1. Forex Market Insight

EUR/USD

The Eurozone Composite Purchasing Managers Index (PMI) fell to 59.0 in August from 60.2 in July, and the PMI is expected to fall slightly again to around 58.5 in September. This reflects a continued slowdown in the pace of economic expansion after a sharp rebound at the start of the reopening, while the spread of the virulent Delta variant is affecting the global economic outlook.

Both manufacturing and services PMIs in the Eurozone fell in August, in line with the slower pace of expansion in these areas. Elsewhere, the German PMI slowed down at a faster pace, with the manufacturing sector being the most important. The German manufacturing PMI fell from 65.9 to 62.6 in August.

In this regard, the September PMI will provide some insight into what is happening to the Eurozone manufacturers as the Delta virus spreads globally. Just the same, the spread of the outbreak could have an impact on manufacturers’ raw material supplies and overseas demand for their products.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, the euro pays attention to the 1.1705-line, and the euro will maintain its operation above the 1.1705-line. On the top, pay attention to the suppression of the two positions of 1.1727 and 1.1753. Once the strength of the euro drops below 1.1705, it will open up further downside space. At that time, pay attention to the two supporting positions of 1.1663 and 1.1622.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England may suspend its hawkish policy adjustments at its September meeting. The central bank’s job has not gotten any easier since its last meeting in August. While inflation continues to rise, the pace of growth has slowed. With the government’s “payroll support” policy ending this month, the job market outlook faces a great deal of uncertainty.

At the same time, the Monetary Policy Committee is likely to vote unanimously to keep the policy rate unchanged at 0.1%. With this, the committee is expected to vote 8-1 in favor of keeping the asset purchase target at £895 billion.

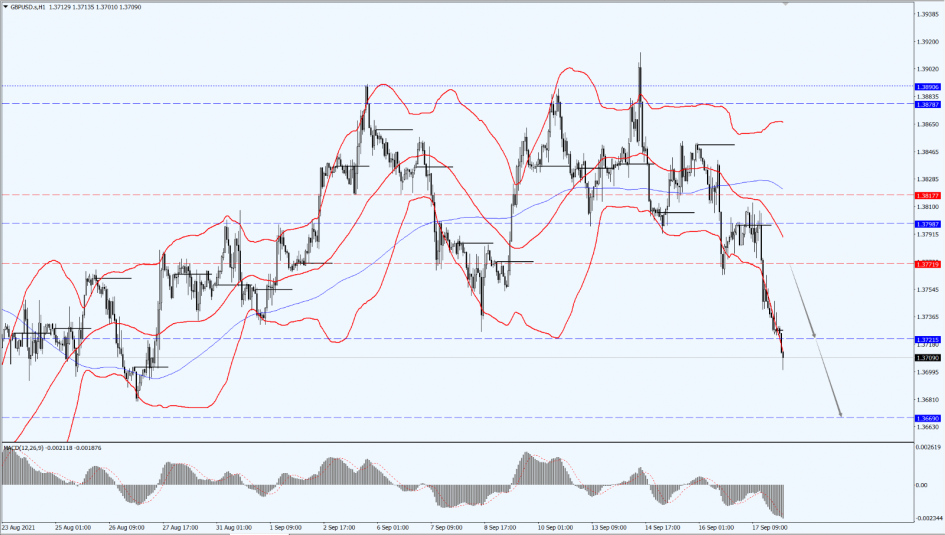

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

For the British pound today, the upper side is focused on the 1.3771 line of suppression, while the lower side is focused on the 1.3669-line of support.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Rising bond yields and renewed strength in the U.S. dollar have exacerbated investor’s apathy towards the gold market. Considering this, gold will continue to be trapped due to a lack of confidence in the market.

In the long run, gold will remain bullish as the U.S. debt levels have recently spiraled out of control. But in the short term, gold will continue to sell off. However, the price of gold needs to get back above $1,830 per ounce to start attracting new investor interest.

As bond yields and the dollar rise, gold continues to compete with record stock market valuations.

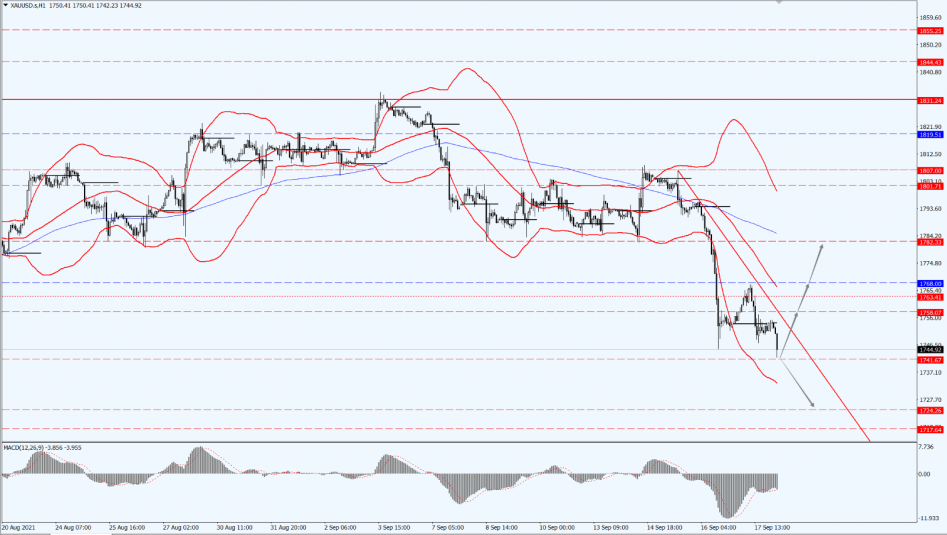

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the support of the 1741-line. If the price of gold remains above the 1741-line, there could be a room for correction. At that time, pay attention to the strength of the rebound. The upper side will focus on the suppression of the 1760 and 1768 positions. Once the price of gold falls below the 1741-line, it will open up room for further downside potential. At that time, pay attention to the support of 1724.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

The U.S. crude oil hovered near 71.62 as oil prices fell on Friday, 17th September 2021, as U.S. energy companies in the Gulf of Mexico restarted production after a succession of hurricanes shut down production in the region.

Last week, Brent crude oil prices rose by 3.3% while the U.S. crude prices rose by 3.2%, thanks to supply constraints caused by hurricane disruptions.

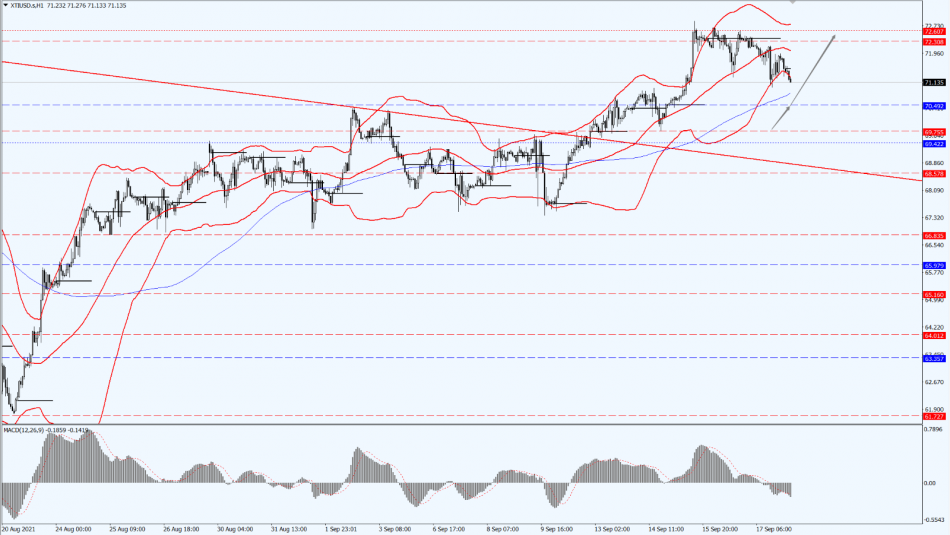

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices is still maintaining its bullish trend today. On the bottom line. focus on the support at 70.49 and 69.75, and 72.60 at the top. Once it breaks through 72.60, it will open up a further upside potential.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.