1. Forex Market Insight

EUR/USD

The EUR/USD shocked back down last week, weighed down by the strong dollar.

At the same time, the deepening energy crisis in the euro zone, and recessionary fears are heating up pressure on the euro

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9909 and 0.9879. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

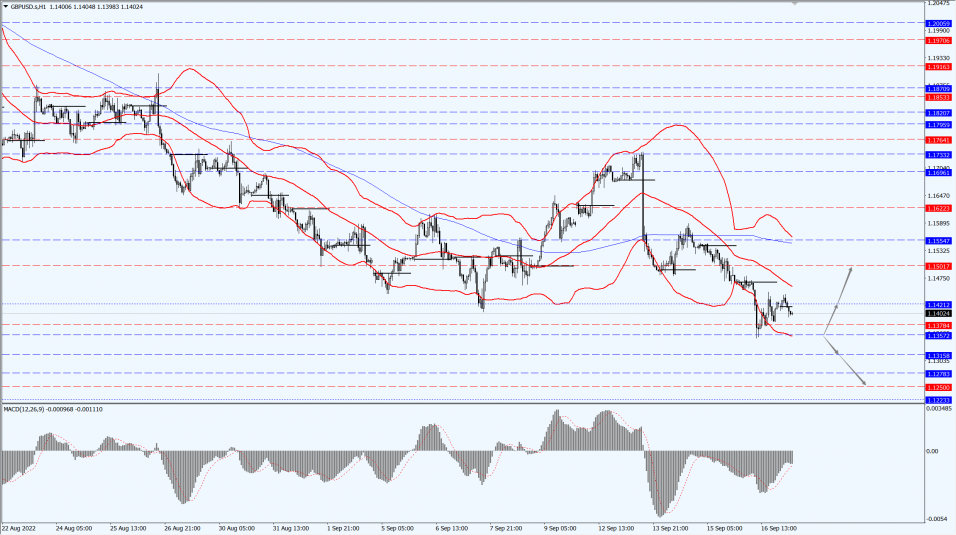

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD fell back last week, weighed down by the strong dollar.

Meanwhile, the deteriorating UK economic outlook and UK political volatility are putting pressure on the pound.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1357-line today. If GBP runs below the 1.1357-line, it will pay attention to the suppression strength of the two positions of 1.1315 and 1.1250. If GBP runs above the 1.1357-line, then pay attention to the suppression strength of the two positions of 1.1421 and 1.1501.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose on Friday, 16th September 2022, as the dollar’s rise took a pause.

But last week’s rally in the dollar and expectations of a sharp U.S. interest rate hike kept gold prices well below the key $1,700 mark and recorded its worst week of performance in four weeks.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1680-line today. If the gold price runs steadily below the 1680-line, then it will pay attention to the support strength of the 1671 and 1660 positions. If the gold price breaks above the 1680-line, then pay attention to the suppression strength of the two positions of the 1686 and 1693.

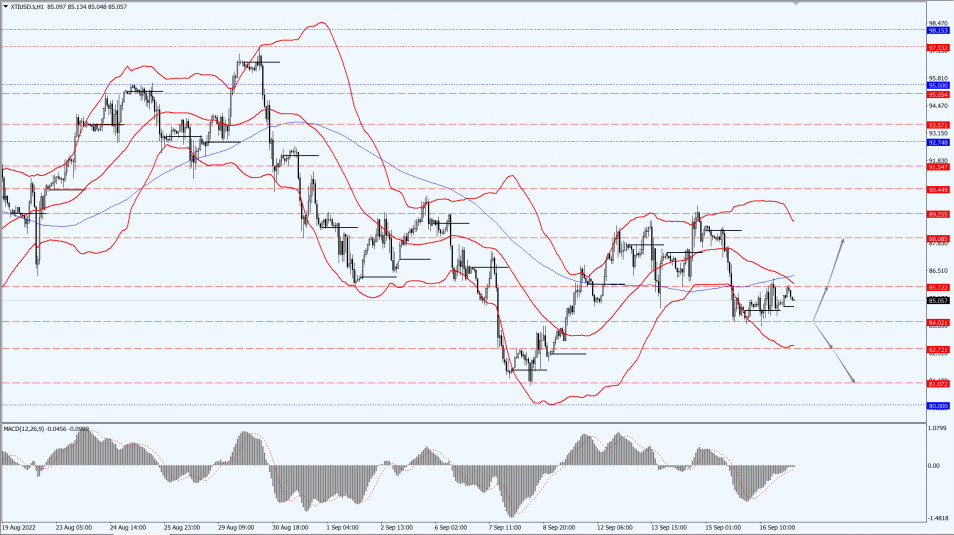

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose slightly on Friday, 16th September 2022, after a spill at the Basra terminal in Iraq appeared likely to limit crude supplies.

Yet, oil prices are still down on a weekly basis on concerns that sharp interest rate hikes will dampen global economic growth and demand for fuel.

Both indicator contracts fell nearly 2% last week, partly due to the strength of the dollar, which has made oil more expensive for buyers using other currencies.

The dollar index was essentially flat on the day, but rose on a weekly basis for the fourth week in five.

So far in the third quarter, both indicator contracts are down about 20%, the largest quarterly percentage decline since the new crown epidemic began in 2020.

The Basra Oil Company says oil exports from Iraq’s Basra oil terminal, which had been suspended Friday, 16th September 2022, due to a spill, are gradually resuming and the situation is under control.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 84.02-line today. If the oil price runs above the 84.02-line, then focus on the suppression strength of the two positions of 85.72 and 81.07. If the oil price runs below the 84.02-line, then pay attention to the support strength of the two positions of 82.72 and 81.07.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.