1. Forex Market Insight

EUR/USD

The euro was hit by rising risk aversion amid soaring natural gas prices and escalating tensions in Ukraine. With this, the euro closed down by 0.54% against the dollar last week to 1.1264, hitting a fresh low of 1.1106 since June 1, 2020.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the support strength of the 1.1096-line. If the euro runs steadily above the 1.1096-line, we will pay attention to the suppression strength of the two positions of 1.1267 and 1.1315. If the strength of the euro breaks below the 1.1096-line, we will pay attention to the support of the 1.1031-line.

GBP Intraday Trend Analysis

Fundamental Analysis:

Last week, GBP/USD closed down 1.36% at 1.3412, hitting a new low of 1.3273 since December 22, 2021.

Investors are cautious on the pound amid a standoff between Russia and the West over Ukraine. In addition, comments from Bank of England officials about future interest rates also weighed on the pound in the short-term.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused about the 1.3276-line today. If the pound runs above the 1.3276-line, it will pay attention to the suppression of the two positions of 1.3443 and 1.3516. If the pound runs below the 1.3276-line, it will pay attention to the support strength of the 1.3186-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

The Ukraine crisis deepened over the weekend as Russian President Vladimir Putin put Russia’s nuclear deterrent on high alert. Adding to this, several countries announced they would close their airspace to Russian flights and Western allies decided to selectively block Russian banks from accessing the SWIFT payment system.

However, it is gratifying that Russia and Ukraine are ready to start a new round of negotiations, and the market’s risk aversion has cooled down.

This week, the main focus is on the U.S. non-farm payroll report for February released on Friday. At the same time, the situation in Russia and Ukraine will continue to stir the international financial market.

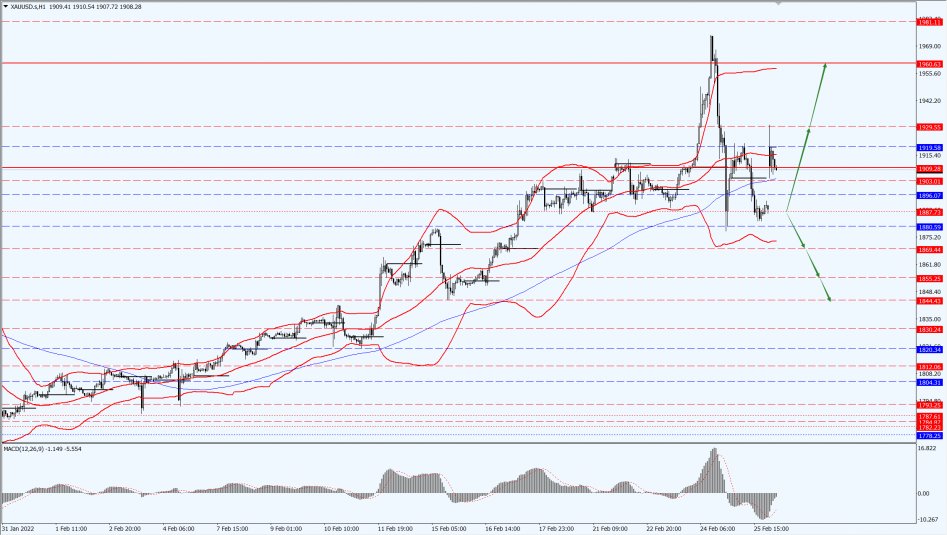

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1887-line today. If the gold price runs steadily above the 1887-line, then it will pay attention to the suppression of the 1929 and 1960 positions. If the gold price breaks below the 1887-line, it will open up further downside. At that time, pay attention to the 1869 and 1855-lines strength of a position.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Today, during the Asian session, U.S. oil once rose over 8% to a high of $99.10/barrel and is now back down to $96.32/barrel.

Geopolitical tensions further escalated as Western sanctions against Russia continued to increase. As the U.S., Britain and Europe sanctioned Russian President Vladimir Putin himself, Putin ordered strategic nuclear forces to be placed on high operational readiness.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 90.44-line today. If the oil price runs above the 90.44-line, then focus on the suppression of the 97.33 and 99.50 positions. If the oil price breaks below the 90.44-line, then pay attention to the support of the 88.02-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home