1. Forex Market Insight

EUR/USD

U.S. housing fell to their lowest level in nearly 1-1/2 years in July, weighed down by higher mortgage rates and building materials prices, data showed on Tuesday, 16th August 2022.

Industrial production, meanwhile, rose to a record high in July.

The euro turned up from down, after data showed German investor confidence fell slightly in August, as fears of rising living costs will hit private consumption after the euro once fell.

Europe is battling an energy crisis after sanctions were imposed on Russia for its invasion of Ukraine.

Germany on Tuesday, 16th August 2022, secured a commitment from major gas importers to keep two floating liquefied natural gas (LNG) terminals fully supplied starting this winter to reduce its dependence on Russian fuel, as Russia warned that sky-high gas prices could jump again.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0190-line today. If EUR runs steadily below the 1.0190-line, then pay attention to the support strength of the two positions of 1.0116 and 09999. If the strength of EUR breaks above the 1.0190-line, then pay attention to the suppression strength of the two positions of 1.0277 and 1.0357.

GBP Intraday Trend Analysis

Fundamental Analysis:

Official data released Tuesday, 16th August 2022, showed more signs of cooling in Britain’s super-hot job market, with companies more cautious about hiring and a record drop in basic wages for laborers after a spike in inflation-adjusted wages.

In the three months to June, the U.K. unemployment rate, as expected in a Reuters poll, remained at 3.8 percent, near its lowest level in half a century.

The Bank of England is closely monitoring labor market data for signs of cooling inflationary pressures, but the mixed data are unlikely to have an impact on next month’s policy decision.

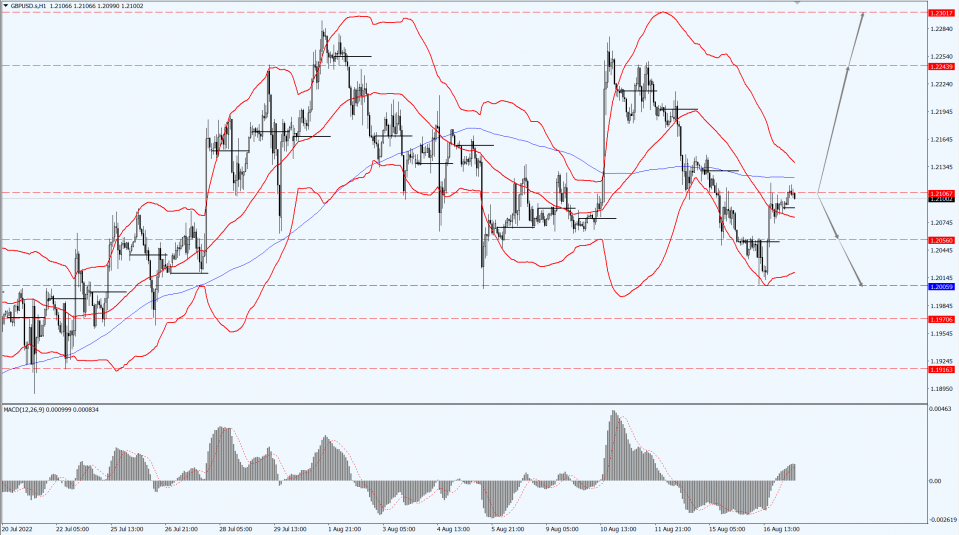

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2106-line today. If GBP runs below the 1.2106-line, it will pay attention to the suppression strength of the two positions of 1.2056 and 1.2005. If GBP runs above the 1.2106-line, then pay attention to the suppression strength of the two positions of 1.2243 and 1.2301.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell on Tuesday, 16th August 2022, as the dollar held near a three-week high. Gold prices advanced on Friday, 12th August 2022, with the help of falling U.S. Treasury yields and are poised for a fourth straight week of gains as investors assess recent U.S. inflation data.

The dollar held near a three-week high hit earlier in the session as investors awaited the release of minutes from the Federal Reserve’s last meeting from which to find direction on rate hikes.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1783-line today. If the gold price runs steadily below the 1783-line, then it will pay attention to the support strength of the 1768 and 1760 positions. If the gold price breaks above the 1783-line, then pay attention to the suppression strength of the two positions of the 1793 and 1812.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell nearly 1% on Tuesday, 16th August 2022, to their lowest point since before the conflict between Russia and Ukraine.

As the economic data raised concerns that the global economy could fall into recession, while the market awaits the outcome of negotiations on the resumption of a deal that could allow Iran to export more oil.

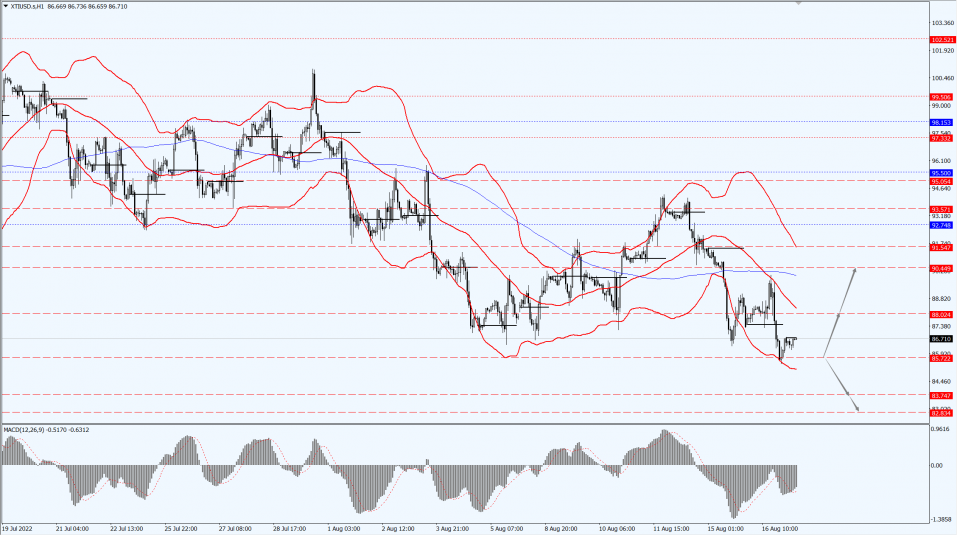

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 85.72-line today. If the oil price runs above the 85.72-line, then focus on the suppression strength of the two positions of 88.02 and 90.44. If the oil price runs below the 85.72-line, then pay attention to the support strength of the two positions of 83.74 and 82.83.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.