1. Forex Market Insight

EUR/USD

The euro rises 0.19% against the dollar on Tuesday, 19th October 2022 at 0.9858.

The economic uncertainty are weighing heavily on the Euro. Under the influence of geopolitics, Europe is caught in an energy crisis that has not seen the end. Nord Stream pipeline cut-off and leakage, continuous record high electricity prices and a series of problems all touching the nerves of the European public.

As Europe’s largest economy, Germany posts first monthly trade deficit in 30 years, and its final GDP grew by only 0.1% in the second quarter. The world is concerned about whether Germany can win back its place as the driving force in the European economy.

Outside Germany, other European economies are also facing a difficult period. As the second largest economy in the Europe, France is in crisis as a nationwide strike took place and many industries are disrupted.

Recently, the news that Credit Suisse has suffered continuous investment losses not only lead the bank Credit Suisse facing heavy pressure, but also causing the fears of a global recession.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9810 line today. If the EUR runs below the 0.9810 line, then pay attention to the support strength of the two positions of 0.9770 and 0.9669. If the strength of EUR rise over the 0.9810 line, then pay attention to the suppression strength of the two positions of 0.9852 and 0.9909.

GBP Intraday Trend Analysis

Fundamental Analysis:

Britain’s new Chancellor of the Exchequer Jeremy Hunt on Monday, 19th October 2022 overturned Prime Minister Tony Truss’s economic plan, which has undermined investor confidence in Britain in recent weeks.

The Chancellor’s decision to overturn much of the government’s “mini-budget” prompted markets to reassess the U.K.’s interest rate outlook and sent the pound down about 0.9% to 1.1254 against the dollar on Tuesday before closing down 0.33% at 1.1321.

The Bank of England said on Tuesday that, it will sell its first holdings of British government bonds through the asset purchase facility on 1st November 2022, given that the government will announce its medium-term fiscal plan on 31st October 2022 as planned.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1378-line today. If GBP runs below the 1.1378 -line, it will pay attention to the suppression strength of the two positions of 1.1250 and 1.1183. If GBP runs above the 1.1378 -line, then pay attention to the suppression strength of the two positions of 1.1421 and 1.1501.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices was steady on Tuesday, 19th October 2022 as the dollar crept lower, although bets of another big interest rate hike from the U.S. Federal Reserve weighed on the non-yielding metal’s appeal and capped its gains.

Federal Reserve Bank of Minneapolis board members sought a full percentage point increase in a key emergency borrowing rate for commercial banks ahead of the central bank’s September monetary policy meeting, minutes of discount rate meetings showed on Tuesday, 19th October 2022.

The dollar edged higher after hitting its lowest level since 6th October 2022 earlier in the session, making greenback-priced bullion more expensive for overseas buyers.

Expectations of a large Fed interest rate hike were cemented following a red-hot U.S. consumer inflation print last week, with markets pricing in a 75-basis-point hike in November. Benchmark U.S. 10-year Treasury yields eased on Tuesday, 19th October 2022 buoying gold.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1642-line today. If the gold price runs below the 1642-line, then it will pay attention to the support strength of the 1627 and 1616 positions. If the gold price breaks above the 1642-line, then pay attention to the suppression strength of the two positions of the 1660 and 1671.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell by more than 2% in volatile trade on Tuesday, 19th October 2022 on fears of higher US supply amid an economic slowdown. Oil prices were also pressured by reports that the US government would continue releasing crude oil from reserves.

The U.S. government will announce the release of 10 million to 15 million barrels of oil reserves to balance the market and prevent gasoline prices from climbing further, sources said. This reserve release will be the latest part of a 180 million barrel program that began in the spring.

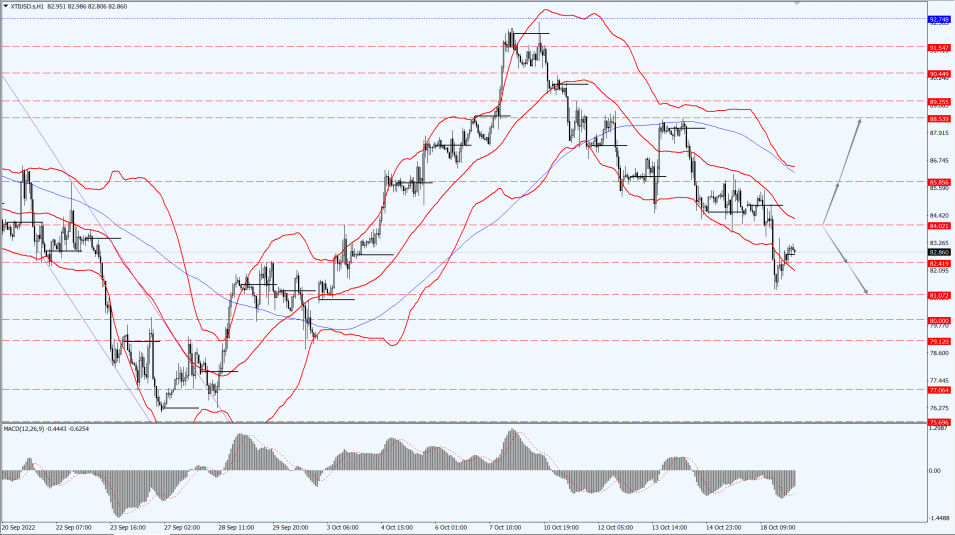

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 84.02-line today. If the oil price runs above the 84.02-line, then focus on the suppression strength of the two positions of 85.85 and 88.53. If the oil price runs below the 84.02-line, then pay attention to the support strength of the two positions of 82.41 and 81.07.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.