1. Forex Market Insight

EUR/USD

The euro rose 0.89% to 1.1084 against the dollar. At one point rose 1.4% to 1.1136, matching the March 17th high.

Meanwhile, short-covering was boosted by higher German bund yields and cross-related buying.

The inflation data for March of Eurozone member countries will be released today and the composite data for the region due on Friday, 1st April 2022.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today we focus on the 1.1143-line. If the euro runs steadily below the 1.1143-line, then pay attention to the support strength of the two positions of 1.1096 and 1.1055. If the strength of the euro breaks above the 1.1143-line, then pay attention to the suppression strength of the two positions of 1.1198 and 1.1226.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD fell less than 0.1% to 1.3092 yesterday, 29th March 2022, with EUR/GBP short-covering and weaker 2-year gilt yields weighing on GBP.

Technical Analysis:

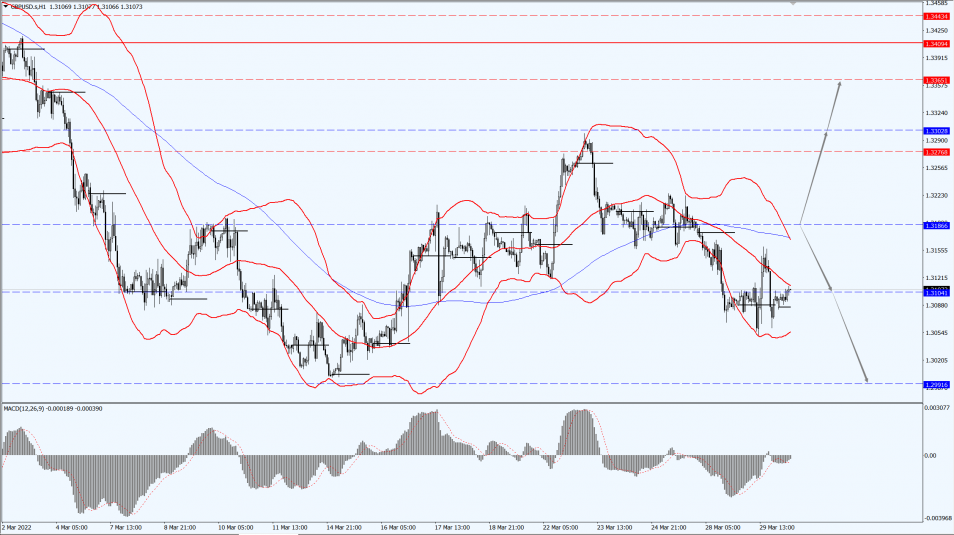

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3186-line. If the pound runs above the 1.3186-line, it will focus on the suppression of the 1.3302 and 1.3365 positions. If the pound runs below the 1.3186-line, it will focus on the support strength of the 1.3104 and 1.2991 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Yesterday, 29th March 2022, spot gold made a sharp V-reversal, rallying to near the 1920-mark in late trading. It fell 1.7% during the session and refreshed the low since February 25th to $1889.98 per ounce.

Besides, signs of progress in Ukraine peace talks dented demand for precious metals.

However, Russian negotiators said a pledge to reduce some military operations did not represent a ceasefire.

Technical Analysis:

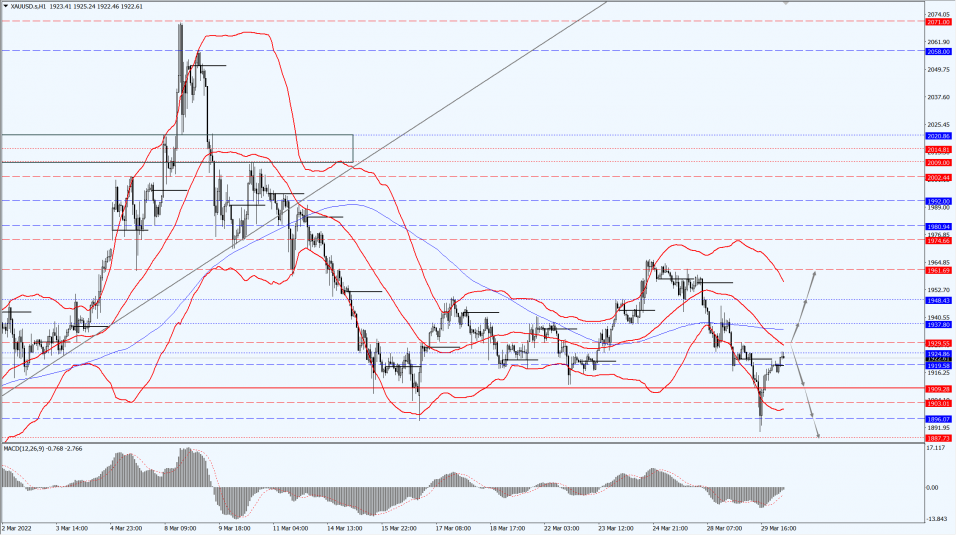

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1929-line today. If the gold price runs steadily below the 1929-line, then it will pay attention to the support strength of the two positions of 1909 and 1896. If the gold price breaks above the 1929-line, it will open up further upward space. At that time, we will pay attention to the suppression strength of the two positions in 1937 and 1948.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fluctuated violently. U.S. oil rebounded to above 105 in late trading, and the decline narrowed to less than 1%. It fell more than 7% to $98.44 per barrel at one point.

Earlier, Russia said it would significantly reduce military operations near the Ukrainian capital, Kyiv and signaled its willingness to consider direct talks between Putin and Zelensky.

Nonetheless, the talks between Russia and Ukraine failed to reach a mutual agreement on a ceasefire yesterday, 29th March 2022. The United States is waiting for signs of cooling off and warned the public about not jumping to a conclusion.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 107.52-line today. If the oil price runs below the 107.52-line, then pay attention to the support strength of the two positions of 102.52 and 99.50. If the oil price runs above the 107.52-line, then pay attention to the suppression of 111.95 and 116.30.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home