EUR/USD closed down 1.01% at 0.9884 on Wednesday, 5th October 2022.

Economic risks in the eurozone remain a major factor in the negative for the euro.

A survey showed that the eurozone business activity fell sharply in September, which may make the eurozone to avoid recession hopes into thin air.

Eurozone September composite PMI final value of 48.1, expected 48.2, the previous value of 48.2, down to a 20-month low.

The index is considered a good indicator of the health of the economy, with a drop below 50 indicating a contraction.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9909 and 0.9864. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP was down 1.1% at $1.1344 after six consecutive sessions of gains.

GBP extended its losses slightly after British Prime Minister Tony Truss pledged to reduce the debt-to-gross domestic product ratio.

And just over a week ago, the government’s plan to cut taxes and increase borrowing shocked the market.

Data showed that private sector economic activity in the U.K. fell the most since early 2021 last month, adding to pressure on the pound.

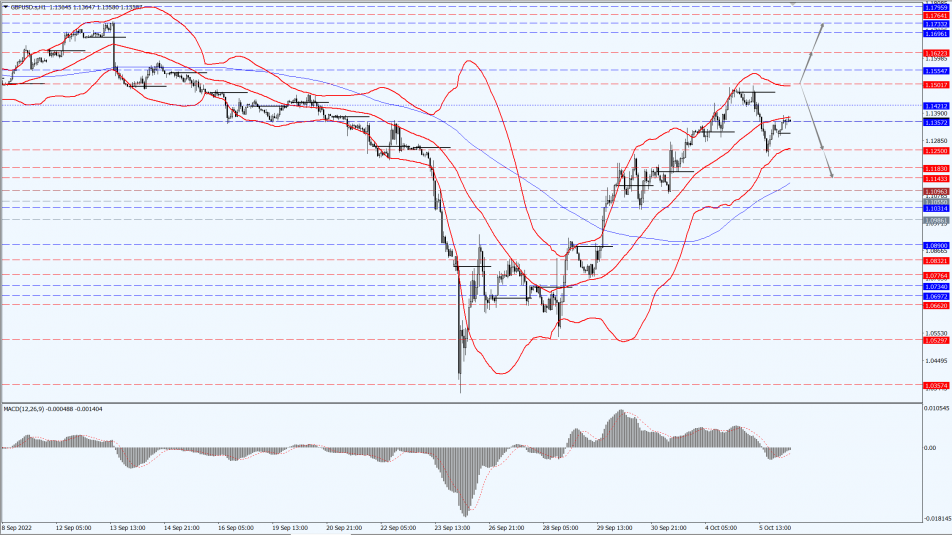

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1501-line today. If GBP runs below the 1.1501-line, it will pay attention to the suppression strength of the two positions of 1.1250 and 1.1143. If GBP runs above the 1.1501-line, then pay attention to the suppression strength of the two positions of 1.1622 and 1.1733.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices slipped more than 1% on Wednesday, 5th October 2022, hurt by a jump in the dollar and U.S. Treasury yields, with upcoming U.S. jobs data likely to influence the Federal Reserve’s path to rate hikes.

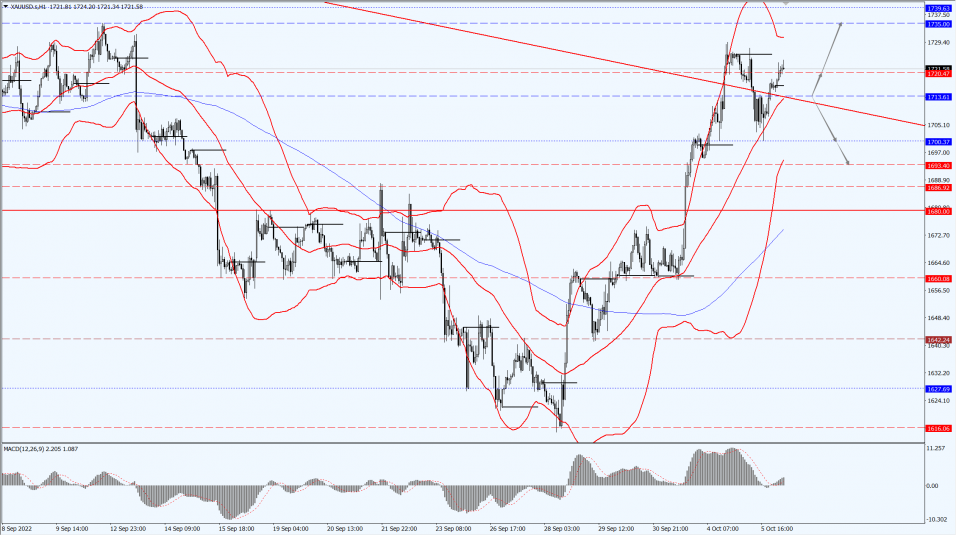

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1713-line today. If the gold price runs steadily below the 1713-line, then it will pay attention to the support strength of the 1693 and 1686 positions. If the gold price breaks above the 1713-line, then pay attention to the suppression strength of the two positions of the 1720 and 1735.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices hit a three-week high on Wednesday, 5th October 2022, after OPEC+ agreed to the deepest production cuts since the new crown epidemic in 2020, despite tight markets and opposition from the U.S. and other countries.

Oil prices were also boosted by U.S. government data showing that both crude oil and refined oil inventories fell last week.

Both indicators have risen sharply in the past two days.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 85.72-line today. If the oil price runs above the 85.72-line, then focus on the suppression strength of the two positions of 88.08 and 89.25. If the oil price runs below the 85.72-line, then pay attention to the support strength of the two positions of 84.02 and 82.41.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.