1. Forex Market Insight

EUR/USD

The market has been assessing whether the rally that pushed the dollar index to its highest level in 20 years last week has further room to go, at least in the short term, as the market has digested much of the hawkishness of the Federal Reserve.

However, the Federal Reserve is expected to tighten policy more than other central banks.

In Europe, for example, economic growth has slowed and energy supplies have been disrupted due to sanctions imposed on Russia. Furthermore, it hit its lowest level since January 2017 at $1.0470 yesterday, 5th May 2022.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If the euro runs steadily below the 1.0529-line, then pay attention to the support strength of the position of 1.0357. If the strength of the euro breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0662 and 1.0776.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD plunged to its lowest level of $1.2379 since July 2020, amid concerns over the outlook for the UK economy. Signs of an economic slowdown and possibly even a recession are intensifying as the cost-of-living creeps up, consumer confidence approaches record lows and retail sales fall for the second month in a row.

The Bank of England appears increasingly cautious about tightening the currency to avoid a recession.

Recent data show that the U.K. economy is slowing its pace as the cost-of-living crisis spreads. With growth expected to be just 0.1 percent this quarter, a sharp downward revision from last month’s forecast of 0.4 percent, and will grow 0.3 percent over the next two quarters.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.2478-line today. If the pound runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2243 and 1.2106. If the pound runs above the 1.2478-line, then pay attention to the support strength of the position of 1.2668.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices surged higher as a retreat yesterday, 5th May 2022, as the market perceived that the Fed was tightening monetary policy more than other major central banks. The U.S. dollar index recorded its largest single-day gain in the past two years, setting a new high in nearly two decades, offsetting the Fed’s relatively less hawkish stance on interest rate hikes to support gold prices.

Field attention began to turn to the evening non-farm payrolls report. From the ISM Manufacturing Employment Index, ISM Non-Manufacturing Employment Index, to ADP, Initial Jobless Claims and other data, the evening non-farm payrolls may increase by a limited number, and may still provide gold prices with the opportunity to bottom out.

However, if the non-farm payrolls performance is stronger than market expectations, it will need to beware of the possibility of gold prices dropping to the 1850 mark.

Technical Analysis:

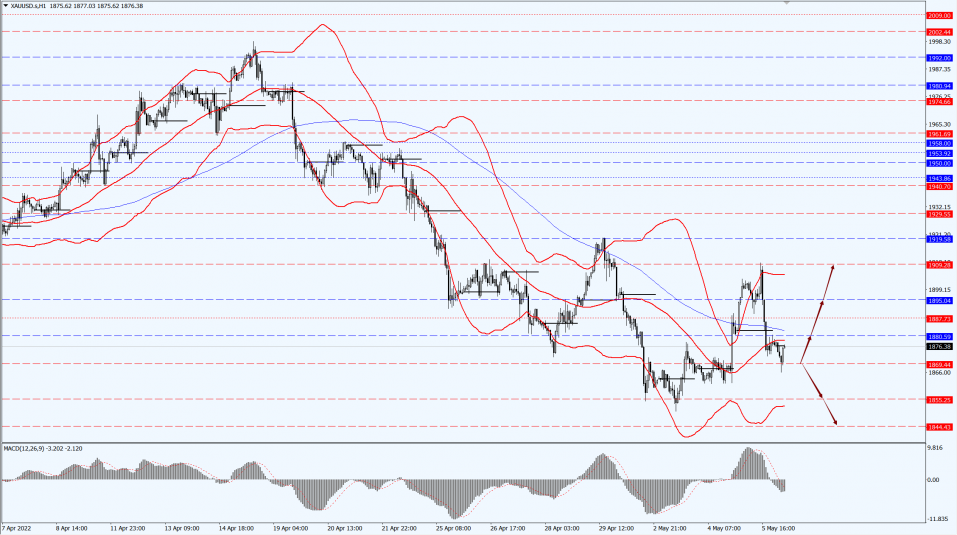

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1869-line today. If the gold price runs steadily above the 1869-line, then it will pay attention to the support strength of the 1880 and 1909 positions. If the gold price breaks below the 1869-line, then pay attention to the suppression strength of the two positions of the 1855 and 1844.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices ended at near 3-week high as market supply worries resumed. WTI futures closed above $108 per barrel for the first time since late March.

Following the EU proposing sanctions on Russian oil, the market finally turned back to supply worries.

Earlier, the benchmark oil price fell 1.3 percent at one point as a rising dollar and plunging stock markets raised fears of another economic downturn.

Technical Analysis:

Trading Strategies:

Oil prices focus on the 107.52-line today. If the oil price runs above the 107.52-line, then focus on the suppression strength of the two positions of 111.95 and 116.30. If the oil price runs below the 107.52-line, then pay attention to the support strength of the two positions of 102.52 and 99.50.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.