1. Forex Market Insight

EUR/USD

The euro fell by 0.05% against the dollar last week Friday, 12th November 2021 to 1.1445, having earlier touched a near 16-month low of 1.1433, with falling German bond yields putting pressure on the euro.

The market is concerned about high cases of the Covid-19 infections in Germany and expects the ECB to maintain its dovish policy. Investors are increasingly pessimistic about the outlook for the euro, and it seems unlikely that the ECB will change its ultra-dovish policy stance in the near term against the backdrop of an economic slowdown.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1535-line. If the euro runs steadily below the 1.1535-line, maintain the bearish trend, and pay attention to the support of the 1.1401-line below. If the strength of the euro breaks through the 1.1535-line, it will open up a further upside space. At that time, pay attention to the two positions of suppression strength at 1.1583 and 1.1622.

GBP Intraday Trend Analysis

Fundamental Analysis:

The sterling bulls got a slight respite last week on Friday, 12th November 2021, as the pound rebounded against the dollar after hitting a new 2021 low. However, the rally may only provide temporary solace as technical and fundamental factors point to further declines.

With the dollar weakening and the EU signaling its commitment to reaching a deal with the U.K. on Northern Ireland, the pound rose by 0.31% against the dollar late in the session to 1.3413, boosted by short-covering. Through this, the pair is down by 0.63% for the week.

Technical Analysis:

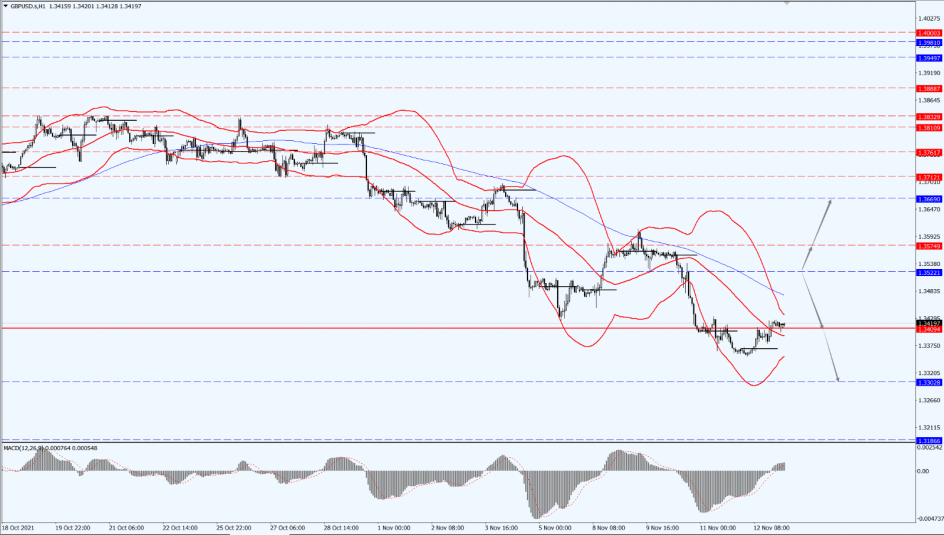

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is focused on the 1.3522-line. If the pound runs below the 1.3522-line, then pay attention to the support at the 1.3302 and 1.3186 positions in turn. If the pound breaks through the 1.3522-line, then pay attention to the suppression at the 1.3574 and 1.3669 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold closed slightly higher on Friday at $1,864.90 per ounce, up by 2.56% for the week, recording its best performance in six months, as a surge in U.S. consumer prices enhanced gold’s appeal as an inflation hedge. However, the indicator 10-year U.S. bond yields moved slightly higher, limiting the upside of gold prices.

Technical Analysis:

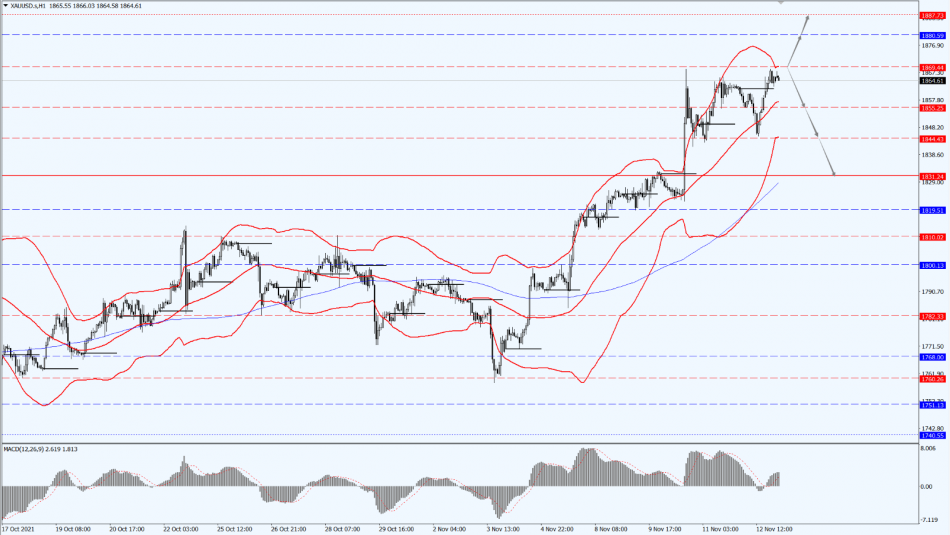

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1869-line today. If the price of gold runs stably below the 1869-line, then pay attention to the support of the 1844 and 1831 positions. If the price of gold breaks through the 1869-line, it will open up further upside space. At that time, pay attention to the suppressive strength of each position at 1880 and 1887.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil fell by more than 1% late Friday last week to close at $80.69 a barrel, falling for a third straight week and the longest weekly losing streak since March.

The U.S. President Joe Biden kept investors guessing whether he would act to curb rising energy prices that are driving soaring inflation.

Biden has been considering moves including releasing strategic oil reserves to lower the cost of gasoline as prices have touched a seven-year high.

People familiar with the matter said his team of senior aides has been discussing potential initiatives. However, consensus has been difficult to reach.

Some U.S. Energy Department officials opposed to releasing the Strategic Petroleum Reserve, while White House aides have called for releasing the reserve or even suspending U.S. crude exports.

The challenges Biden faces in terms of gasoline costs are particularly evident in California, where gasoline prices are typically higher than elsewhere in the United States. The state’s average retail price is currently $4.65 per gallon, just 2 cents below the record set in 2012, according to AAA data.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 78.92-line. If oil prices run above the 78.92-line, they will focus on the suppression of the 81.07 and 82.83 positions in turn. If the oil price drops below 78.92, it will open up a further downward space. At that time, focus on the 76.89 line of support.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.