1. Forex Market Insight

EUR/USD

In Europe, the attitude towards monetary policy has begun to change. Villeroy de Gallo, a member of the European Central Bank Governing Council and the governor of the Bank of France indicated that the European Central Bank should raise the deposit rate to a positive value this year.

His comments suggest he supports at least three rate hikes in the year 2022.

Nagel, the president of the Bundesbank and European Central Bank Governing Council member Nagel also said that the window of time for the central bank to raise interest rates in response to record inflation is slowly closing, implying that he supports an early rate hike.

For this reason, EUR/USD held above 1.05 mark in a slight fluctuation in the foreign exchange market on Monday, 9th May 2022.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the position of 1.0357. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0662 and 1.0776.

GBP Intraday Trend Analysis

Fundamental Analysis:

Last Thursday, 5th May 2022, the Bank of England raised interest rates to the highest level since 2009. Yet, it warned that the economy was at risk of recession.

However, some members of the Bank of England believe that the neutral interest rate in the UK should be higher than 1, and if inflation expectations continue to rise, UK interest rates may need to be higher than the neutral level.

In the foreign exchange market on Monday, 5th May 2022, GBP continued to struggle at low levels.

Technical Analysis:

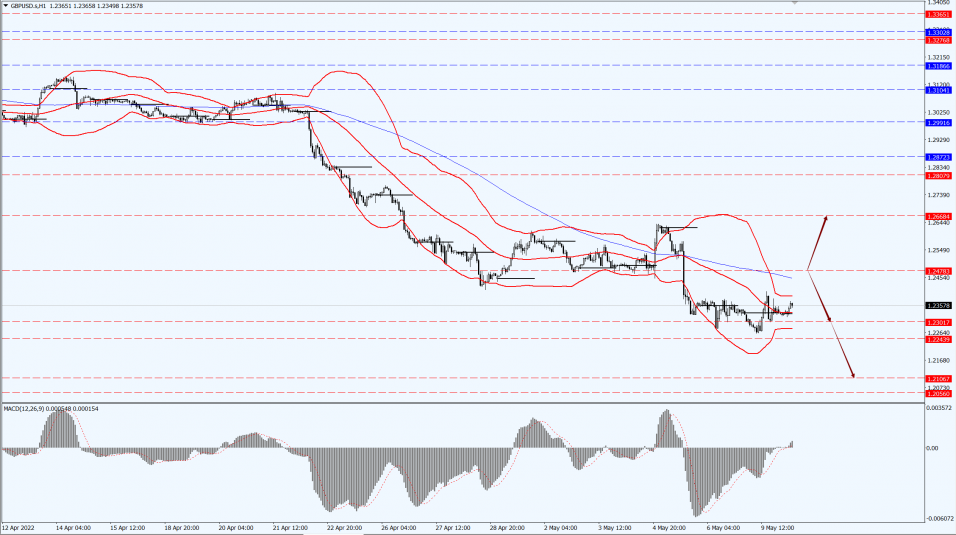

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2478-line today. If GBP runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2243 and 1.2106. If GBP runs above the 1.2478-line, then pay attention to the support strength of the position of 1.2668.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices continued to retreat on Monday, 9th May 2022, falling more than 1 percent, with gold’s appeal waning as the dollar hovers at nearly 20-year highs. Spot gold fell 1.4% to close at $1,853.92 an ounce.

U.S. gold futures fell 1.3% to close at $1,858.60 an ounce.

The dollar has moved sharply higher as the market expects the Federal Reserve to take a more aggressive policy, which in turn has put pressure on gold.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1855-line today. If the gold price runs steadily above the 1855-line, then it will pay attention to the support strength of the 1869 and 1892 positions. If the gold price breaks below the 1855-line, then pay attention to the suppression strength of the two positions of the 1844 and 1830.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices plunged more than 6% yesterday, 9th May 2022, joining stocks in a big drop, as the continued implementation of epidemic closures in major Asian countries added to concerns about the demand outlook.

Brent crude oil futures fell $6.45, or 5.7%, to settle at $105.94 a barrel. U.S. crude futures fell $6.68, or 6.1%, to settle at $103.09 a barrel.

So far, both contracts are up about 35% this year.

Global financial markets have been nervous over interest rate hikes and recession fears, Furthermore, tighter sealing controls in large Asian countries led to slower export growth in April.

The coronavirus lockdown in major Asian countries is having a negative impact on oil markets, which have been selling off along with equities.

China’s crude oil imports in April rose nearly 7% from a year earlier, but imports from January to April fell 4.8% from a year earlier.

In April, China’s oil imports from Iran were lower than the highs set in late 2021 and early 2022. Independent refiners’ demand for Iranian oil weakened amid sequestration measures cracking down on fracking margins and increasing imports of lower-priced Russian oil.

The dollar hit a nearly 20-year high, which also made oil prices more expensive for holders of other currencies. In addition, Saudi Arabia, the world’s largest oil exporter, cut its official selling price of crude oil to Asia and Europe for June.

Technical Analysis:

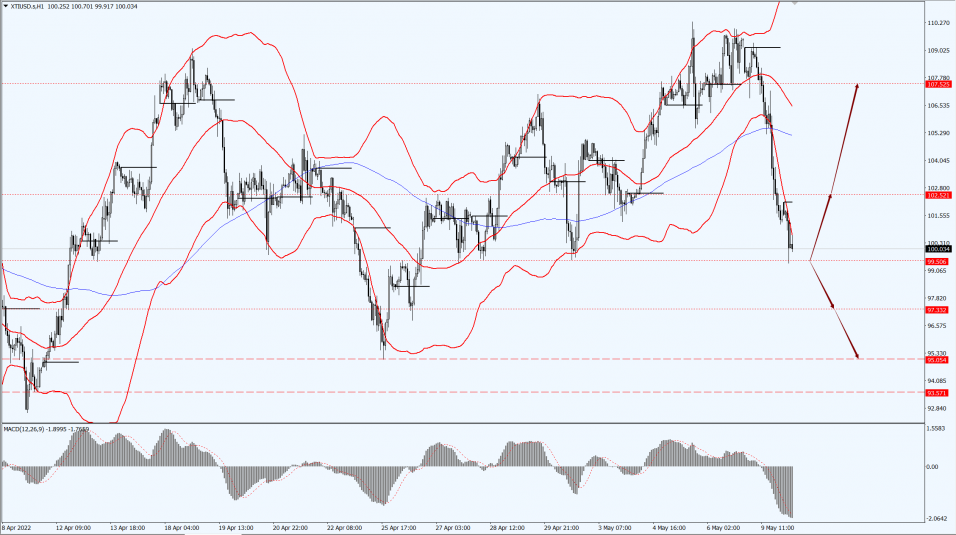

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 99.50-line today. If the oil price runs above the 99.50-line, then focus on the suppression strength of the two positions of 102.52 and 107.52. If the oil price runs below the 99.50-line, then pay attention to the support strength of the two positions of 97.33 and 95.05.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.