1. Forex Market Insight

EUR/USD

The dollar index was up by 0.12% to 93.95 as the U.S. 10-year Treasury yield slipped for the third consecutive day. Previous data showed that U.S. consumer confidence unexpectedly strengthened in October.

The dollar is likely to remain steady ahead of a series of central bank meetings and economic data that could change perceptions of interest rates, inflation, and growth rates. The euro was down by 0.1% against the dollar to 1.1596.

Additionally, the euro has recently weakened due to expectations that the European Central Bank will take a dovish stance at the meeting. On Tuesday, 26th October 2021, news emerged that bond investors’ inflation expectations for the eurozone have reached a seven-year high of more than 2.07%.

Technical Analysis:

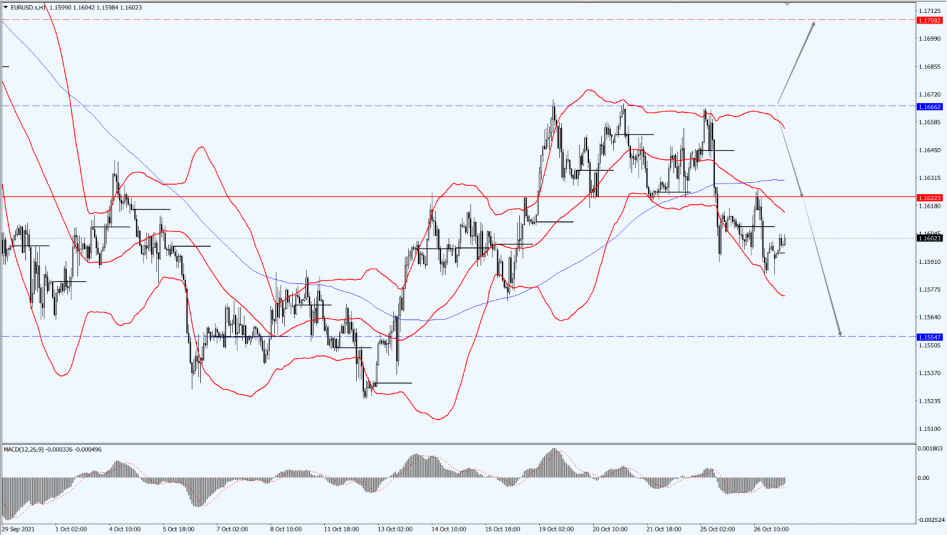

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1666-line. If the strength of the euro breaks through the 1.1666-line, it will open up a further upside. At that time, pay attention to the suppression of the 1.1708-line. Once the euro falls under the pressure of the 1.1666-line, pay attention to the support at the 1.1622 and 1.1554 positions at that time.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound climbed above $1.38 at one point, after British retailers reported stronger-than-expected sales in October, confirming the prospect of higher interest rates. However, the pound then retreated and was flat on the day at $1.3764.

Technical Analysis:

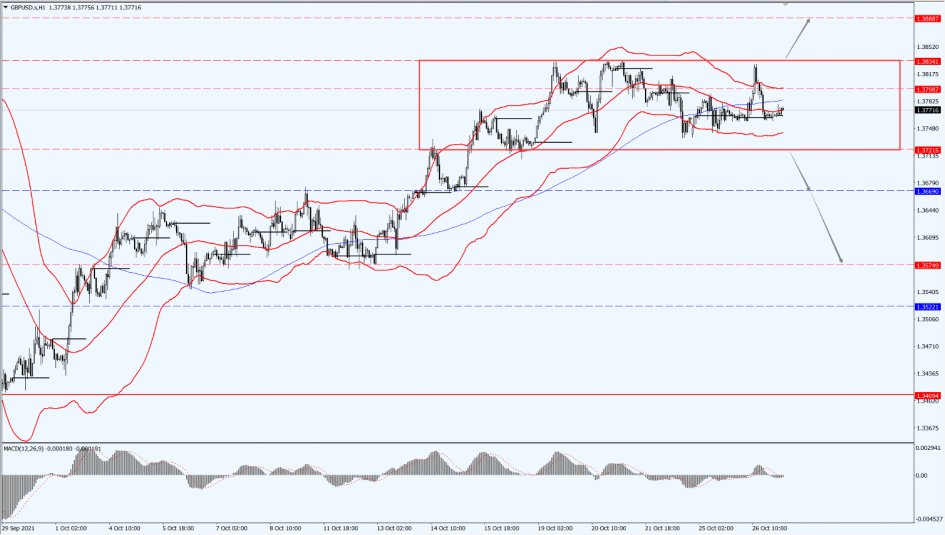

(GBP/USD 1-hour chart)

Execution Insight:

Today, the pound is mainly focused on the direction of the breakout of the 1.3721 to 1.3834 range. If it breaks upwards through the 1.3834-line, it will open up a further upside. Then, pay attention to the 1.3888-line. If it drops below the 1.3721-line, it will open up a further downside space. At that time, then pay attention to the support strength of the two positions of 1.3669 and 1.3574.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold closed down by 0.82% at $1,792.90 per ounce yesterday. The intraday drop was down by 1.4% at one point during the session, ending a previous five-day rally as the stronger dollar and strong corporate earnings boosted investor demand for riskier assets.

Technical Analysis:

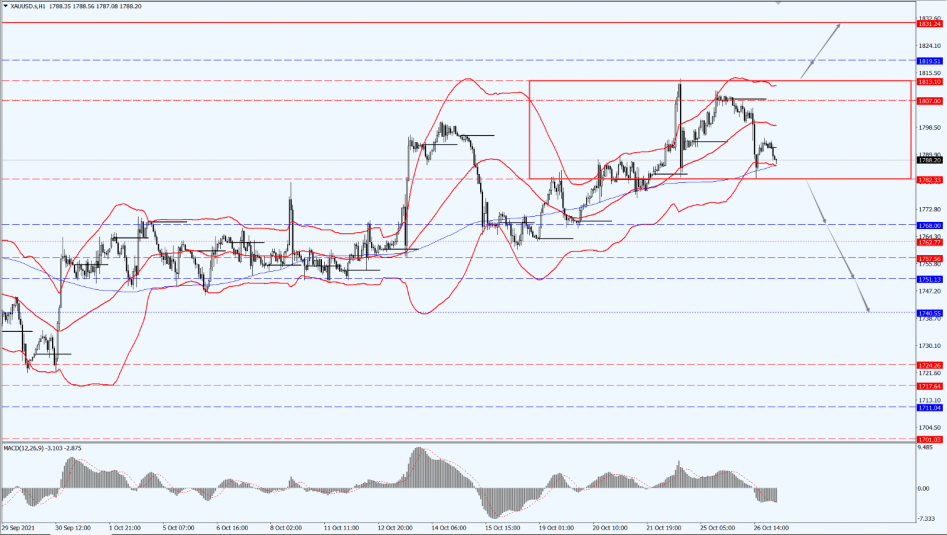

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the direction of the breakthrough of the range from 1782 to 1813. If it breaks upwards through the 1813-line, then pay attention to the suppression of the 1819 and 1831 positions. If it falls below the 1782-line, then pay attention to the support of the 1768 and 1752 positions.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose on Tuesday, 26th October 2021, as the market awaits U.S. supply data to see if inventories at Cushing, the crude storage hub, tighten further. The U.S. crude futures rose by 1.1%, holding at a 2014 high.

The American Petroleum Institute will release inventory data later on Tuesday. Cushing supplies are expected to fall again this week amid falling U.S. production, a drilling moratorium, and increasing demand. Additionally, oil prices continue to rise on concerns that inventories are falling below levels needed to maintain minimum operations. Thus, refiners are digesting Cushing inventories at an incredible rate and stocks are nearing clearing.

The Organization of the Petroleum Exporting Countries and its allies are scheduled to meet next week to assess output policy. Nigeria joined Saudi Arabia this week in saying it must resist accelerating pressure to increase production until the new crown epidemic is over. With this, the market is closely watching negotiations around the resumption of the Iran nuclear deal, which may eventually be able to restart the agreement and thus allow the country to increase crude exports.

Against this background, the West Texas Intermediate crude oil futures for December delivery rose by 89 cents to settle at $84.65 per barrel while Brent crude oil futures for December delivery rose by 41 cents to close at $86.40 per barrel.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices pay attention to the suppression of the 85-line, and the support levels at 83.04 and 81.33. Once the oil price falls below the 81.33-line, oil prices will open up a further downward space.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home