1. Forex Market Insight

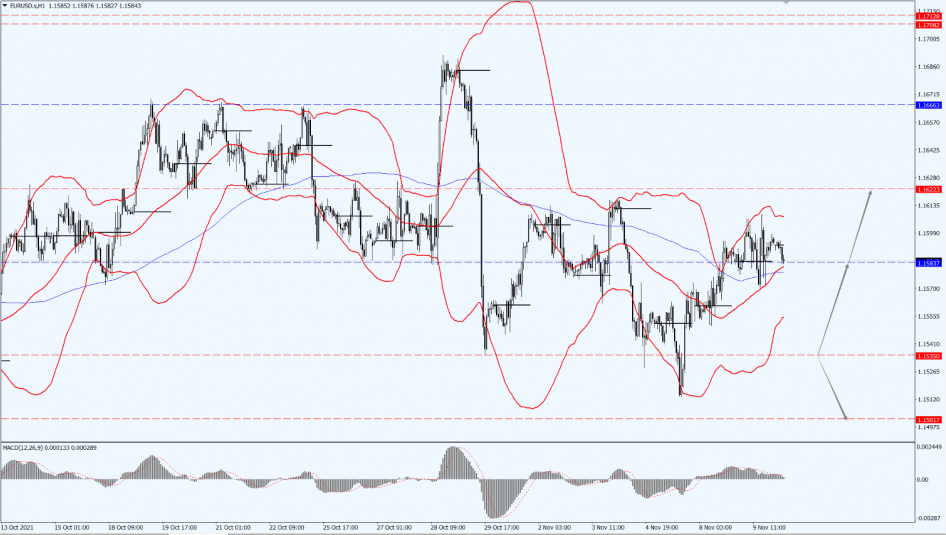

EUR/USD

Data released on Tuesday, 9th November 2021, showed that the U.S. Producer Price Index (PPI) rose strongly in October, suggesting that high inflation could persist for some time as supply chains are strained due to the epidemic.

However, the market was reluctant to push the move sharply ahead of the Consumer Price Index (CPI) data scheduled for release today. Therefore, the euro consolidated yesterday.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1535-line. If the euro runs steadily above the 1.1535-line, then pay attention to the suppression of the two positions 1.1583 and 1.1622 in turn. If the strength of the euro drops below the 1.11535-line, it will open up a further downside space. At that time, pay attention to the support of the 1.1501-line.

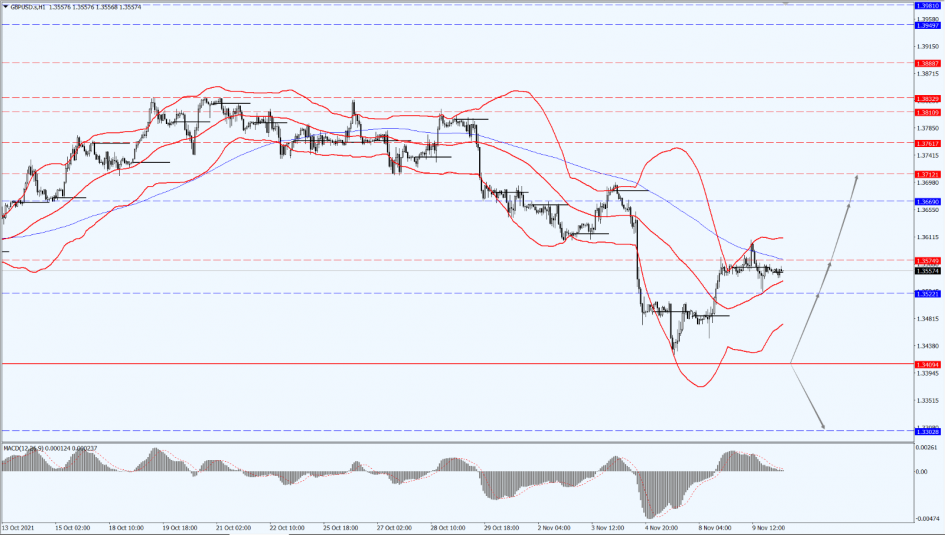

GBP Intraday Trend Analysis

Fundamental Analysis:

In the absence of macroeconomic data releases and new headlines around Brexit, the next move for GBP/USD will be volatile.

At a virtual event organized by the Bank of England, Governor Bailey reiterated that if they see clear evidence of rising inflation pushing up wages, they will have to act on interest rates.

However, these comments do not seem to have a significant impact on market expectations that the BoE will raise interest rates in December. Currently, the CME Group’s BoE Watch tool shows a 67.5% chance of a 20-basis point rate hike by the end of this year.

Meanwhile, the EU is waiting for the UK to take the next step in the Brexit negotiations, after making it clear that they will take action of the appropriate scale if the UK triggers Article 16. The fundamentals seem to be both positive and negative for the pound and will intertwine to influence the pound’s movement.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3409-line. If the pound runs above the 1.3409-line, then pay attention to the suppression of the upper 1.3522 and 1.3574 positions in turn. If the pound strength falls below the 1.3409-line, then pay attention to the 1.3302-line of support.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Yesterday, gold prices saw four consecutive gains, mainly because of the weak trend of the dollar and U.S. stocks supporting the gold prices.

In addition to the high PPI index has also kept inflation expectations high, resulting in anti-inflationary properties of gold to gain favor. However, Bullard’s hawkish speech limited gold price gains.

The focus during the day will be the U.S. October CPI and initial jobless claims released at 21:30 in the evening (Wintertime will be implemented in North America starting on November 7). As Thursday, 11th November 2021 is the United States Veterans Day, so the initial claims data is requested in advance. The CPI is currently expected to continue to rise, which may be bullish for gold prices. If it is weaker than expected, it may be bearish for gold prices.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1831-line today. If the price of gold runs stably below the 1831-line, then pay attention to the support at 1810 and 1800. If the price of gold breaks through the 1831-line, it will open up a further upside space. At that time, pay attention to the suppressive strength of each position of 1844 and 1855.

3. Commodities Market Insight

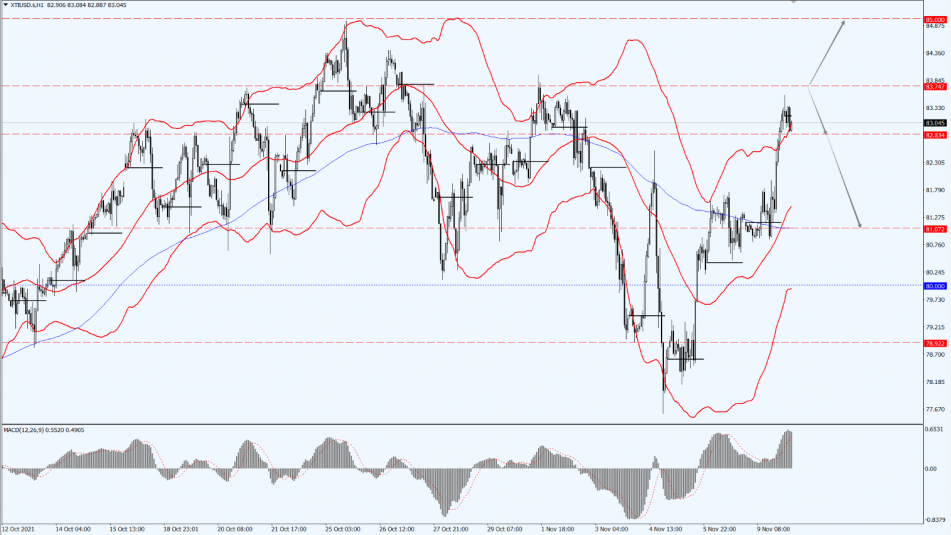

WTI Crude Oil

Fundamental Analysis:

U.S. oil extended its rally, once again hitting a new record high of $84.97 per barrel over the past twelve days. It was boosted by early API data showing a reduction in inventories, and the White House said early today that it would not announce plans to release the Strategic Petroleum Reserve (SPR).

During this interval, oil prices rose sharply by more than 3% on Tuesday, with energy reports forecasting an increase in crude oil supply next year, leading to speculation that the Biden administration may shelve plans to release the country’s emergency reserves.

On intraday, focus on the China’s CPI annual rate in October, the U.S. initial jobless claims for the week ending November 6, the final monthly rate of U.S. wholesale inventories in September, and the EIA data.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices today pay attention to the 83.74-line. If the oil price breaks above the 83.74-line, pay attention to the suppression of the 85-line. If the oil price runs below the 83.74-line, it will open up further room for correction. At that time, pay attention to the support at the 82.83 and 81.07 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.