1. Forex Market Insight

EUR/USD

USD has been supported in recent months by investors seeking safe-havens as various markets sank across the board on fears of soaring inflation, a hawkish Federal Reserve stance and the impact of the Russia-Ukraine conflict.

However, the wave of gains came to an abrupt halt last week as volatility in global financial markets increased.

Coupled with USD rise to highs in recent months, EUR downtrend has temporarily slowed and a wave of rebound has been launched.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily above the 1.0529-line, then pay attention to the support strength of the two positions of 1.0662 and 1.0776. If the strength of EUR breaks below the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0184.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD pared gains to 0.19%, after rising 0.3% to 1.2500.

GBP rose 1.94% last week, marking the biggest one-week gain since December 2020.

It is because the latest economic data suggest that the market may not need to significantly lower expectations for the Bank of England to raise interest rates.

UK consumer confidence fell to its lowest level in at least 48 years, as rising prices dampened consumers’ spending power.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2478-line today. If GBP runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2243 and 1.2106. If GBP runs above the 1.2478-line, then pay attention to the suppression strength of the two positions of 1.2668 and 1.2807.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold rose slightly on Friday, 20th May 2022, to close at $1845.46 an ounce, up 1.86% for the week, recording its first weekly gain in five weeks.

U.S. bond yields fell for a third straight session as a slide in U.S. bond yields supported safe-haven gold.

The market remains concerned about the growing signs of economic slowdown.

The economic data is weak due to the most aggressive rate hike cycle in decades embarked by the Federal Reserve. This includes a larger-than-expected number of first-time jobless claims in the U.S., highlighting the risks to economic growth.

Fears of a potential recession are driving gold prices up again.

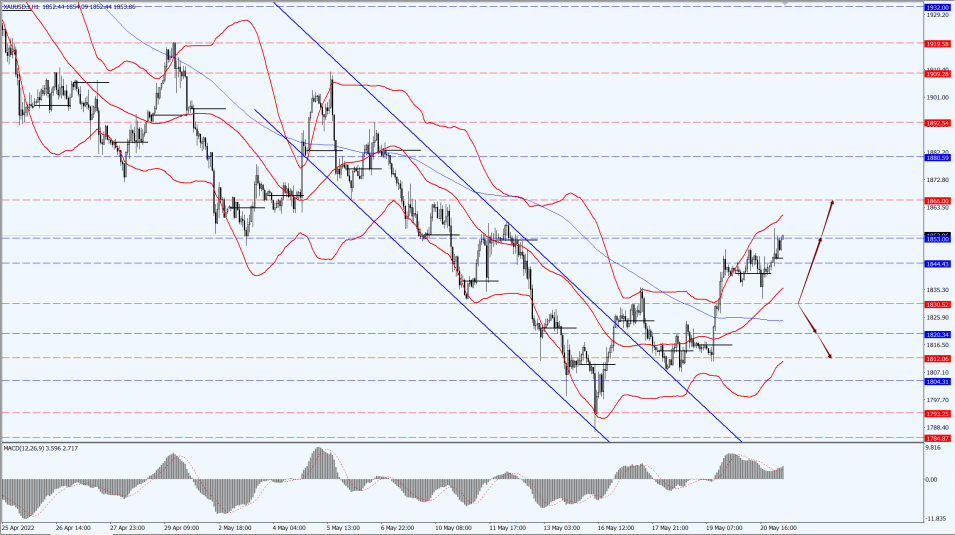

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1830-line today. If the gold price runs steadily below the 1830-line, then it will pay attention to the support strength of the 1820 and 1812 positions. If the gold price breaks above the 1830-line, then pay attention to the suppression strength of the two positions of the 1853 and 1866.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed slightly higher on Friday, 20th May 2022, with U.S. oil ending the day up 0.42% at $110.36 a barrel.

As the European Union plans to impose an oil embargo in Russia, some regions relax the New Crown outbreak closure.

The refined oil market remains tight, easing concerns that slower economic growth will affect demand.

The EU wants to reach an agreement on a proposal to ban imports of Russian crude oil, including solutions for the exclusion of member states most dependent on Russian oil, such as Hungary.

According to Baker Hughes statistics, energy companies in the U.S. added oil and natural gas rigs for the ninth straight week last week.

This is because most small producers are responding to high oil prices and are being pushed by the government to increase production.

The rig count is an indicator of future production growth.

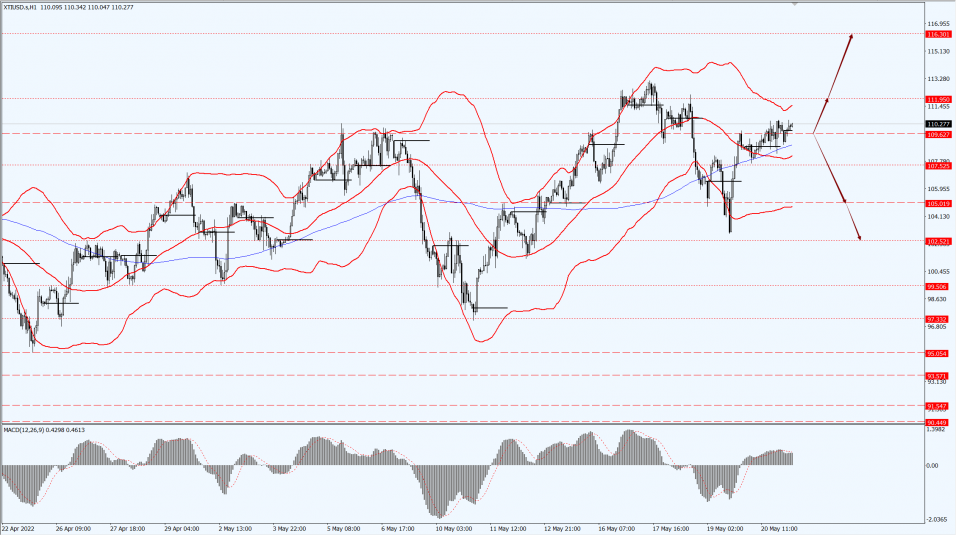

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 109.62-line today. If the oil price runs below the 109.62-line, then focus on the suppression strength of the two positions of 105.01 and 102.52. If the oil price runs above the 109.62-line, then pay attention to the support strength of the two positions of 111.95 and 116.30.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.