1. Forex Market Insight

EUR/USD

Yesterday, the U.S. dollar index ended by 0.64% lower to 95.00 in late trading, after once falling to 94.90 during the session, the lowest since 11th November 2021.

The U.S. consumer prices rose strongly in December, the largest annual gain in nearly 40 years, supporting expectations that the Federal Reserve will raise interest rates at least three times this year.

The G-10 currency rose broadly against the dollar while the U.S. bond market reacted little to the inflation data, as yields have risen sharply since the beginning of the year.

During this interval, the euro rose by 0.66% against the dollar to 1.1442, the highest since 15th November last year.

Technical Analysis:

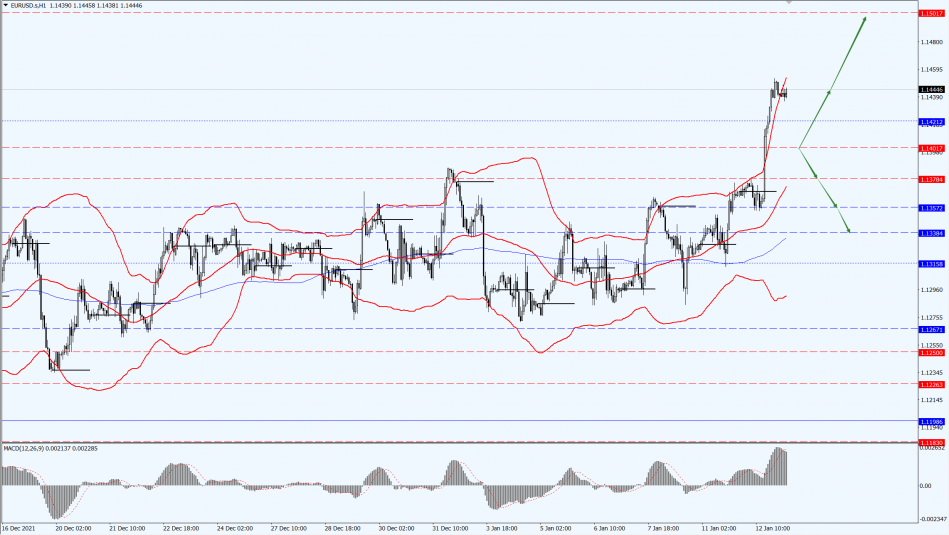

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the support strength of the 1.1401-line. If the euro runs steadily above the 1.1401-line, we will pay attention to the suppression strength at the top of 1.1501-line.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rose by 0.56% against the dollar, helped by a weaker dollar and the view that the U.K. may be weathering the worst of the spike in Omicron cases, which helped pave the way for another U.K. interest rate hike in the near future.

Technical Analysis:

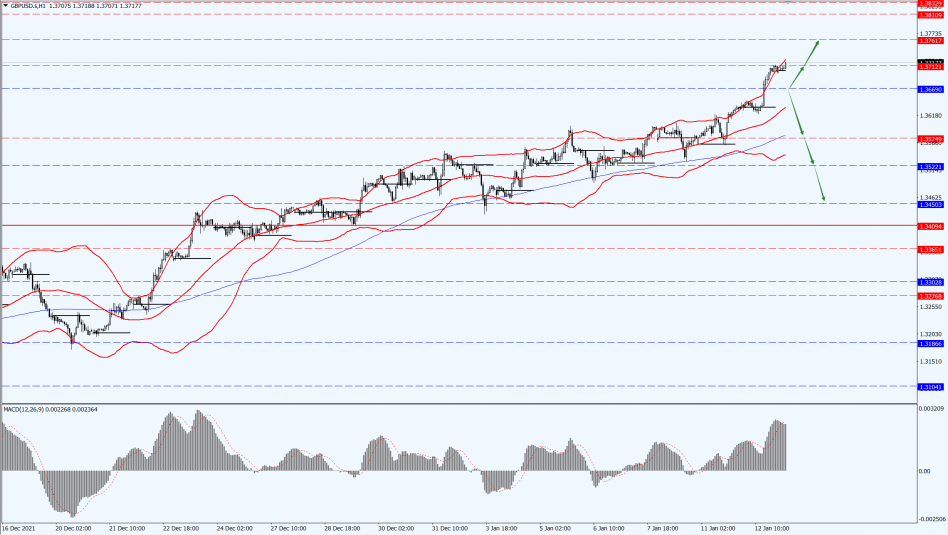

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3669-line today. If the pound runs above the 1.3669-line, it will pay attention to the suppression of the two positions of 1.3761 and 1.3801. If the pound runs below the 1.3669-line, it will pay attention to the support strength of the 1.3574-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose for the fourth consecutive session yesterday.

Data showed that the U.S. inflation hit a 39-year high, in line with market expectations, sparking concerns about a depreciating dollar.

At the same time, high inflation boosted the market’s appeal for safe-haven gold. However, the strength of the stock market and hawkish speeches by Fed officials still limited the rise in gold prices.

The main focus during the day will be on initial claims and the U.S. PPI for December.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is concerned about the 1812-line today. If the price of gold runs steadily below the 1812-line, then it will pay attention to the support strength of the two positions of 1793 and 1804. If the gold price breaks above the 1812-line, it will open up further upward space. At that time, pay attention to the suppression of the 1831-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices climbed yesterday, with U.S. oil rising to a two-month high of $83.10 per barrel, as supply tightened and crude inventories in the U.S., the world’s biggest consumer, fell to their lowest level since 2018, as well as a weaker dollar and easing concerns over the Omicron variant.

Technical Analysis:

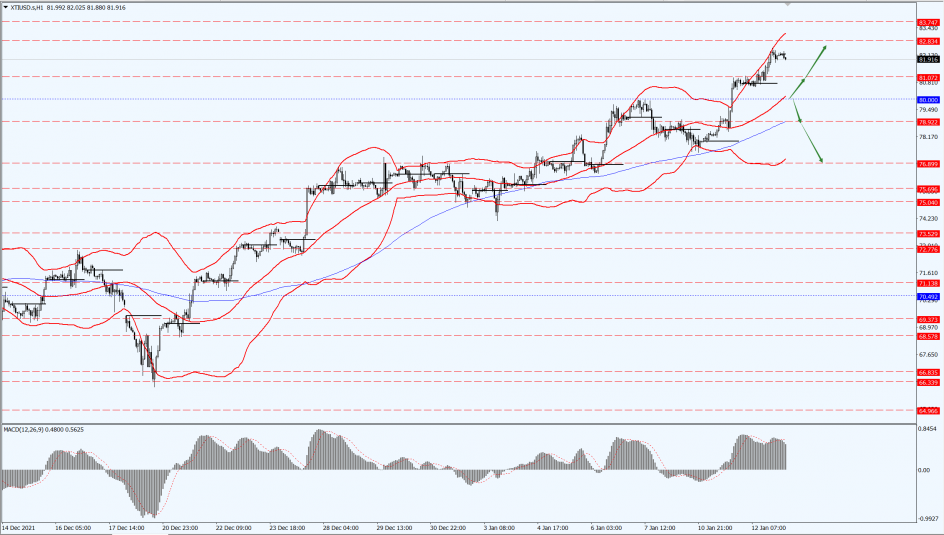

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 80-line today. If the oil price runs below the 80-line, then focus on the support at 76.89 and 75.69. If the oil price breaks above the 80-line, then pay attention to the suppression of the 81.07-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home