1. Forex Market Insight

EUR/USD

ECB Governing Council member, Pierre Wunsch said that at some point, it will be necessary to withdraw from the monetary and fiscal stimulus measures. Of course, such an exit will be difficult because it is subtractive rather than an addition.

The current theme is to exit, and the path will not go smoothly. Inflation will be higher than the previous forecast, and the statement about inflation being partly temporary is correct. Though the inflation is only temporary, we hope that the policy will work and the inflation rate will return to 2% at some point. This process will come sooner than we thought 6 months ago.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we pay attention to the 1.1554-line of support. If the euro breaks below the 1.1554-line, it will open up a further downside potential. At that time, pay attention to the 1.1501-line of support as it could possibly open up a further upside potential.

GBP Intraday Trend Analysis

Fundamental Analysis:

The UK and the six Gulf Cooperation Council states have begun preliminary talks on a free trade agreement, Bahrain said, as London seeks to bolster its trade position post-Brexit.

‟A trade agreement with the Gulf Cooperation Council is a huge opportunity to liberalize trade with a growing market for British business and deepen ties with a region that is vital to our strategic interests,” said International Trade Secretary Anne-Marie Trevelyan.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

Today, the pound pays attention to the suppression of 1.3669, and the support below 1.3522 and 1.3409. Once the pound sits above the 1.3669-line, it will open up a further upside potential. At that time, we will pay attention to the suppression of the 1.3721-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Yesterday, gold prices surged higher before surrendering all the gains. At one point, it rose by more than 1% during the day due to the weaker-than-expected U.S. jobs data. However, investors believe the Fed may still have enough reasons to wean the U.S. economy off its dependence on stimulus this year. Under these circumstances, the gold prices then retreated.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold is still paying attention to the direction of the breakthrough in the 1745 to 1768 range. If it breaks through 1768 upwards, it will open up a further upside potential. At that time, it will pay attention to the suppression of 1782 and 1801. If it falls below the 1745-line, it will open up a further downside space. At that time, we will pay attention to the support of 1740 and 1724.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, the WTI oil rose by $1.29, or 1.65%, to close at $79.59/barrel in late trading. The cumulative increase this week was 5.08%, marking the seventh consecutive week of gains, the longest streak since December last year. Brent oil rose by $0.63, or 0.77%, to close at $82.58 per barrel, a cumulative increase of 4.22% this week.

U.S. gasoline futures also closed at their highest level since October 2014. OPEC+ producers remain tight on supply amid a global energy crisis boosting demand, while the U.S. Department of Energy said it is not announcing immediate action to depress oil prices, such as releasing strategic oil reserves. This has further supported the oil market.

In the face of improving fuel demand, the energy market has tightened, and many fear that a cold winter could further tighten gas supplies. Higher oil prices have been spurred by soaring natural gas prices in Europe, which has prompted power generators to turn to oil to generate electricity. There are many signs this week that supplies will remain constrained.

Technical Analysis:

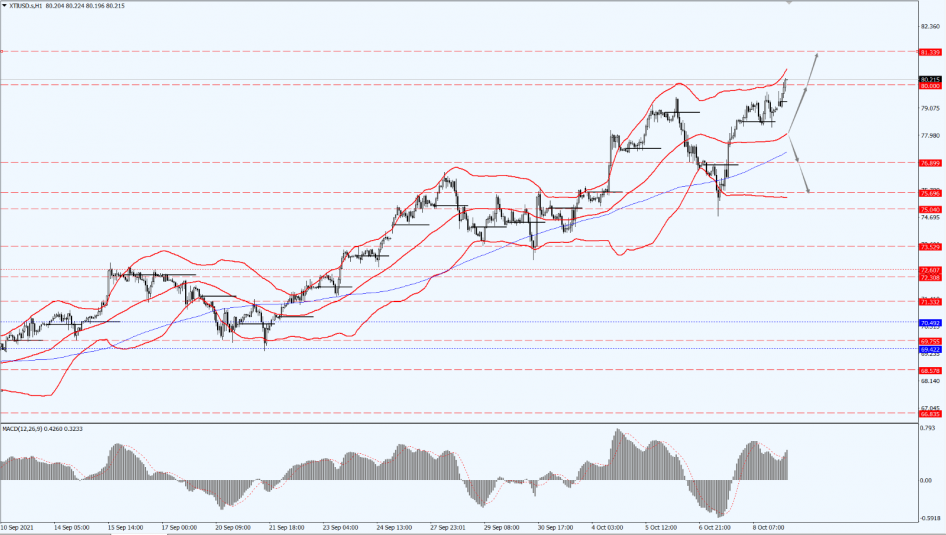

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices pay attention to the middle rail of the Bollinger Bands. If oil prices are running above the middle rail of the Bollinger Bands, it will be ideal to take advantage of the trend and focus on the suppression of the 80 and 81.40 positions in turn. Once the oil price falls below the middle track of the Bollinger Band, it will open up a further downside potential. At that time, we will pay attention to the support at 76.89 and 75.69.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.