1. Forex Market Insight

EUR/USD

They are starting to consider the slower pace of rate hikes that Lagarde indicated last December, according to officials briefed on discussions among ECB policymakers.

The officials said that while the 50 basis point hike hinted at by Lagarde in February is still possible, the prospect of a modest 25 basis point hike at the next meeting in March is gaining support. The news, although unconfirmed, weighed on the euro that day.

Technical Analysis:

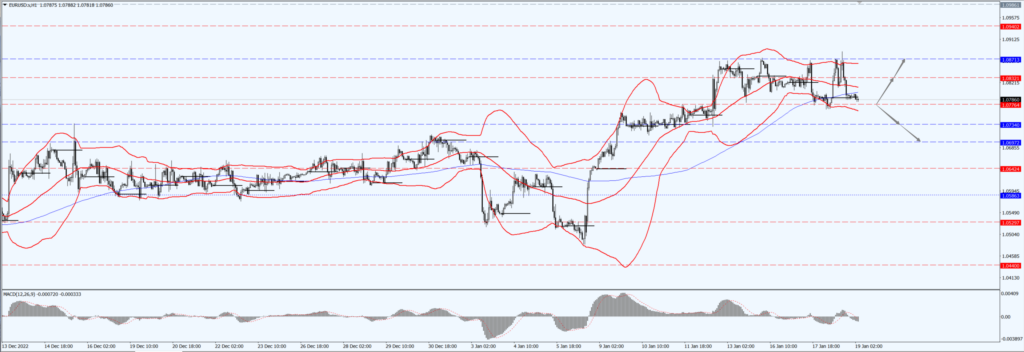

(EUR/USD 1-hour Chart)

We focus on the 1.0776 line today. If the EUR runs below the 1.0776 line, then pay attention to the support strength of the two positions of 1.0734 and 1.0697. If the strength of EUR rises over the 1.0776 line, then pay attention to the suppression strength of the two positions of 1.0832 and 1.0871.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Office for National Statistics said average weekly pay, net of bonuses, rose 6.4% year-on-year between September and November, the largest increase since records began in 2001, which excludes abnormal increases due to city closures and government subsidy measures during the epidemic.

The Office for National Statistics said the U.K. unemployment rate remained at 3.7% over the same period, in line with market forecasts and near its lowest level in nearly 50 years.

The data showed a tight labor market and accelerating wage growth, adding to the Bank of England’s inflation concerns and raising market expectations that the BoE will continue to raise interest rates. This is one of the main reasons why the pound is currently well-supported.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2298-line today. If GBP runs below the 1.2298-line, it will pay attention to the suppression strength of the two positions of 1.2222 and 1.2147. If GBP runs above the 1.2298-line, then pay attention to the suppression strength of the two positions of 1.2445 and 1.2540.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell Wednesday, 18th January 2023, giving back earlier gains made on weak U.S. economic data, but remained above the $1,900 level as key Federal Reserve policymakers signaled their intention to continue raising interest rates to fight inflation.

Spot gold fell 0.2% to $1,904.84 an ounce, after hitting a daily low of $1,896.32 earlier.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1899-line today. If the gold price runs below the 1899-line, then it will pay attention to the support strength of the 1892 and 1880 positions. If the gold price breaks above the 1899-line, then pay attention to the suppression strength of the two positions of 1909 and 1919.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell about 1% Wednesday, giving back earlier gains, as concerns about a possible U.S. recession overshadowed optimism that lifting new crown restrictions would boost demand for its crude.

Two major indicators of crude oil touched their highest since Dec. 5 at one point during the session. U.S. crude closed lower for the first time in nine trading days.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 79.28 – line today. If the oil price runs above the 79.28 -line, then focus on the suppression strength of the two positions of 80.13 and 81.31. If the oil price runs below the 79.28 -line, then pay attention to the support strength of the two positions of 78.14 and 76.94.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.