1. Forex Market Insight

EUR/USD

The euro oscillated broadly against the dollar on Tuesday 7th February 2023, falling to a near one-month low of 1.0669 during the session, rising to 1.0766 after Powell’s speech and closing at 1.0727, close to a close, or about 0.03%.

The ECB may try to correct the market’s dovish interpretation of the February rate decision and statement, which may attract euro buying, but euro confidence is likely to remain low ahead of next week’s U.S. CPI release. The longer-term trend for the euro remains tilted to the upside against the dollar due to its own improving terms of trade, a boost in Chinese growth, a narrowing of the Fed/ECB policy spread and attractive valuations.

The main downside risks lie in a new Russian offensive against Ukraine, a further deterioration in relations between Russia and the West and disruptions in European energy supplies.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0729 line today. If the EUR runs below the 1.0729 line, then pay attention to the support strength of the two positions of 1.0697 and 1.0642. If the strength of EUR rises over the 1.0729 line, then pay attention to the suppression strength of the two positions of 1.0776 and 1.0802.

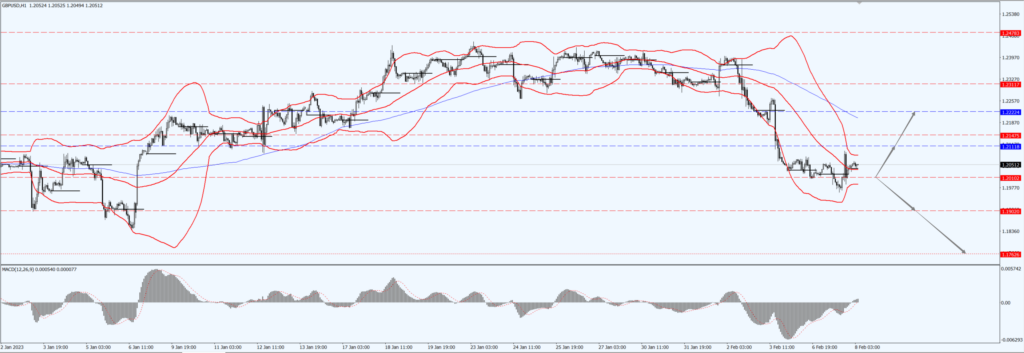

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound bottomed out against the dollar on Tuesday, hitting a near one-month low of 1.1960 during the day and rebounded to 1.2094 after Powell’s speech, closing at 1.2047, up about 0.26%.

After last week’s Bank of England meeting was seen as a dovish result, the market is waiting for further statements from the central bank officials this week. U.K. GDP is expected to be flat in the fourth quarter of 2022, with GDP contracting to 0.4% in December from a year earlier, driven by widespread weakness in construction, manufacturing and services.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2010-line today. If GBP runs below the 1.2010-line, it will pay attention to the suppression strength of the two positions of 1.902 and 1.782. If GBP runs above the 1.2010-line, then pay attention to the suppression strength of the two positions of 1.2111 and 1.2222.

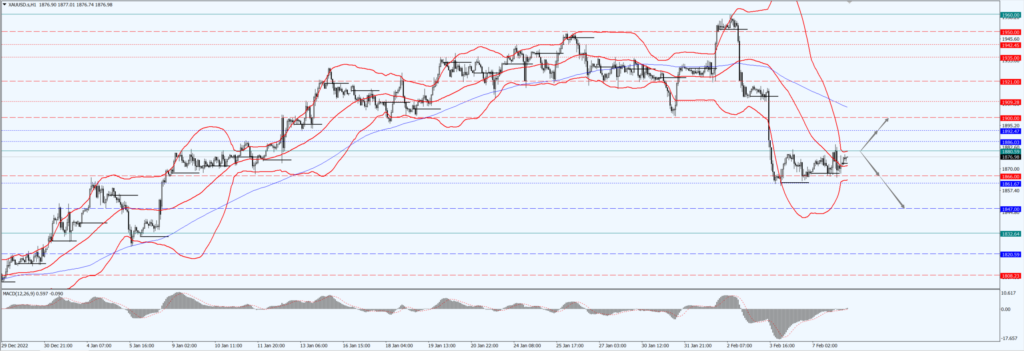

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices reluctantly rose on Tuesday, 7th February 2023, the dollar retreated slightly, Powell said Tuesday, the latest U.S. jobs report showed that the process of driving inflation back to the Fed’s 2% target will take “quite a long time” and pointed out the need to further increase interest rates.

After Powell’s speech, the dollar index fell from a one-month high, pushing gold prices once jumped 0.8%.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1880-line today. If the gold price runs below the 1880-line, then it will pay attention to the support strength of the 1866 and 1847 positions. If the gold price breaks above the 1880-line, then pay attention to the suppression strength of the two positions of 1892 and 1900.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices climbed more than 3% Tuesday, 7th February 2023, after Federal Reserve Chairman Jerome Powell eased market concerns about interest rate hikes and a recovery in Chinese demand boosted oil prices.

Federal Reserve Chairman Jerome Powell said Tuesday that the very strong jobs data released last week confirmed that the Fed has some way to go in terms of raising interest rates.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 75.04 – line today. If the oil price runs above the 75.04 -line, then focus on the suppression strength of the two positions of 76.00 and 76.89. If the oil price runs below the 75.04 -line, then pay attention to the support strength of the two positions of 73.52 and 72.37.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.