1. Forex Market Insight

EUR/USD

EUR/USD rose back above parity on Wednesday, 1 September 2022. However, the outlook for the EUR remains mired in uncertainty due to the energy crisis and recession fears.

EUR ended the session up 0.31% at $1.0047.

Eurozone hit a record high again in January and will soon reach double digits.

This signals that the European Central Babk (ECB) may offer a series of sharp interest rate hikes, despite the growing certainty of a painful recession ahead.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.09999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9938 and 09864. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD was down 0.3% at $1.16185.

The month-to-date decline of 4.6% is on track for the worst monthly performance since October 2016. As investors are concerned that the UK economy is slowing sharply at a time when inflation is accelerating.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1554-line today. If GBP runs below the 1.1554-line, it will pay attention to the suppression strength of the two positions of 1.1501 and 1.1421. If GBP runs above the 1.1554-line, then pay attention to the suppression strength of the two positions of 1.1622 and 1.1696.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices slipped on Wednesday, 31st August 2022, falling for a fifth straight month, weighed down by aggressive interest rate hikes by major global central banks.

The Federal Reserve will need to raise interest rates above 4% by early next year, Federal Reserve Bank of Cleveland Chairman Mester said Wednesday, 31st August 2022, then keep it there in order to bring the excessive inflation back to the target level.

Eurozone inflation hit a record high again in August and will soon reach double digits.

This signals that the ECB may offer a series of sharp interest rate hikes, despite the growing certainty of a painful recession ahead.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1700-line today. If the gold price runs steadily below the 1700-line, then it will pay attention to the support strength of the 1693 and 1680 positions. If the gold price breaks above the 1700-line, then pay attention to the suppression strength of the two positions of the 1713 and 1720.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices extended losses on Wednesday, 31st August 2022, on concerns that the global economy will slow further.

According to a survey conducted by Reuters, both OPEC and U.S. production reached their highest levels since the early days of the new crown epidemic, with OPEC production reaching 29.6 million barrels per day in the latest month, while U.S. production rose to 11.82 million barrels per day in June.

Both are at their highest levels since April 2020.

OPEC+ sources said the oil market will see only a small surplus of 400,000 bpd in 2022, well below previous forecasts, due to a shortfall in production from its members.

Some OPEC+ members have called for production cuts. The organization will meet on 5th September 2022.

Weak demand from Asia has led Saudi Arabia to reduce its official sales price to the region.

The U.S. Energy Information Administration said Wednesday, 31st August 2022, that U.S. crude oil inventories fell by 3.3 million barrels, while gasoline stocks fell by 1.2 million barrels.

Technical Analysis:

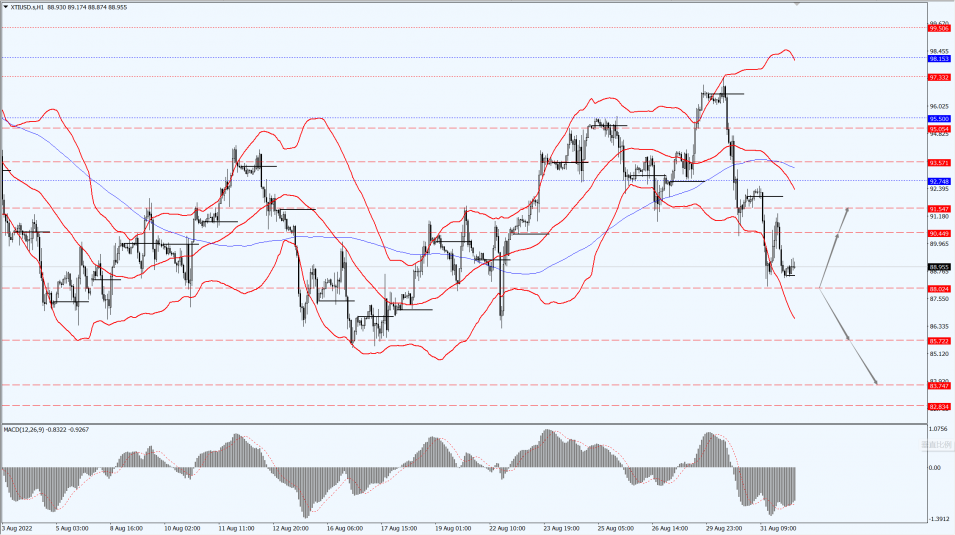

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 88.02-line today. If the oil price runs above the 88.02-line, then focus on the suppression strength of the two positions of 90.44 and 91.54. If the oil price runs below the 88.02-line, then pay attention to the support strength of the two positions of 85.72 and 83.74.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.