1. Forex Market Insight

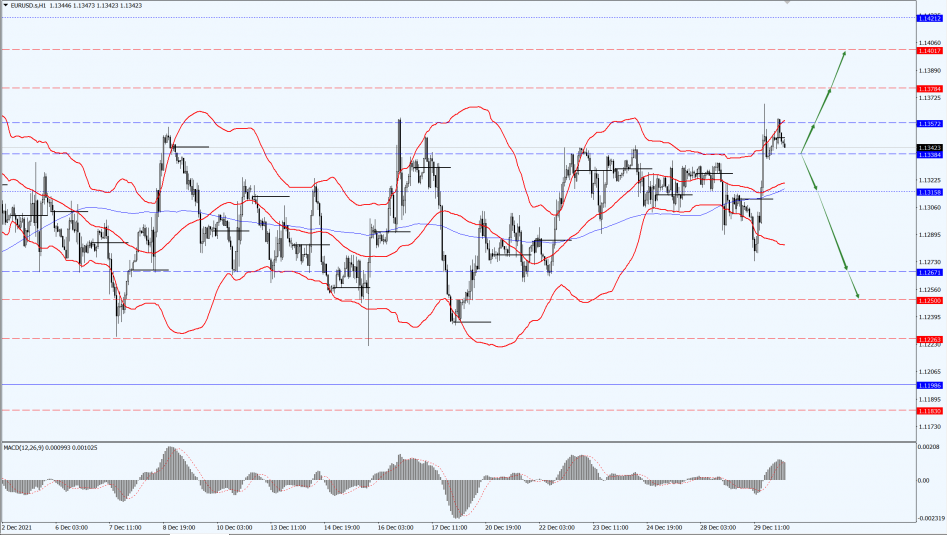

EUR/USD

Although the Omicron variant has caused record high numbers of new cases in many countries, it has not led to the introduction of new and widespread restrictions. As a result, the euro rose by 0.34% against the dollar to 1.1349; at one point in the session, it rose by 0.5% to its highest since 30th November 2021.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the suppression of the 1.1338-line. If the euro runs stably below the 1.1338-line, then pay attention to the support at the lower 1.1315 and 1.1267 positions. If the euro breaks through the 1.1338-line, then pay attention to the suppression at the 1.1359 and 1.1378 positions.

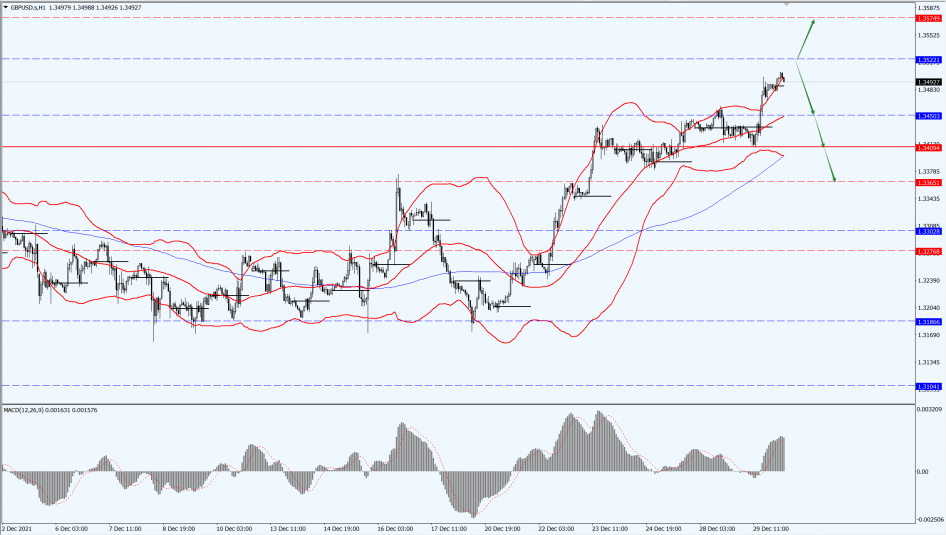

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rose by 0.4% against the dollar to 1.3486, the highest level since 19th November 2021. Meanwhile, the British government bond yields were higher across the board, with the 10-year yield breaking through 1%.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3522-line. If the pound runs below the 1.3522-line, then pay attention to the support at 1.3450 and 1.3409. If the pound runs above the 1.3522-line, then pay attention to the suppression at the 1.3574-line.

2. Precious Metals Market Insight

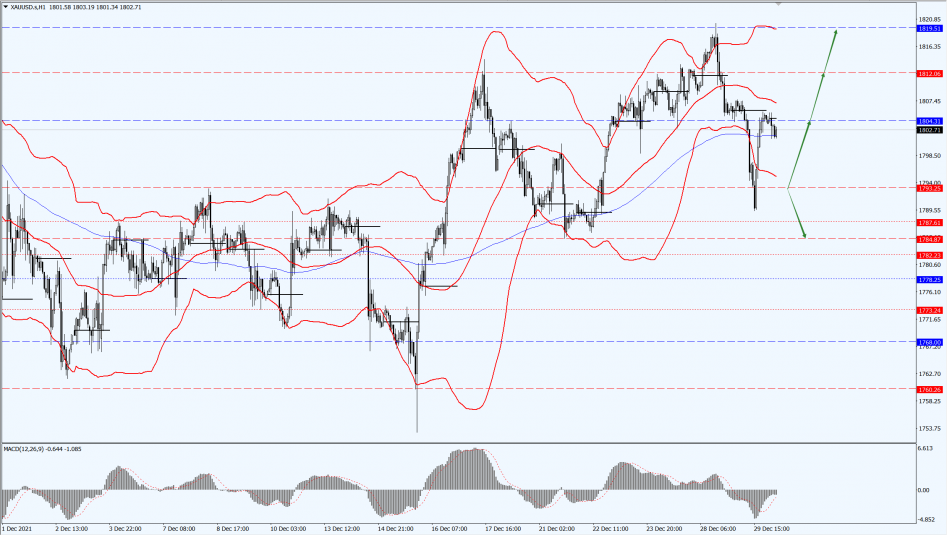

Gold

Fundamental Analysis:

Gold prices bottomed out on Wednesday, 29th December 2021, and fell back to the 1800-mark, as a weaker dollar offset pressure from rising U.S. Treasury yields and increased investor demand for riskier assets. The main focus during the day will be on the initial claims and Chicago PMI. In addition, the European Central Bank will also release its Economic Bulletin.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the 1793-line. If the price of gold runs stably above the 1793-line and maintains the bullish trend, then pay attention to the suppression of the 1812 and 1819 positions. If the gold price drops below the 1793-line again, it will open a further downward space. At that time, pay attention to the support of 1784.

3. Commodities Market Insight

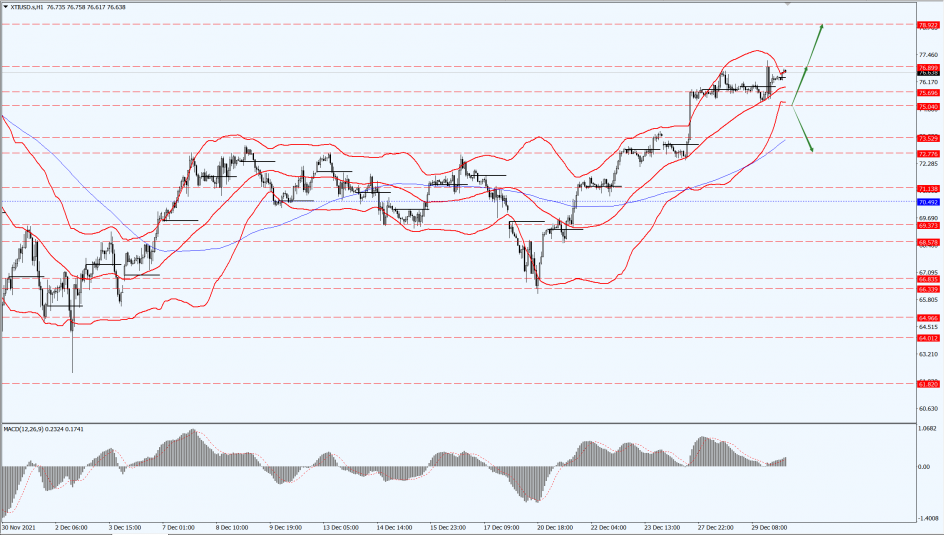

WTI Crude Oil

Fundamental Analysis:

Oil prices extended its gains yesterday to a one-month high of $77.37 per barrel, boosted by 70 record highs for the year in U.S. stocks. EIA data showed that both U.S. crude and refined product inventories fell last week, overshadowing concerns that an increase in Covid-19 cases could pull down demand. Meanwhile, investor concerns about the Omicron strain are easing as the likelihood of imposing further epidemic prevention restrictions is expected to decline.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices pay attention to the 75.04-line. If oil prices run above the 75.04-line, then pay attention to the suppression of the 76.89 and 78.92 positions. If the oil price breaks below the 75.04 line, then pay attention to the support at the 73.52 and 72.77 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.