1. Forex Market Insight

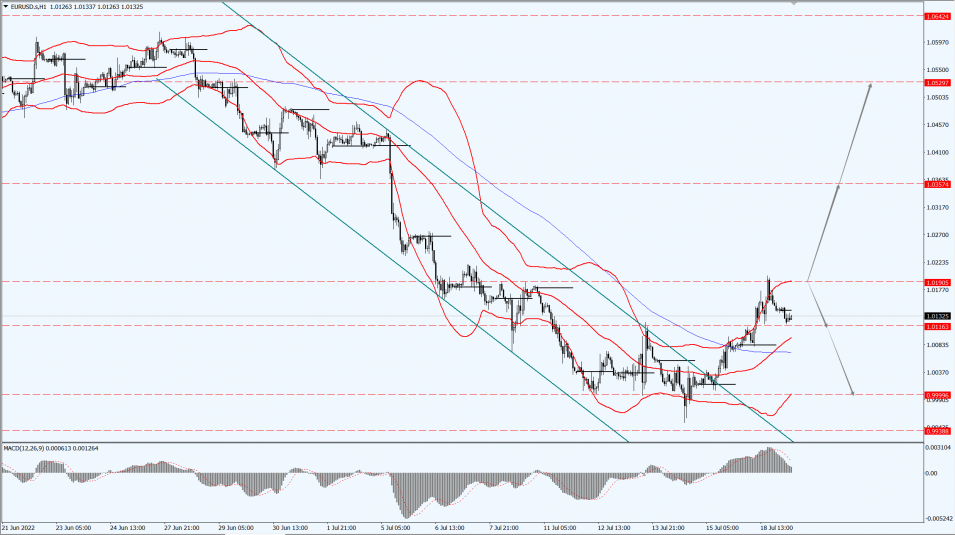

EUR/USD

The euro pared its gains.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0190-line today. If EUR runs steadily below the 1.0190-line, then pay attention to the support strength of the two positions of 1.0116 and 0.9999. If the strength of EUR breaks above the 1.0190-line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0529.

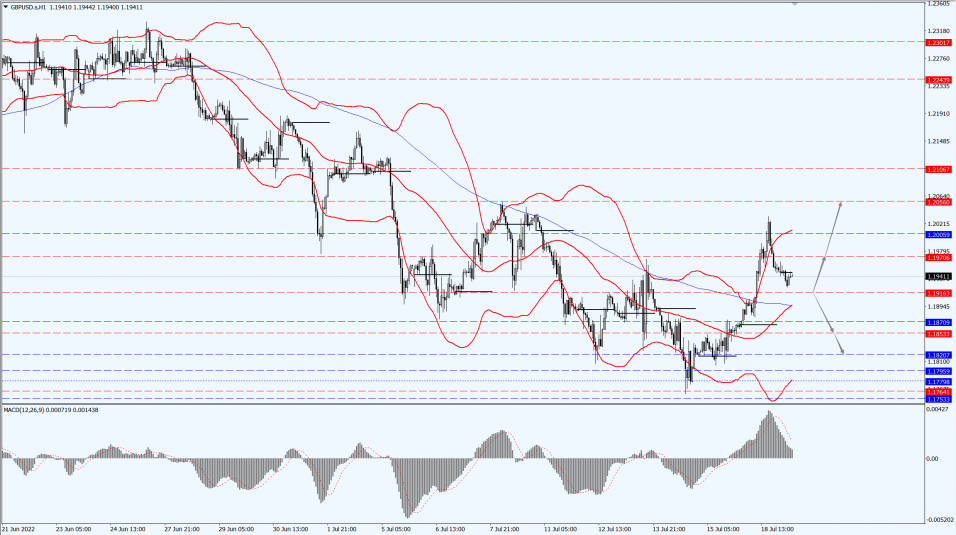

GBP Intraday Trend Analysis

Fundamental Analysis:

Broad dollar weakness helped sterling up 0.75% at $1.1959.

But political risks in the U.K. and ongoing recession concerns limited gains.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1916-line today. If GBP runs below the 1.1916-line, it will pay attention to the suppression strength of the two positions of 1.1853 and 1.1820. If GBP runs above the 1.1916-line, then pay attention to the suppression strength of the two positions of 1.1970 and 1.2005.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices recovered on Monday, boosted by a retreat in the dollar.

This comes as market bets on the Fed raising rates by 100 basis points next week have weakened.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1701-line today. If the gold price runs steadily below the 1701-line, then it will pay attention to the support strength of the 1690 and 1680 positions. If the gold price breaks above the 1701-line, then pay attention to the suppression strength of the two positions of the 1722 and 1742.

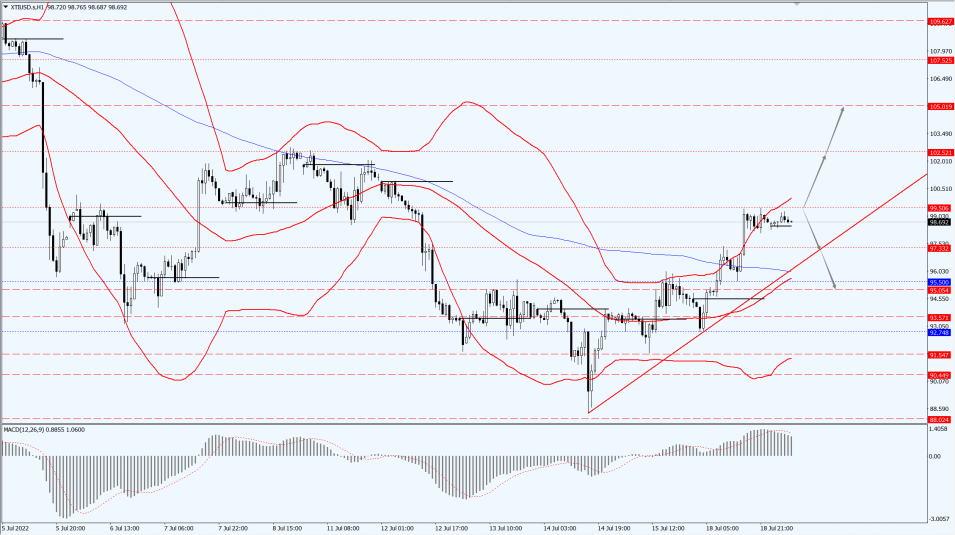

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices jumped more than $5 on Monday, 18th July 2022, as oil supplies remained tight.

As expected, President Joe Biden’s visit to Saudi Arabia did not result in any commitment from the largest OPEC producer to increase oil supplies.

Reuters reported earlier that Gazprom had declared force majeure on gas supplies to Europe to at least one major customer, according to a letter from Gazprom.

This could exacerbate the conflict between Russia and Europe.

That added support to oil prices as traders see it as a possible harbinger of Russia’s move to use energy as a weapon.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 99.50-line today. If the oil price runs above the 99.50-line, then focus on the suppression strength of the two positions of 102.52 and 105.01. If the oil price runs below the 99.50-line, then pay attention to the support strength of the two positions of 97.33 and 95.05.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.