1. Forex Market Insight

EUR/USD

The euro closed up 0.21% against the dollar on Tuesday, 15th November 2022, closing at $1.0347, after rising 1.44% during the session to a new high since July 5 to 1.047.

The euro fell sharply after reports about Poland. German economic sentiment ZEW index, the index rose in November. The data also showed that the employment rate in the euro zone rose in the third quarter.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0277 line today. If the EUR runs below the 1.0277 line, then pay attention to the support strength of the two positions of 1.0190 and 1.0116. If the strength of EUR rises over the 1.0277 line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound rose 0.95% against the dollar on Tuesday, 15th November 2022 to $1.1862, after rising as much as 2.27% earlier in the session to hit a near three-month high of 1.2028.

The British government is set to unveil a tough budget plan later this week, and data showed the U.K.’s unemployment rate unexpectedly rose and vacancies fell for a fifth report in a row as employers worried about the economy.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1723-line today. If GBP runs below the 1.1723-line, it will pay attention to the suppression strength of the two positions of 1.1641 and 1.1565. If GBP runs above the 1.1723-line, then pay attention to the suppression strength of the two positions of 1.1898 and 1.1977.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose Tuesday, 15th November 2022 touching their highest in three months earlier on some safe-haven buying.

Gold prices have turned lower and slipped from their highest point since Aug. 15, which they touched earlier, as the dollar index turned up from a three-month low.

Earlier data showed that U.S. producer prices rose less than expected in October, further evidence that inflation is starting to fade.

Technical Analysis:

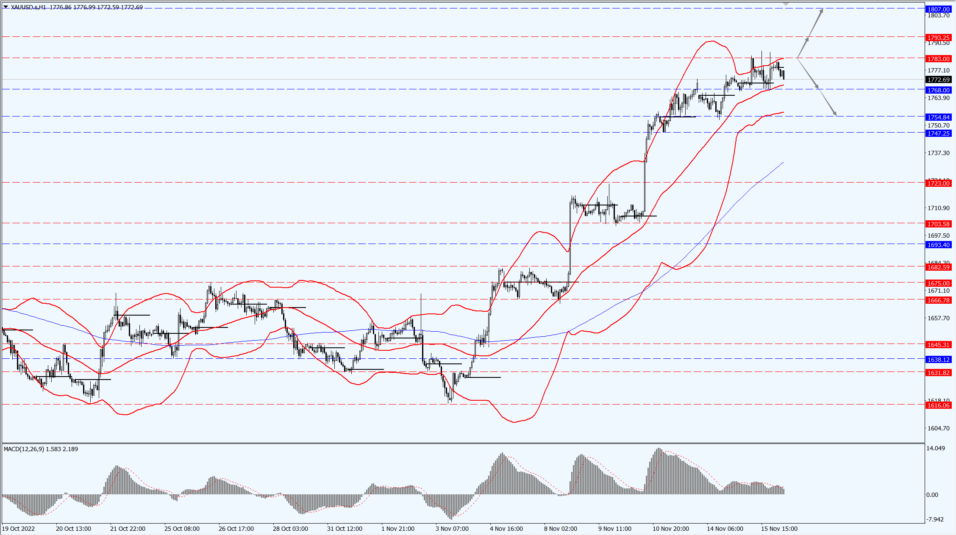

(Gold 1-hour Chart)

Gold pays attention to the 1783-line today. If the gold price runs below the 1783-line, then it will pay attention to the support strength of the 1768 and 1754 positions. If the gold price breaks above the 1783-line, then pay attention to the suppression strength of the two positions of the 1793 and 1807.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Russian oil production will fall by 1.4 million barrels per day next year after the European Union’s ban on Russian seaborne exports takes effect, the International Energy Agency (IEA) said on Tuesday, 15th November 2022.

That means the EU will need to find new sources of supply to replace the 1 million bpd of crude and 1.1 million bpd of oil products, the IEA said, adding that diesel is particularly scarce and expensive, with prices 70% higher than a year ago, which has fueled global inflation.

Providing support for oil prices was a weaker-than-expected increase in U.S. producer prices in October, further evidence that inflation is beginning to ease and could cause the Federal Reserve to slow the pace of its aggressive rate hikes.

U.S. stock indexes rose after the data was released, while the dollar index fell. Data from the American Petroleum Institute (API) said U.S. crude inventories fell sharply last week, but fuel stocks increased; crude stocks plunged by about 5.8 million barrels, gasoline stocks rose by about 1.7 million barrels and distillate stocks rose by about 850,000 barrels in the week ended Nov. 11.

Technical Analysis:

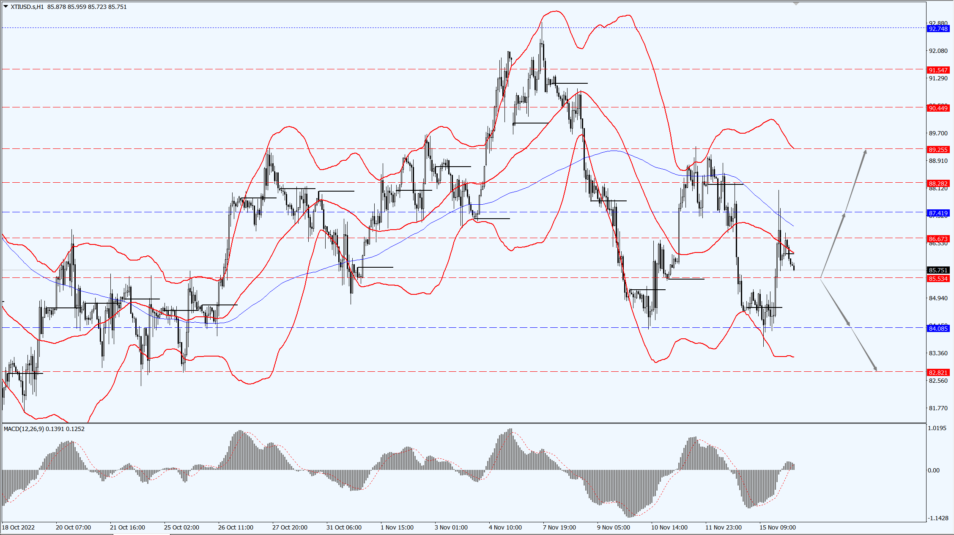

(Crude Oil 1-hour Chart)

Oil prices focus on the 85.53 line today. If the oil price runs above the 85.53-line, then focus on the suppression strength of the two positions of 87.41 and 89.25. If the oil price runs below the 85.53-line, then pay attention to the support strength of the two positions of 84.08 and 82.82.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.