1. Forex Market Insight

EUR/USD

The core members of the European Central Bank (ECB) recently emphasized that they want to avoid a premature withdrawal from the easing policy and stressed that the current upward inflationary pressures are mostly temporary.

By emphasizing this, they effectively postponed any possibility of an early “recalibration” of the pandemic emergency purchase program (PEPP), which will end at the end of the first quarter. Meanwhile, the asset purchase program (APP) will be until at least December when employees update their forecasts.

The recent survey data have weakened significantly while inflation data remain high, highlighting that the supply costs and labor constraints are holding back economic activity and should increase concerns about the October PMI.

With this, the ECB’s cautious stance puts it at the moderate end of a global shift toward tightening or rate hikes that could limit any rally in the EURUSD.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we still pay attention to the 1.1622-line. If the euro is suppressed by the 1.1622-line, it will test the support of the Bollinger Bands and the 1.1554 again. If the euro breaks through 1.1622 and stands above the 1.1622-line, it will open up a further upside potential. At that time, pay attention to the suppression of the two positions at 1.1663 and 1.1708 in turn.

GBP Intraday Trend Analysis

Fundamental Analysis:

The data shows that the number of employees in British companies rose by 207,000 from August to a record high. Employers are hiring staff through recruitment agencies and jobs are being created by accommodation and food companies entering the recovery.

Additionally, another official figure showed that the unemployment rate fell to 4.5% in the three months to August from 4.6% in May-July, in line with expectations.

The Bank of England, poised to become the first major central bank to raise interest rates since the outbreak of the Covid-19 virus. It is currently observing how many people will lose their jobs when the wage subsidy program ends.

These data allow the Bank of England to keep the possibility of raising interest rates before the end of the year. However, a recent survey showed that U.K. consumer spending grew at the slowest rate since January in September due to concerns about fuel shortages.

The British Retail Consortium (BRC) said retail spending growth lost significant momentum last month, rising just 0.6% compared with September 2020, and the increase was also well below the 3.0% growth in August.

Due to lack of tanker truck drivers, supply was interrupted, and panic fuel purchases occurred in most parts of the U.K. last month. The government blamed it on problems facing the global economy as it reopens after the embargo, but critics say this also reflects UK’s stricter immigration regulations after Brexit.

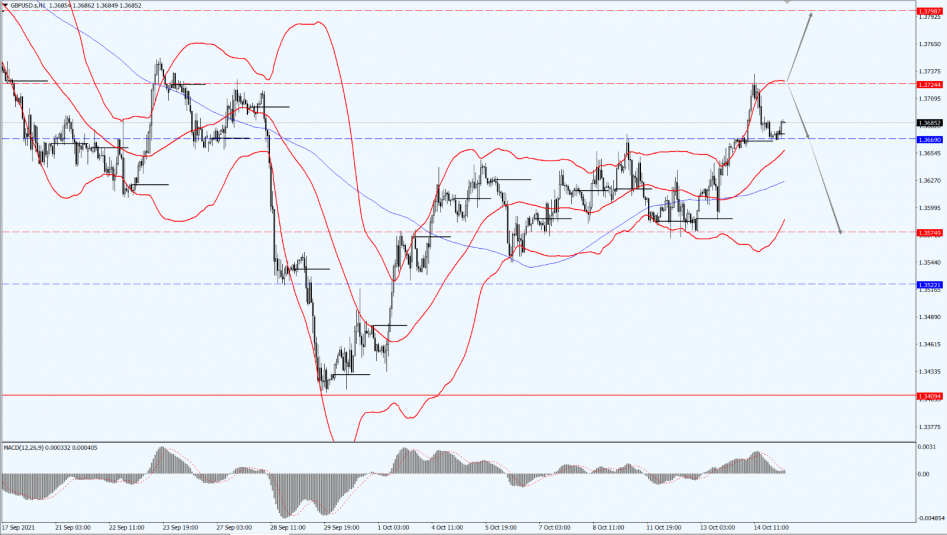

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today pays attention to the 1.3724-line. If the pound moves above the 1.3724-line, pay attention to the suppression of the 1.3798 line. If the pound is strongly suppressed by the 1.3724-line, then pay attention to the support at the 1.3669 and 1.3574 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices hit a one-month high yesterday as the falling dollar and U.S. bond yields caused investors to turn to gold as a hedge against inflation risks. During this interval, spot gold rose by 0.42% at one point, hitting its highest since September 15th at $1,800.55.

The U.S. consumer prices rose more than expected in September, resuming the previous accelerated upward trend, and highlighting the continued inflationary pressure on the economy. A decline in the yield on the 10-year U.S. Treasury note also boosted gold’s strength. Additionally, lower real interest rates supported gold as there is a growing belief in the market that inflation is likely to remain at higher levels for longer.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the first line of 1782. If the price of gold runs above the first line of 1782, keep the trend of bullishness. At that time, pay attention to the suppression of 1801 and 1807. Once it falls below the first line of 1782, pay attention to the support of the first line of 1768.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose more than 1% after the release of the U.S. inventory report showing the biggest drop in Oklahoma’s Cushing crude stocks since June. New York crude futures rose by 1.1% yesterday, settling at a near seven-year high.

Inventories in Cushing, the largest crude oil storage site in the United States, fell last week as traders shipped more crude oil to the Gulf Coast for export. However, the U.S. domestic crude stocks rose more than 6 million barrels last week, exceeding expectations, and oil production increased for the fifth consecutive week.

An intensifying global gas crisis has fueled crude oil gains in recent months, while the Saudi energy minister reiterated the need for OPEC and its allies to take a gradual, phased approach to increasing supply.

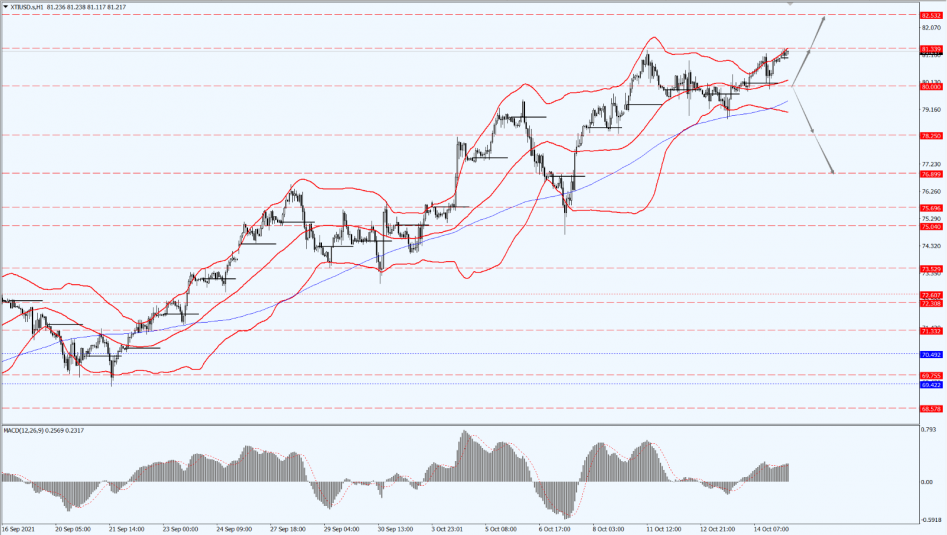

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices pay attention to the 80-line. If the oil price is above the 80-line, maintain the bullish trend. Then, pay attention to the suppression of the 81.33 and 82.57 positions. If the oil price falls below the 80-line, it will open up a further downside potential. At that time, we will pay attention to the strength of support at 78.25 and 76.89.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.