1. Forex Market Insight

EUR/USD

The European Central Bank will meet today and is expected to take a dovish stance. The German government lowered its growth forecast for this year as semiconductor supply bottlenecks and rising energy costs slowed the recovery. Additionally, the German 10-year bond yields fell to the lowest in more than a week, leading to a flattening yield curve.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1666-line. If the strength of the euro breaks through the 1.1666-line, it will open up a further upside. At that time, pay attention to the suppression of the 1.1708-line. Once the euro falls under the pressure of the 1.1666-line, pay attention to the support at the 1.1622 and 1.1554 positions at that time.

GBP Intraday Trend Analysis

Fundamental Analysis:

The market is generally concerned t that the Bank of England will be less hawkish at the November 4th meeting than what the market is reflecting. Considering that the market has already reflected that the November meeting will raise rates by about 15 basis points, the pound will enter a correction ahead of the meeting unless there is other positive news.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the direction of the breakthrough in the range of 1.3721 to 1.3834. If it breaks upwards through the 1.3834-line, it will open up further upside. With that, pay attention to the 1.3888 line. If it falls below the 1.3721-line, it will open up a further downside space. At that time, pay attention to the support strength of the two positions of 1.3574 and 1.3669.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Global bond yields weakened as concerns about economic growth rose again, pushing gold prices back from early losses. The benchmark 30-year U.S. Treasury yield fell by more than 10 basis points on Wednesday, 27th October 2021, flattening the global bond yield curve and suggesting investors are concerned about a possible slowdown in economic growth.

However, this is a positive for gold, as investors tend to buy gold for safe-haven in times of economic turmoil. With this, gold prices remain below the $1,800 per ounce level and the market is still speculating on how central banks will deal with inflation while preparing to scale back their economic stimulus efforts.

Technical Analysis:

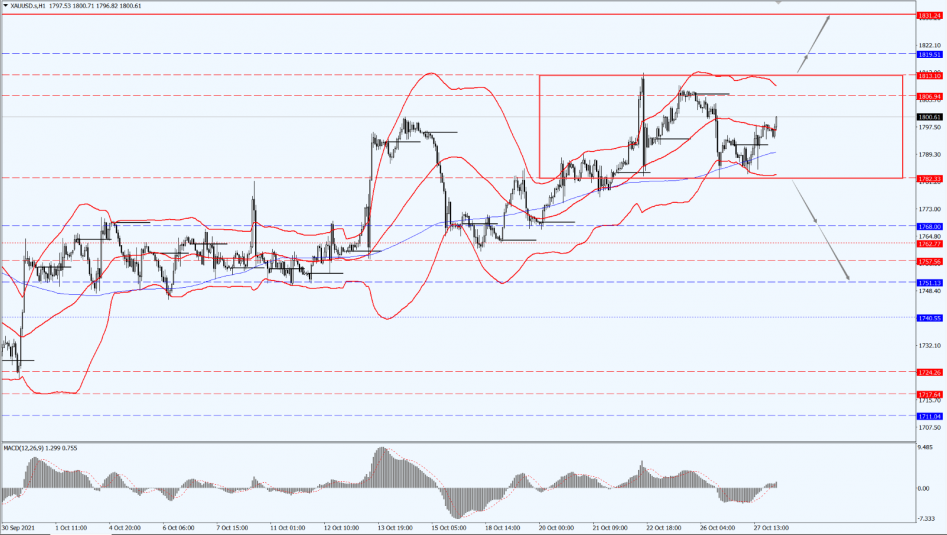

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the direction of the breakthrough of the range from 1782 to 1813. If it breaks upwards through the 1813-line, then pay attention to the suppression of the 1819 and 1831 positions. If it falls below the 1782-line, then pay attention to the support of the 1768 and 1752 positions.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Crude oil prices fell after Iran and the European Union agreed to restart talks aimed at resuming the 2015 nuclear deal by the end of next month, signaling an increased likelihood of a return to the market for Iranian crude. With this, New York crude futures fell by 2.4% on Wednesday, 27th October 2021.

Iranian Deputy Foreign Minister Ali Bagheri Kani said that Iran and the EU agreed to restart nuclear talks by the end of November, with the exact date to be announced next week.

Meanwhile, a U.S. inventory report showed a larger-than-expected increase in crude stocks also put pressure on oil prices. If the talks lead to an end to U.S. sanctions and an increase in Iranian oil exports, then it could end “the threat of a supply shortage, which is partly behind the surge in oil prices”.

Against this background, the West Texas Intermediate crude futures contract for December delivery fell by $1.99 to settle at $82.66 per barrel while Brent crude futures for December delivery fell by $1.82 to close at $84.58 per barrel.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 83.04-line. If the oil price runs below the 83.04-line, we will still maintain a bearish mindset. With this, pay attention to the support at the 80 and 76.89 positions. If the oil price rises above the 83.04 line again, it will test the 85 first-line suppression again.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.