1. Forex Market Insight

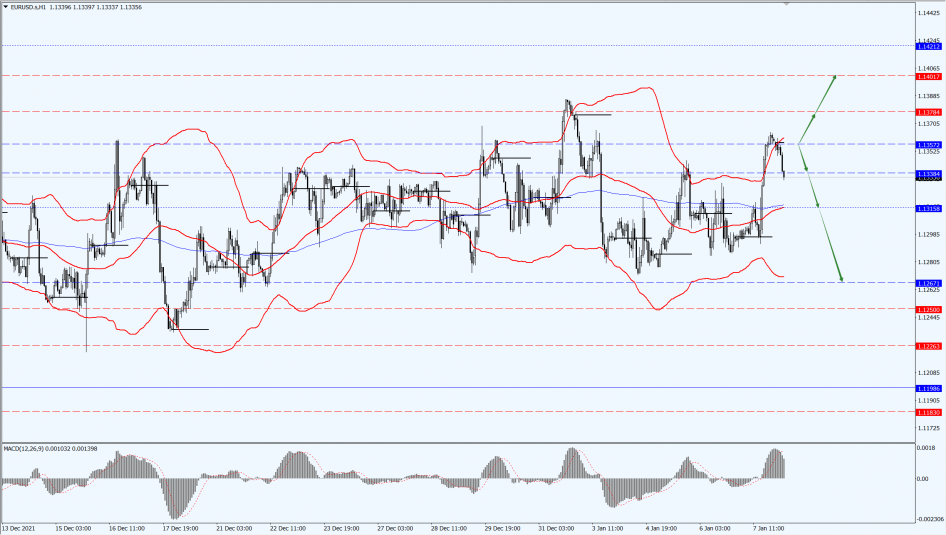

EUR/USD

The Eurozone’s economic sentiment index fell more than expected in December 2021, while inflation hit another record high, suggesting new pressures on the economy.

Meanwhile, the re-emergence of the Covid-19 epidemic is also forcing governments to tighten restrictive measures.

With the Omicron variant sweeping through Europe and new infections being added on a single day almost daily, growth is likely to take a hit around the start of the year, although governments have largely avoided implementing the kind of restrictive measures that led to economic stagnation a year ago.

The EU Executive Committee’s economic sentiment index fell much more than expected in December 2021, touching its lowest since May. This is a key indicator of the physical health of the eurozone economy.

At the same time, the outlook for the service sector has deteriorated significantly and employment expectations have fallen. In Germany, the eurozone’s largest economy, the hard data already reflects a slowdown in the economy.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the suppression strength of the 1.1357-line. If the euro runs steadily below the 1.1357-line, we will pay attention to the support strength of the two positions below 1.1267 and 1.1315.

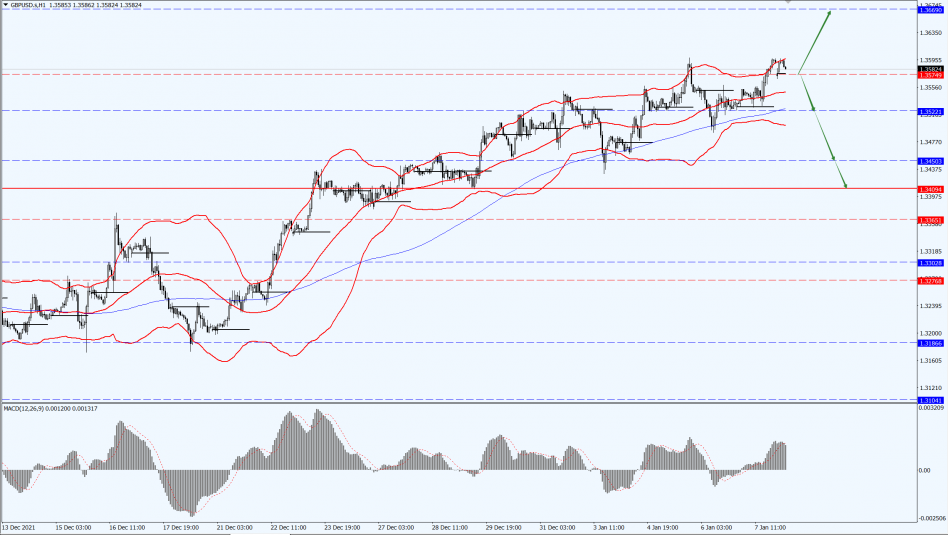

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound climbed to a two-month high last week as investors increased expectations that the Bank of England will raise interest rates as early as next month.

Currency markets are digesting expectations that the BOE will raise interest rates twice, 15 basis points each time, before its March meeting, as well as by 1 percentage point by the end of the year.

During this interval, expectations are growing that the U.K. will not introduce Covid-19 restrictions to hamper economic activity.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is focused on the 1.3574-line today. If the pound runs below the 1.3574-line, it will pay attention to the support strength of the 1.3522 and 1.3450 positions. If the pound runs above the 1.3574-line, it will pay attention to the suppression of the 1.3669-line.

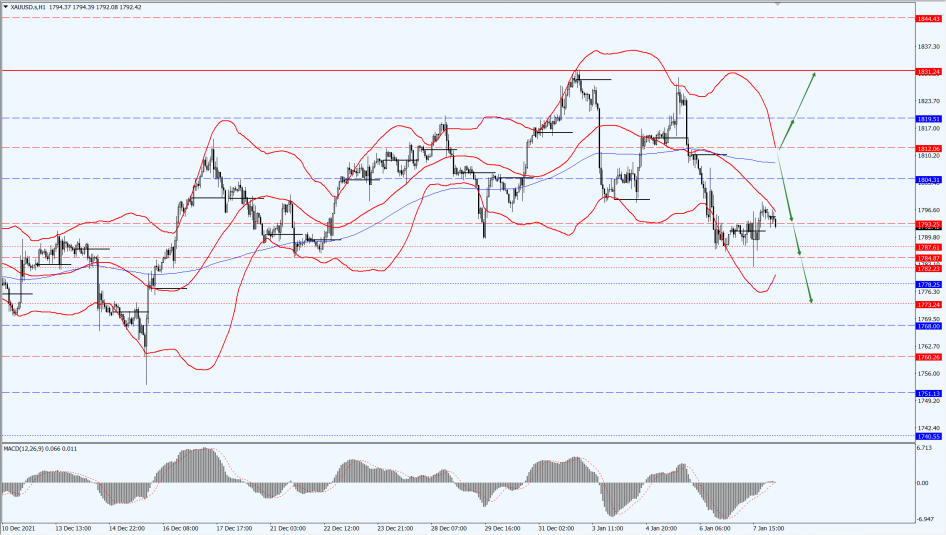

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices bottomed out on Friday, 7th January 2022, as the December non-farm payrolls report continued to blow out and both the dollar index and U.S. stocks posted declines.

However, hawkish expectations from the Federal Reserve continue to weigh on gold prices. This week, focus on the U.S. CPI, retail sales and consumer confidence, China CPI, in addition to many Fed officials’ speeches.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1812-line today. If the gold price runs steadily below the 1812-line, then pay attention to the support strength of the two positions of 1784 and 1773. If the gold price breaks above the 1812-line, then it will open up further upward space. At that time, pay attention to the suppression of 1820.

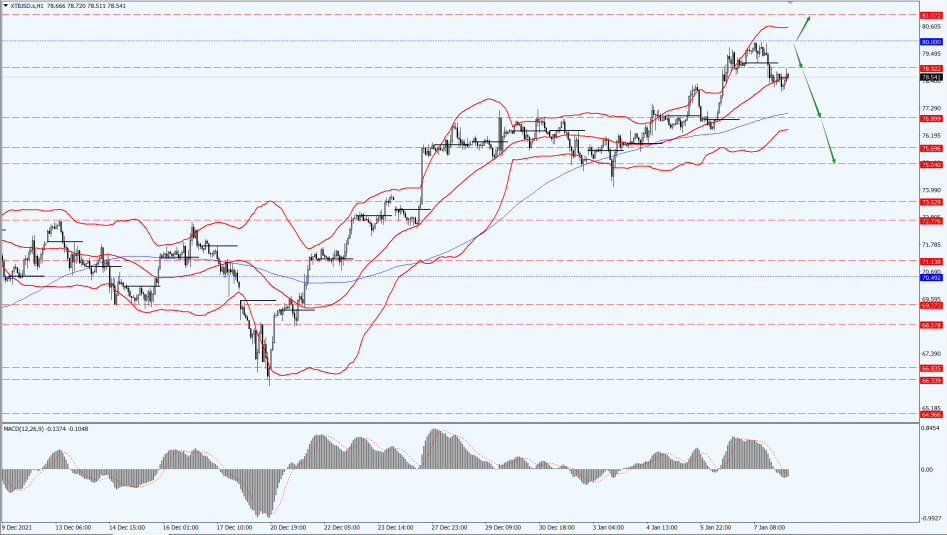

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed lower on Friday, 7th January 2022, as the market weighed supply concerns stemming from unrest in Kazakhstan and production cuts in Libya against a weaker-than-expected U.S. jobs report and its potential impact on Federal Reserve policy. In addition, renewed concerns that a mutated strain of Omicron could still dampen demand.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 80-line today. If the oil price runs below the 80-line, then focus on the support at 78.92 and 76.89. If the oil price breaks above the 80-line, then pay attention to the suppression of the 81.07-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.