1. Forex Market Insight

EUR/USD

The euro rose by 0.10% against the dollar to 1.1248, having earlier touched a 16-month low of $1.1226. The selling of macro accounts pushed the euro off intraday highs against the dollar. Meanwhile, European bond yields were higher, boosted by hawkish ECB comments and an unexpected acceleration in regional business activity indices.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the 1.1278-line. If the euro runs stably below the 1.1278-line, maintain the bearish trend. Below, pay attention to the support at 1.1223 and 1.1183. If the strength of the euro breaks through the 1.1278-line, then pay attention to the repressive strength at 1.1315 and 1.1338.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England is unlikely to give a more rigid guidance. It is also unlikely that the size of the balance sheet will remain unchanged forever. However, the biggest concern is the tight labor market in the U.K. where the QE program will eventually have to be cancelled.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3450-line. If the pound runs below the 1.3450-line, then pay attention to the 1.3302-line of support. If the pound breaks through the 1.3450-line, then pay attention to the 1.3522-line of suppression.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold fell by more than 1% yesterday, refreshing its low since 4th November 2021, to $1,782.05 an ounce. During the same interval, Powell’s nomination for a second term as Fed chairman fueled bets for a faster rate hike, boosting the dollar and U.S. bond yields.

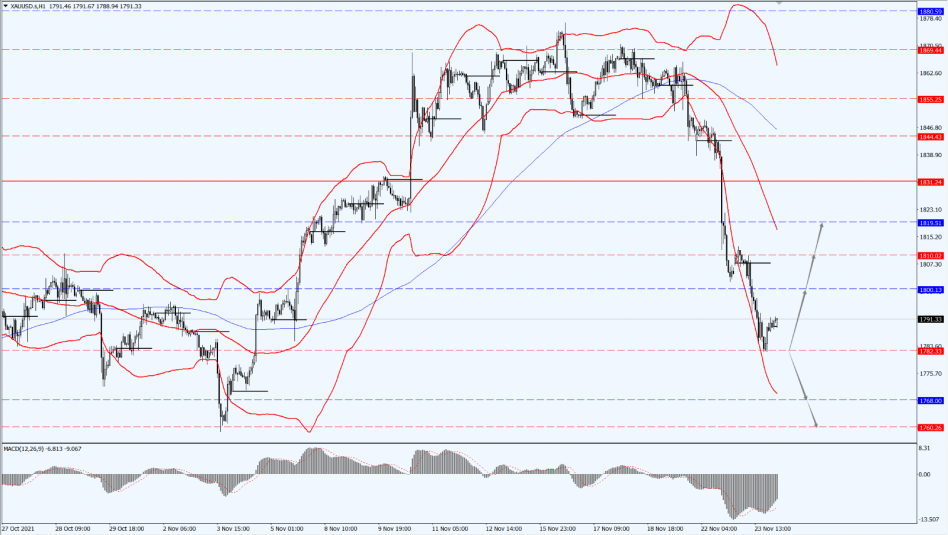

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold is likely to recover from the sharp decline in the previous session. Therefore, if the price of gold runs stably above 1782, then pay attention to the suppression of the two positions of 1800 and 1810. If the price of gold falls below 1782, then it will open up a further downside space. At that time, pay attention to the support of the 1768 and 1760 positions.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices hit their biggest gain in two weeks, with Brent oil rising by more than 3% to a one-week high, as oil-consuming countries joined forces to release the Strategic Petroleum Reserve not as much as the market had expected.

The White House issued a statement announcing that it will release the Strategic Petroleum Reserve. Despite the seemingly large size of the release, a large portion of the crude oil is of a temporary loan nature and will need to be returned later, prompting the market to expect a tighter supply-demand balance going forward.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices pay attention to the 76.89-line. If oil prices run above the 76.89-line, focus on the suppression of the 78.92 and 80 positions in turn. If the oil price drops below 76.89, it will open up further downward space. At that time, focus on the strength of support at 75.69 and 75.04.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.