1. Forex Market Insight

EUR/USD

Preliminary data released by Eurostat showed that seasonally adjusted eurozone gross domestic product (GDP) grew 0.7% in the second quarter of this year and EU GDP grew 0.6% sequentially.

However, the reality of achieving growth in the second quarter did not diminish the fears of recession in Europe.

The European economy will continue to face serious challenges due to the impact of multiple pressures.

In addition, energy supply risks in Germany and some other European countries seem to be growing, and the euro rally space remains blocked.

Given that the current geopolitical conflict that triggered the surge in European energy prices continues to fester, the euro appears to be a growing resistance to the upside.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0277-line today. If EUR runs steadily below the 1.0277-line, then pay attention to the support strength of the two positions of 1.0190 and 1.0116. If the strength of EUR breaks above the 1.0277-line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England may have to raise interest rates further to combat inflationary pressures that are taking hold in the UK economy, Deputy Governor Ramsden told Reuters.

GBP has slightly stabilized its recent streak of losses against the dollar as a result of the news. The Bank of England raised interest rates from 1.25% to 1.75% last week, the sixth rate hike since the end of 2021.

As interest rates continue to rise, the central bank has begun warning that a recession may occur by the end of this year and could last until 2024.

Against this gloomy backdrop, the battle for the successor to British Prime Minister Johnson has also brought uncertainty to the pound.

One of the major uncertainties hanging over the pound is what the new government’s new fiscal plan will be.

Obviously there could be significant fiscal easing, but the exact form it will take is still up for discussion.

Therefore, the market will then have doubts about how much higher the interest rate of the pound can continue to be.

Technical Analysis:

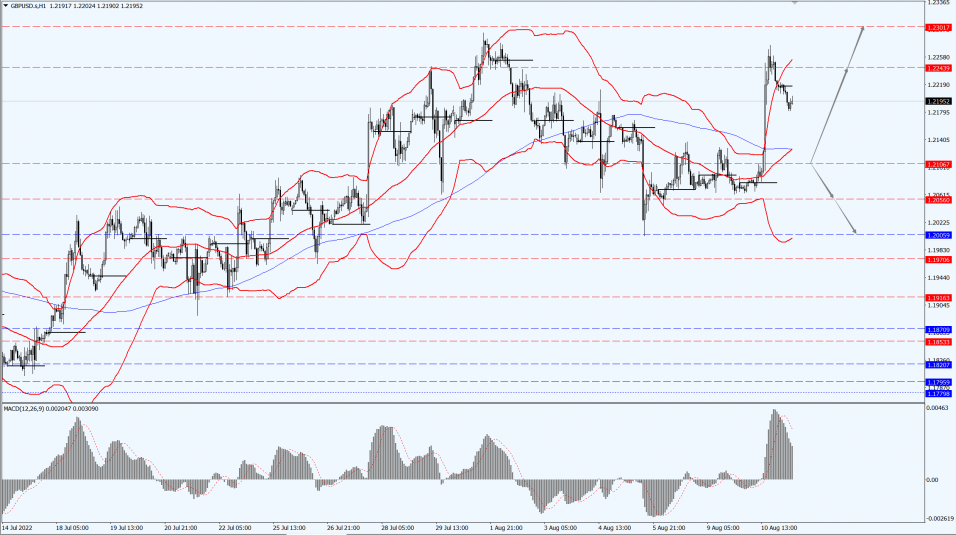

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2106-line today. If GBP runs below the 1.2106-line, it will pay attention to the suppression strength of the two positions of 1.2056 and 1.2005. If GBP runs above the 1.2106-line, then pay attention to the suppression strength of the two positions of 1.2243 and 1.2301.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold reversed earlier gains to fall on Wednesday, 10th August 2022, once setting a new one-month high to 1807.72 during the day; hawkish statements from Fed officials dampened hopes of slowing aggressive policy tightening action after the release of modest inflation data.

U.S. consumer prices were flat in July from the previous month as the cost of gasoline fell sharply, the first sign of a significant slowdown in inflation for Americans who have watched it climb over the past two years.

Gold prices came under pressure after U.S. Federal Reserve Bank of Minneapolis President Kashkari and Federal Reserve Bank of Chicago President Evans reiterated an aggressive path of interest rate hikes.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1783-line today. If the gold price runs steadily below the 1783-line, then it will pay attention to the support strength of the 1768 and 1760 positions. If the gold price breaks above the 1783-line, then pay attention to the suppression strength of the two positions of the 1793 and 1807.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose on Wednesday, 10th August 2022, rebounding from an early session decline, helped by encouraging U.S. gasoline demand data, while weaker-than-expected U.S. inflation data prompted investors to buy riskier assets.

Crude oil inventories jumped 5.5 million barrels to 432 million barrels in the week ended 5th August 2022, the U.S. Energy Information Administration (EIA) said Wednesday, 10th August 2022. Although gasoline stocks fell sharply and implied demand increased after demand had been poor during what was supposed to be the peak summer driving weeks.

EIA data showed that supplies of gasoline products increased in the latest week, but averaged 8.9 million barrels per day over the past four weeks, down 6 percent from a year earlier.

U.S. consumer prices were flat in July from the previous month as the cost of gasoline fell sharply, the first sign of a significant slowdown in inflation for Americans who have watched it climb over the past two years.

This boosted risk assets, including equities, and the dollar index fell more than 1%.

Most global oil sales are settled in U.S. dollars, and the weaker dollar is giving oil support. However, crude oil did not gain much on Wednesday, 10th August 2022.

Earlier in the session, oil prices were down for a time as pipelines from Russia to Europe resumed oil deliveries.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 91.54-line today. If the oil price runs above the 91.54-line, then focus on the suppression strength of the two positions of 92.66 and 95.50. If the oil price runs below the 91.54-line, then pay attention to the support strength of the two positions of 90.44 and 88.02.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.