1. Forex Market Insight

EUR/USD

A survey on Monday, 7th November 2022, showed that investor morale in the euro zone improved in November, the first rise in three months, reflecting hopes that the recent rise in temperatures and falling energy prices will prevent the introduction of gas rationing in Europe this winter.

The euro rose to 1.0033 on Monday, 7th November 2022, the highest since Oct. 27, before closing up 1.14% at 1.00.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9909 line today. If the EUR runs below the 0.9909 line, then pay attention to the support strength of the two positions of 0.9852 and 0.9810. If the strength of EUR rises over the 0.9909 line, then pay attention to the suppression strength of the two positions of 0.9999 and 1.0116.

GBP Intraday Trend Analysis

Fundamental Analysis:

A few days ago, a new round of demonstrations broke out in the UK and the British economy may face a prolonged recession, which may limit the rise of the pound.

According to data released by British credit card agencies in October, more Britons are saving money by cutting back on their nightlife, bringing their own lunches to work and buying fewer new clothes to ensure they can pay their energy bills this fall and winter.

Due to the geopolitical conflicts, participation in sanctions and other factors, the UK is in a deep energy crisis, and there is currently huge pressure on the UK’s gas and electricity supply. The pound closed up 1.21% against the dollar at 1.15 on Monday, 7th November 2022.

Technical Analysis:

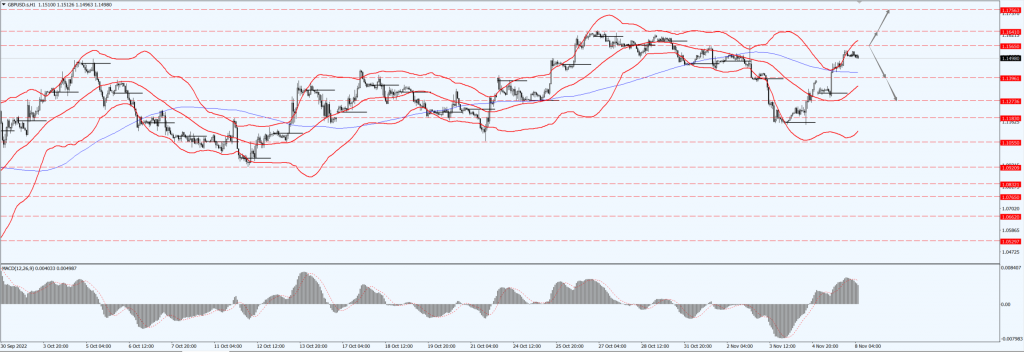

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1565-line today. If GBP runs below the 1.1565-line, it will pay attention to the suppression strength of the two positions of 1.1396 and 1.273. If GBP runs above the 1.1565-line, then pay attention to the suppression strength of the two positions of 1.1641 and 1.1756.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices held steady Monday near a three-week peak hit in the previous session, buoyed by a weaker dollar, while investors look forward to U.S. inflation data due later this week, which could influence the size of the Federal Reserve’s interest rate hike.

Although gold is seen as an inflation hedge, higher interest rates can raise the opportunity cost of holding bullion. The U.S. Consumer Price Index (CPI) report will be released on Thursday, 10th November 2022. Traders now expect the Fed to raise interest rates by 50 basis points at its December meeting with a 67% probability.

On 8th November 2022, Tuesday’s U.S. midterm elections are also being watched, which will determine control of Congress and could spur market-wide moves.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1682-line today. If the gold price runs below the 1682-line, then it will pay attention to the support strength of the 1669 and 1661 positions. If the gold price breaks above the 1682-line, then pay attention to the suppression strength of the two positions of the 1688 and 1693.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed lower on Monday, 7th November 2022, to an over two-month high as pandemic restrictions slowed to boost prices; China’s crude oil imports in October rebounded to the highest level since May.

Despite refineries around the world increasing production, oil prices are also supported by an expected tightening in supply as the EU ban on Russian seaborne crude exports is set to take effect on 5th December 2022. U.S. refinery capacity utilization reached levels near or above 90% this quarter.

Technical Analysis:

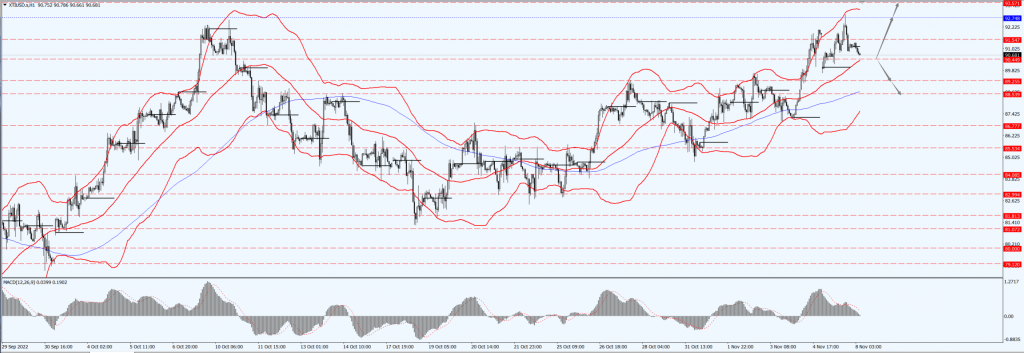

(Crude Oil 1-hour Chart)

Oil prices focus on the 90.44 line today. If the oil price runs above the 90.44-line, then focus on the suppression strength of the two positions of 92.74 and 93.57. If the oil price runs below the 90.44-line, then pay attention to the support strength of the two positions of 89.25 and 88.53.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.