The euro rose 0.3% to $0.9825.

Earlier data showed that manufacturing activity in the eurozone fell further in September.

Given the precarious energy situation in Europe, reports that the OPEC+ alliance of the Organization of Petroleum Exporting Countries (OPEC) and allies is discussing a possible production cut of more than 1 million barrels per day are also putting pressure on the euro.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9701-line today. If EUR runs steadily below the 0.9701-line, then pay attention to the support strength of the two positions of 0.9625 and 0.9559. If the strength of EUR breaks above the 0.9701-line, then pay attention to the suppression strength of the two positions of 0.9810 and 0.9909.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD jumped on Monday, 3rd October 2022, after Britain said it would abandon plans to scrap the top rate of income tax and the dollar fell against other major currencies.

After the media reported this policy reversal, GBP/USD hit its highest since 22nd Sept. 2022, a day after Chancellor of the Exchequer Kwarteng proposed a new “growth plan” that included tax cuts and regulatory measures that the government would finance through a massive debt issue.

The move triggered market shocks.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1212-line today. If GBP runs below the 1.1212-line, it will pay attention to the suppression strength of the two positions of 1.1013 and 1.0926. If GBP runs above the 1.1212-line, then pay attention to the suppression strength of the two positions of 1.1355 and 1.1463.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

The yield on the U.S. index 10-year Treasury note fell to a more than one-week low, supporting demand for interest-free gold.

The softening dollar has provided some respite for gold, which has seen a small rebound in prices since last week’s slide to its lowest point since April 2020.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1697-line today. If the gold price runs steadily below the 1697-line, then it will pay attention to the support strength of the 1680 and 1660 positions. If the gold price breaks above the 1697-line, then pay attention to the suppression strength of the two positions of the 1713 and 1720.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices jumped nearly $4 a barrel Monday, 3rd October 2022, as OPEC+ considered cutting production by more than 1 million barrels a day to support prices, which would be the steepest cut since the start of the new crown epidemic.

OPEC+ is considering cutting production by more than 1 million barrels per day ahead of Wednesday’s meeting, an OPEC source added, a figure that does not include additional voluntary cuts by individual members

If agreed, it would be the second straight month of production cuts by the organization after it cut 100,000 bpd last month.

Technical Analysis:

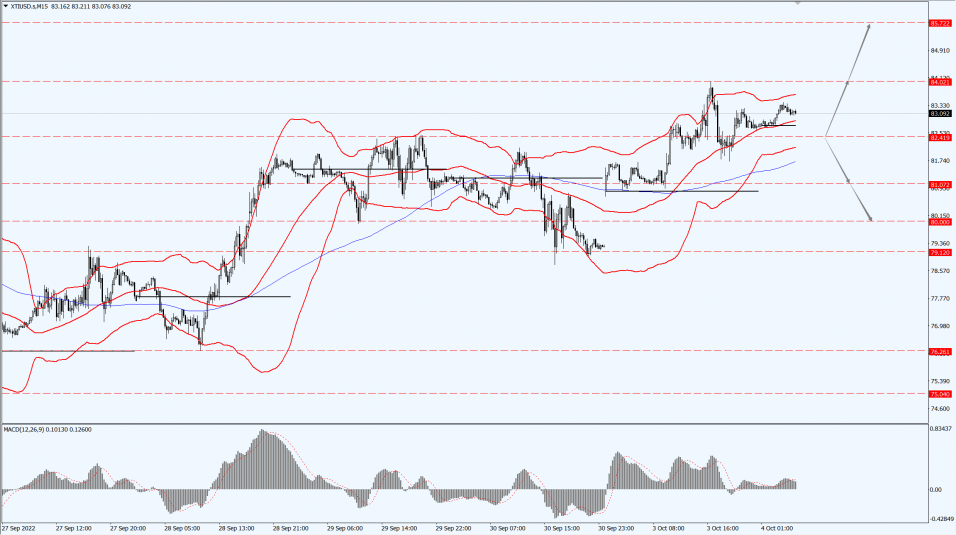

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 82.41-line today. If the oil price runs above the 82.41-line, then focus on the suppression strength of the two positions of 84.02 and 85.72. If the oil price runs below the 82.41-line, then pay attention to the support strength of the two positions of 81.07 and 80.00.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.