1. Forex Market Insight

EUR/USD

Recently, European Central Bank (ECB) President Christine Lagarde indicated that the ECB may take key interest rates out of negative territory and may raise interest rates further by the end of September.

EUR strengthened after the ECB hinted that it would become more hawkish.

The Fed’s hawkishness seems to have finally stabilized.

Simultaneously, the European Central Bank brought forward policy tightening expectations, this shift in central bank dynamics limits the dollar’s upside.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0697-line today. If EUR runs steadily above the 1.0697-line, then pay attention to the support strength of the two positions of 1.0734 and 1.0776. If the strength of EUR breaks below the 1.0697-line, then pay attention to the suppression strength of the two positions of 1.0662 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

UK to release economic data for this month.

If the recession slows down or grows, it will undoubtedly further boost the price of GBP in the short term. Furthermore, GBP can get buying support again.

On the contrary, the Bank of England has been less hawkish than the Fed in raising interest rates, which will inevitably hit the pound.

After all, it is quite clear that the Fed will continue to shrink its balance sheet and raise interest rates.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2478-line today. If GBP runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2301 and 1.2243. If GBP runs above the 1.2478-line, then pay attention to the suppression strength of the two positions of 1.2668 and 1.2807.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices pared losses after the release of the Fed meeting minutes, which did not mention a more aggressive pace of interest rate hikes.

Most Fed officials lean to 50 basis points rate hikes in the next couple of meetings.

This will give policymakers the flexibility to “shift gears” later when necessary.

The dollar gave back some of its gains after the minutes, also giving support to gold.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1866-line today. If the gold price runs steadily below the 1866-line, then it will pay attention to the support strength of the 1847 and 1832 positions. If the gold price breaks above the 1866-line, then pay attention to the suppression strength of the two positions of the 1880 and 1892.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices edged up yesterday, 25th May 2022, helped by tight supply and U.S. refineries boosting processing activity to the highest level since before the start of the new crown pandemic.

But the EU’s proposal to phase out Russian oil has apparently stalled, capping gains in oil prices.

Technical Analysis:

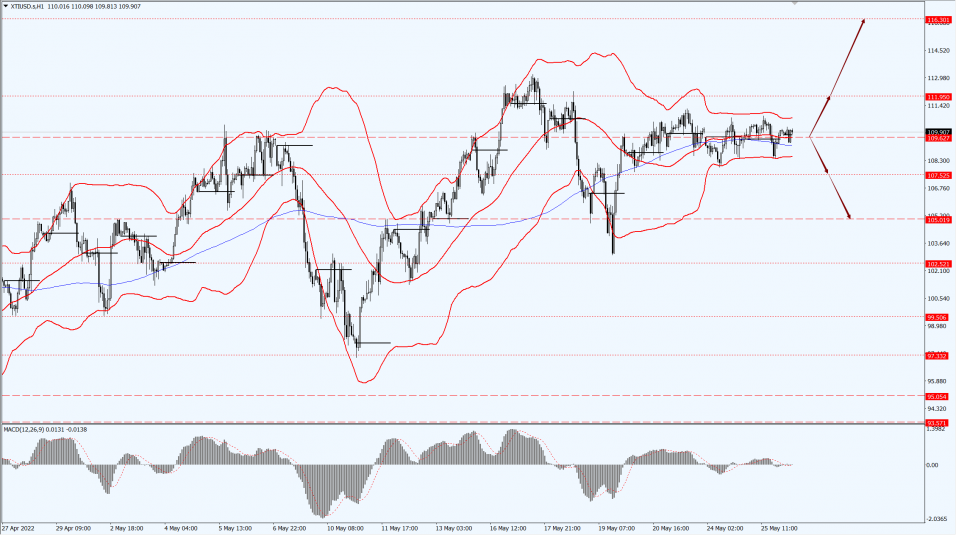

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 109.62-line today. If the oil price runs below the 109.62-line, then focus on the suppression strength of the two positions of 107.52 and 105.52. If the oil price runs above the 109.62-line, then pay attention to the support strength of the two positions of 111.95 and 116.30.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.