1. Forex Market Insight

EUR/USD

The dollar rose by 0.18% to 92.71, having previously risen to 92.86, its highest since August 27th. Meanwhile, the euro retreated yesterday as the dollar rose sharply.

New York Fed President Williams said the labor market needs to make more progress to achieve “further substantial progress” toward the Fed’s maximum employment target. However, if the economy continues to improve, it may deem appropriate for the Fed to start slowing the pace of asset purchases later this year.

The Federal Reserve reported Wednesday, 8th September 2021, that the U.S. economy “slowed slightly” in August, with a renewed surge in the number of new cases hitting the restaurant, travel and tourism industries.

Over and above, the data released on Wednesday showed that the number of job openings in the United States rose to nearly 11 million in July.

Technical Analysis:

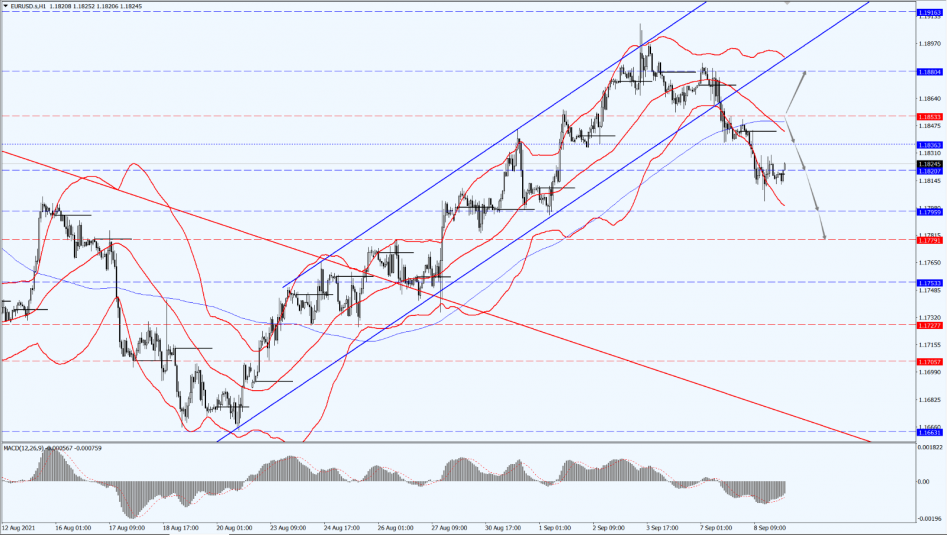

(EUR/USD 1-hour chart)

Execution Insight:

Today, the euro is focused on the 1.1853-line. As long as the euro runs steadily below the 1.1853-line, then it will maintain its bearish trend. On the lower end, pay attention to the support of the 1.1795 and 1.1779 positions. If the euro rises above the 1.1853-line, it could possibly open up further room for rebound. At that time, pay attention to the suppression of the 1.1880 line.

GBP Intraday Trend Analysis

Fundamental Analysis:

Just like his peers, the Governor of the Bank of England, Andrew Bailey, also believes that the minimum standard for tightening monetary policy has been reached. This statement may strengthen market expectations for the Bank of England to raise interest rates next year.

Bailey said in Parliament on Wednesday that at the August meeting, central bank officials were divided on whether there was clear evidence that the economy was eliminating idle capacity and “sustainably” achieving the 2% inflation target, and that the numbers of the two factions were basically the same.

Also, Bailey stressed that those who believe the conditions outlined in the forward guidance have been met do not see this as a sufficient reason to tighten policy immediately.

Ultimately, Bailey told lawmakers that the rebound in the U.K. economy is entering a plateau due to the impact of the spread of the Delta strain. The July data release is due on Friday, 10th September 2021 and it is expected to show the economy’s growth rate falling to its lowest level since January.

Technical Analysis:

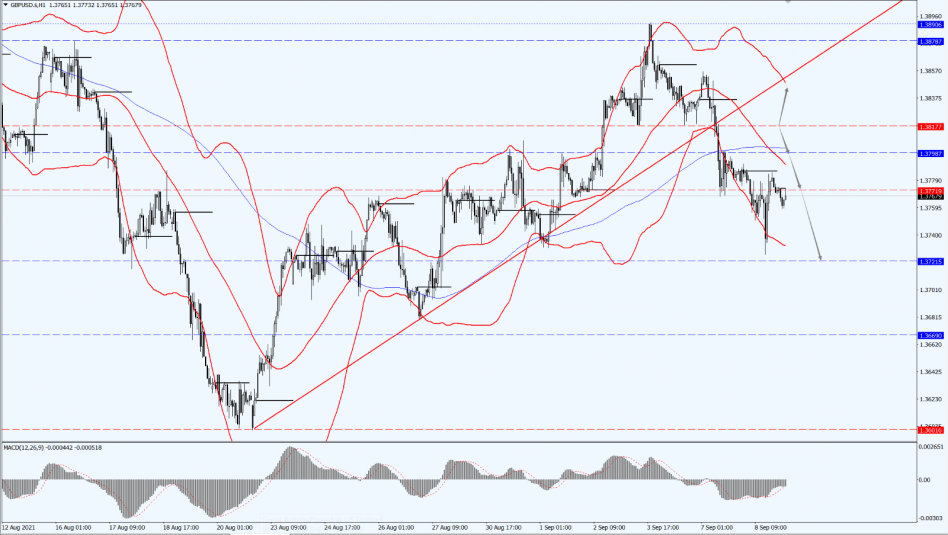

(GBP/USD 1-hour chart)

Execution Insight:

Today, the pound is focused on the 1.3817-line. If the pound runs steadily below the 1.3817-line, it will be bearish. On the bottom, focus on the support of the 1.3721-line. If the pound rises above the 1.3817-line, the upper Bollinger band will focus on the suppression of the pound.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices slipped on Wednesday, 8th September 2021, falling for a third day in a row, as concerns about the outlook for global growth led investors to turn to the dollar for safe-haven, reducing demand for gold as an alternative asset.

Gold prices have been fluctuating in a narrow range for some time. On the one hand, the dollar is performing strongly and the threat of a pullback in monetary policy stimulus has been on-going. At the same time, Covid-19 broke out once again, posing the risk of derailing economic growth.

Technical Analysis:

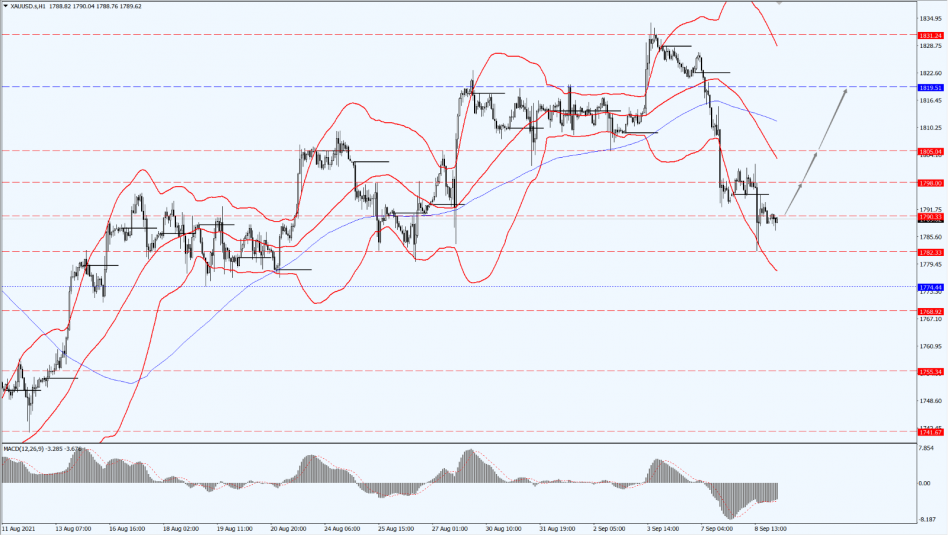

(Gold 1-hour chart)

Trading Strategies:

Gold fell to 1782 yesterday as expected, and then stabilized and rebounded. Today, focus on the 1790-line. If the price of gold can effectively stabilize above the 1790-line, then pay attention to the suppression of the 1798 and 1805 positions in turn. On the bottom, focus on the strength of the 1782 first-line support.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose yesterday, with the U.S. oil rising up by more than 2%, reaching a new daily high of $69.75 per barrel, as U.S. production is gradually recovery after Hurricane Ida.

According to the U.S. Bureau of Safety and Environmental Enforcement data, more than a week after the landing of “Ida”, about 77% of the U.S. Gulf of Mexico’s offshore oil production has yet to recover.

Technical Analysis:

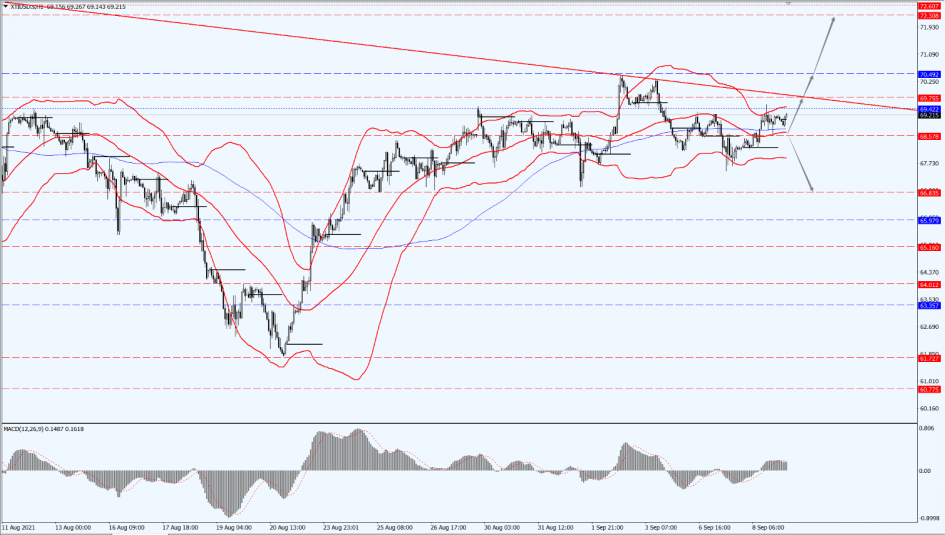

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices went up unilaterally as expected yesterday. Today, we pay attention to the 68.57-line. If oil prices run stably above the 68.57-line, it will maintain the bullish trend. The top will follow the suppression efforts at 69.75 and 70.49 in turn. If the oil price falls below 68.57, it could possibly open up a further downside potential. At that time, pay attention to the strength of the 66.83-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.