1. Forex Market Insight

EUR/USD

Last week, the EUR/USD retreated from Thursday’s high of 1.0868, but still closed near 1.0833. Data on Friday, 13th January 2023, showed that core inflation in Spain rose to a record high of 7% in December 2022, exceeding headline inflation (5.7%) for the first time.

In other eurozone countries, a favorable base in the energy component is expected to lead to a further decline in headline inflation for the coming months, but inflationary pressures in the rest of the economy will remain high.

For this reason, the ECB will focus mainly on whether core inflation continues to cool. Hence, the ECB will be cautious to talk about policy adjustments until core inflation starts to fall.

Technical Analysis:

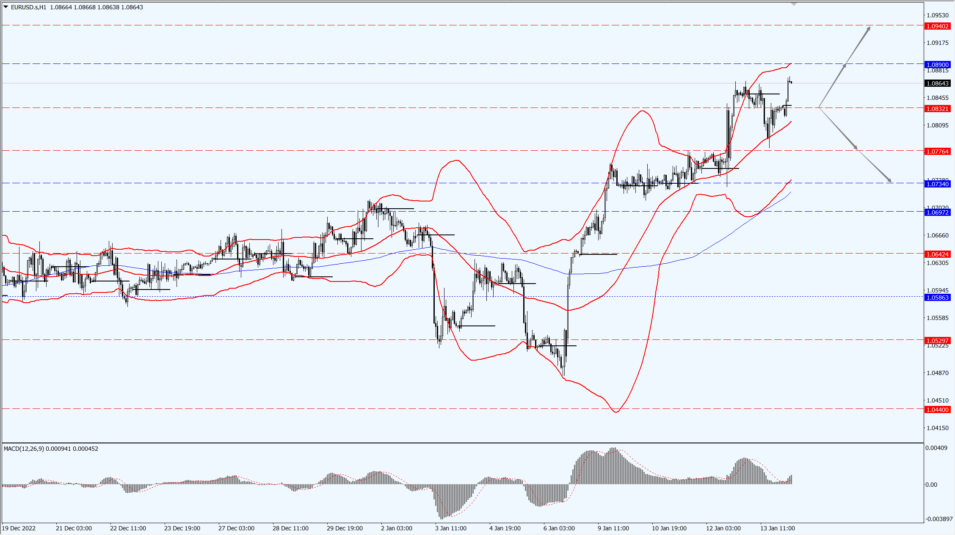

(EUR/USD 1-hour Chart)

We focus on the 1.0832 line today. If the EUR runs below the 1.0832 line, then pay attention to the support strength of the two positions of 1.0776 and 1.0734. If the strength of EUR rises over the 1.0832 line, then pay attention to the suppression strength of the two positions of 1.0890 and 1.0940.

GBP Intraday Trend Analysis

Fundamental Analysis:

Last week, the British pound continued to rise 0.20% against the U.S. dollar to close at 1.2235. Data on Friday, 13th January 2023, showed that U.K. gross domestic product (GDP) rose 0.1% in November from a year earlier, down from a 0.5% increase in October but above market forecasts for a 0.2% decline. The data helped the pound maintain its recent gains against the dollar.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2222-line today. If GBP runs below the 1.2222-line, it will pay attention to the suppression strength of the two positions of 1.2111 and 1.2010. If GBP runs above the 1.2222-line, then pay attention to the suppression strength of the two positions of 1.2311 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Last week, gold prices maintained a shock climbing trend, and broke through the key $1,900 integer barrier in one fell swoop, opening further upside.

As the U.S. inflation has signs of topping, the Federal Reserve’s sharp rise in interest rates is expected to cool, and the Fed officials released a slowdown in the tone of interest rate rises supported the gold price.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1932-line today. If the gold price runs below the 1932-line, then it will pay attention to the support strength of the 1919 and 1909 positions. If the gold price breaks above the 1932-line, then pay attention to the suppression strength of the two positions of 1944 and 1955.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Last week, U.S. oil traded near $79.74 per barrel; oil prices posted their biggest weekly gain since October 2022 last week as the dollar fell to a seven-month low and more indicators point to growing demand from the biggest oil importers; geopolitical tensions continued to support oil prices as Russia raided energy facilities across Ukraine on Sunday, 15th January 2023.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 80.13- line today. If the oil price runs above the 80.13 -line, then focus on the suppression strength of the two positions of 81.31 and 82.28. If the oil price runs below the 80.13 -line, then pay attention to the support strength of the two positions of 79.07 and 77.76.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.