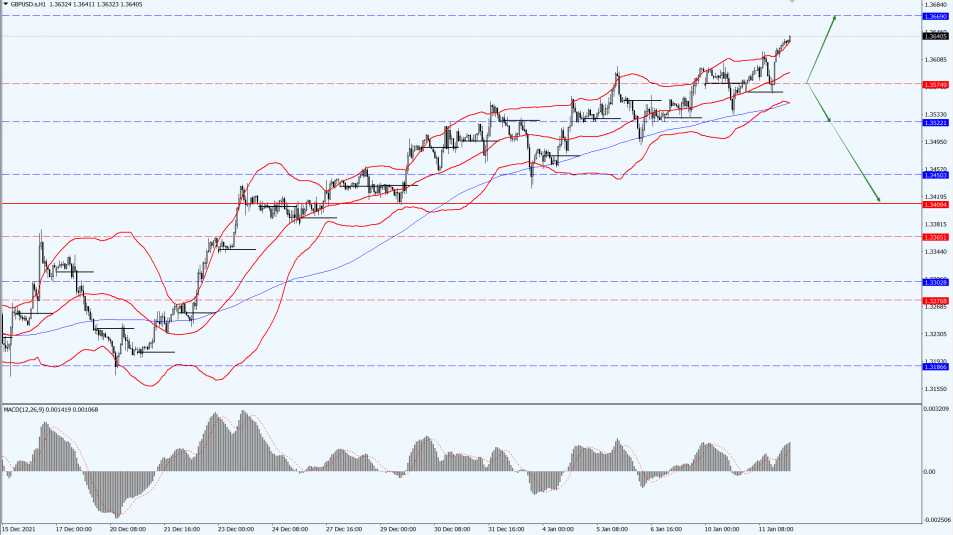

(Gold 1-hour chart)

Trading Strategies:

Gold is focused on the 1812-line today. If the price of gold runs steadily below the 1812-line, then it will pay attention to the support strength of the two positions of 1793 and 1804. If the gold price breaks above the 1812-line, it will open up further upward space. At that time, pay attention to the suppression of the 1831-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, Brent oil rose by $2.78, or 3.44% in late trading, to close at $83.65 per barrel. Expectations that the surge in Covid-19 cases and the spread of the Omicron variant will not derail the global demand recovery supported oil prices higher.

Meanwhile, the dollar fell, boosting the attractiveness of dollar-denominated commodities given that expectations of a Fed rate hike have largely been digested and that the hike will not come before March.

Technical Analysis:

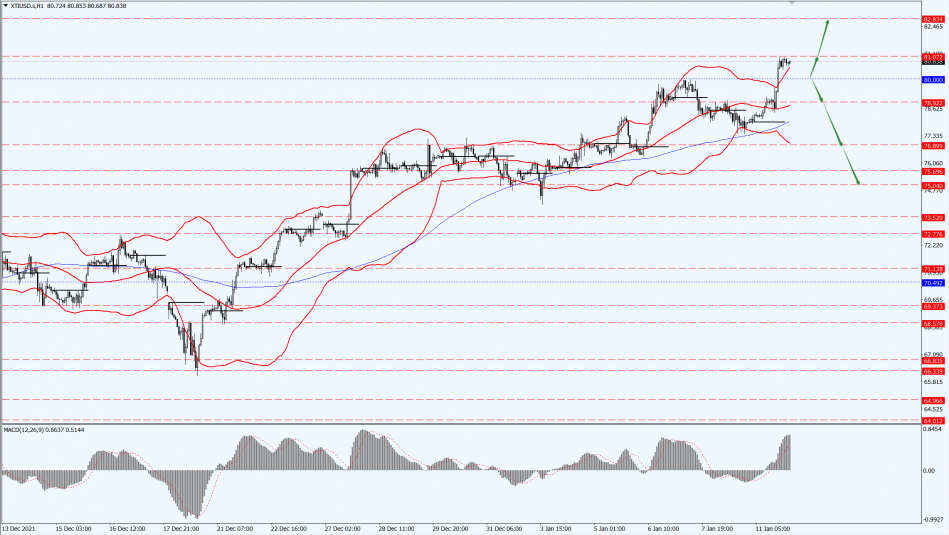

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 80-line today. If the oil price runs below the 80-line, then focus on the support at 76.89 and 75.69. If the oil price breaks above the 80-line, then pay attention to the suppression of the 81.07-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home