1. Forex Market Insight

EUR/USD

On Friday, 14th October 2022, the EUR/USD closed down 0.55% at 0.9723, economic risks are still a main negative factor for the EUR.

The macroeconomic outlook in Europe is bleak and the inflation will continue to rise.

Russian-Ukrainian War is taking a growing toll on the European economy, Russian natural gas deliveries to European have dropped more than 80%. The burden of soaring energy prices, rising costs of business and living have led to an inflationary crisis in Europe.

Moreover, the European Central Bank rate hike is also putting the EUR under pressure.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9810 line today. If the EUR runs below the 0.9810 line, then pay attention to the support strength of the two positions of 0.9770 and 0.9701. If the strength of EUR breaks above the 0.9810 line, then pay attention to the suppression strength of the two positions of 0.9852 and 0.9909.

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound fell sharply against the dollar on Friday, 14th October 2022, closing down 1.32% at 1.1176.

This comes after British Prime Minister Alex Truss replaced Chancellor of the Exchequer Kwarteng and eliminated parts of their economic program. These programs wreaked havoc on the financial markets of the UK.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1378-line today. If GBP runs below the 1.1378 -line, it will pay attention to the suppression strength of the two positions of 1.1250 and 1.1183. If GBP runs above the 1.1378 -line, then pay attention to the suppression strength of the two positions of 1.1421 and 1.1501.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell more than 1% on Friday, 14th October 2022 and were headed for their worst week since mid-August, dragged lower by a stronger U.S. dollar and worries over the Federal Reserve potentially continuing with big rate hikes to curb inflation.

Data on Thursday, 13th October 2022 showed U.S. consumer prices increased more than expected in September, providing ammunition to the Fed to deliver another big rate hike, and consequently setting up what could be gold’s worst week in nearly two months.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1642-line today. If the gold price runs below the 1642-line, then it will pay attention to the support strength of the 1627 and 1616 positions. If the gold price breaks above the 1642-line, then pay attention to the suppression strength of the two positions of the 1660 and 1680.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices plummeted more than 4% on Friday, 14th October 2022, as global recession fears and weak oil demand, outweighed support from a large cut to the OPEC+ supply target.

The Brent and WTI contracts both oscillated mostly above and below flat on Friday, 14th October 2022, but fell for the week by 6.4% and 7.6%, respectively.

Technical Analysis:

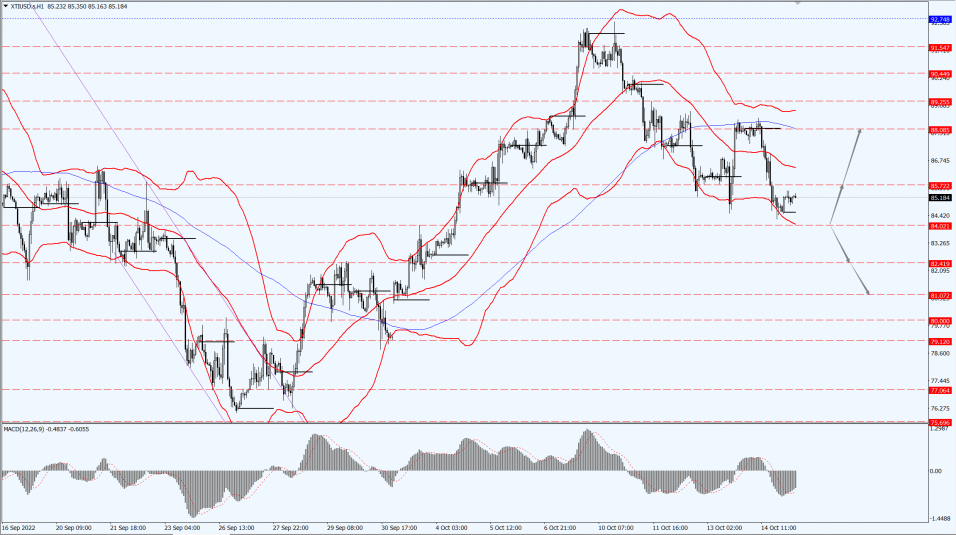

(Crude Oil 1-hour Chart)

Oil prices focus on the 84.02-line today. If the oil price runs above the 84.02-line, then focus on the suppression strength of the two positions of 85.72 and 88.08. If the oil price runs below the 84.02-line, then pay attention to the support strength of the two positions of 82.41 and 81.07.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.