1. Forex Market Insight

EUR/USD

USD weakened on Monday, 1st August 2022, as investors increased their bets that the Fed’s aggressive policies will send the U.S. economy into recession.

U.S. manufacturing activity slowed less than expected in July, with signs that supply constraints are easing and the manufacturing input price sub-indicator falling to a two-year low, suggesting inflation may have peaked.

The weakness of USD led to a shock to the upside in the euro.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0277-line today. If EUR runs steadily below the 1.0277-line, then pay attention to the support strength of the two positions of 1.0190 and 1.0116. If the strength of EUR breaks above the 1.0277-line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP edged up against the U.S. dollar and will move with a bit of a wait-and-see attitude ahead of the Bank of England’s interest rate announcement on Thursday, 4th August 2022, with interest rate expectations suggesting that the market is now fully digesting the possibility of a 50 basis point rate rise.

As a result, there is some risk of a hawkish pricing of the market that cannot be ignored as a pullback, which could trigger some weakness in the pound.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2301-line today. If GBP runs below the 1.2301-line, it will pay attention to the suppression strength of the two positions of 1.2106 and 1.2056. If GBP runs above the 1.2301-line, then pay attention to the suppression strength of the two positions of 1.2478 and 1.2668.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices were near a one-month high on Monday, 1st August 2022, as the dollar fell and markets awaited economic data that could influence the Fed’s tightening policy path.

Safe-haven gold has recently found some support from weak economic data, including an unexpected contraction in the U.S. economy in the second quarter and a slowdown in manufacturing activity in the eurozone.

The market will be closely watching Friday’s monthly U.S. jobs report, which could influence the Federal Reserve’s plans to raise interest rates.

Technical Analysis:

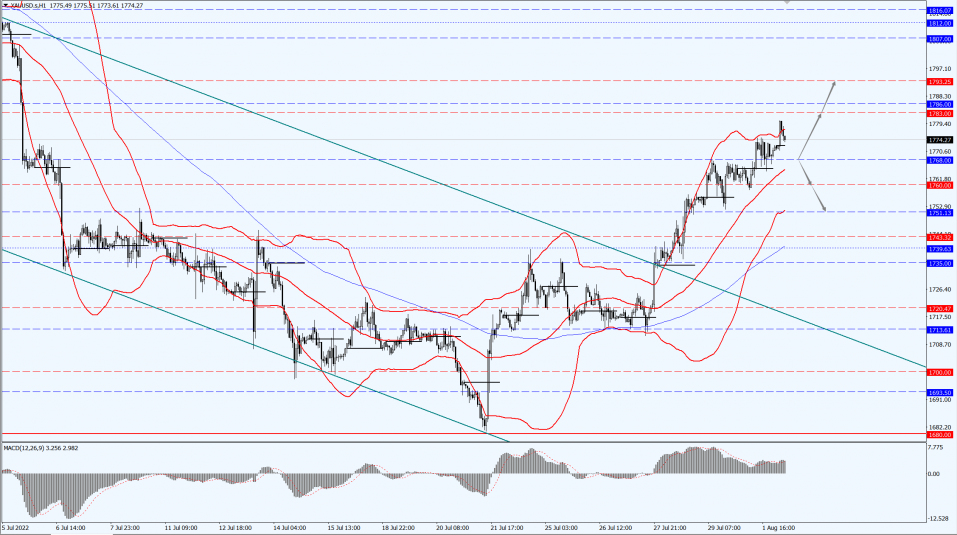

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1768-line today. If the gold price runs steadily below the 1768-line, then it will pay attention to the support strength of the 1760 and 1751 positions. If the gold price breaks above the 1768-line, then pay attention to the suppression strength of the two positions of the 1783 and 1793.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell more than 4% on Monday, 1st August 2022, as weak manufacturing data from several countries weighed on the demand outlook while investors prepared for a supply meeting this week between OPEC and its oil-producing allies.

Factories across the U.S., Europe and Asia struggled to gain momentum in July as low global demand and epidemic controls slowed production, a survey showed Monday, potentially fueling fears that the economy is sliding into recession.

Brent and U.S. crude both fell for a second straight month in July for the first time since 2020, as soaring inflation and higher interest rates sparked fears of a recession that would erode fuel demand.

Technical Analysis:

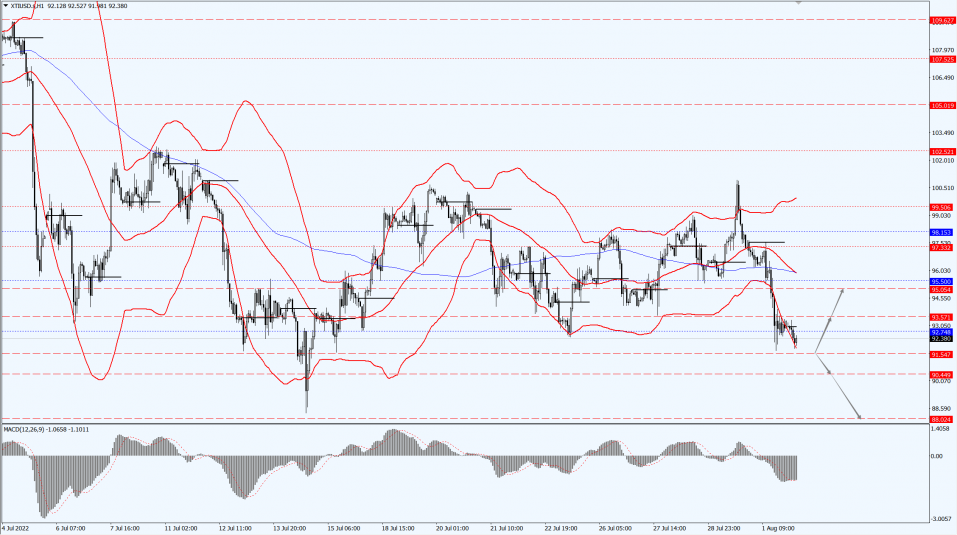

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 91.54-line today. If the oil price runs above the 91.54-line, then focus on the suppression strength of the two positions of 93.57 and 95.05. If the oil price runs below the 91.54-line, then pay attention to the support strength of the two positions of 90.44 and 88.02.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.