1. Forex Market Insight

EUR/USD

The dollar rose 0.804% to 114.05 against a basket of currencies =USD on Monday, 26th September 2022, having earlier touched the highest since May 2002 at 114.58.

EUR/USD also touched a new 20-year low of $0.9528, ending the day down 0.81%.

In the economy, the eurozone manufacturing PMI preliminary value of 48.5% in September, services PMI preliminary value of 48.9%, comprehensive PMI preliminary value of 48.2%, are significantly lower than the 50% critical level, the eurozone economy showed signs of recession.

And with the European energy crisis festering, the weakness of EUR/USD remains difficult to be eased.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9701-line today. If EUR runs steadily below the 0.9701-line, then pay attention to the support strength of the two positions of 0.9620 and 0.9559. If the strength of EUR breaks above the 0.9701-line, then pay attention to the suppression strength of the two positions of 0.9770 and 0.9810.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP plunged as much as 5% against the dollar when trading resumed in Asia on Monday, 26th September 2022, hitting $1.0327, the weakest on record, before recovering most of the day’s losses in European trading.

As investors are concerned that Britain’s new economic plan will damage the country’s fiscal position, and the Bank of England said it is watching financial marktes “very closely” after the sharp fluctuations in asset prices.

The market’s reaction suggests that investors have lost confidence in the government’s approach, causing a degree of volatility that has reduced the pound to the same position as some emerging market currencies.

Now it seems likely that the Bank of England will be forced to raise interest rates sharply at its upcoming November meeting. Let’s see if we can then stem the weak pattern of a sharp drop in the pound.

Technical Analysis:

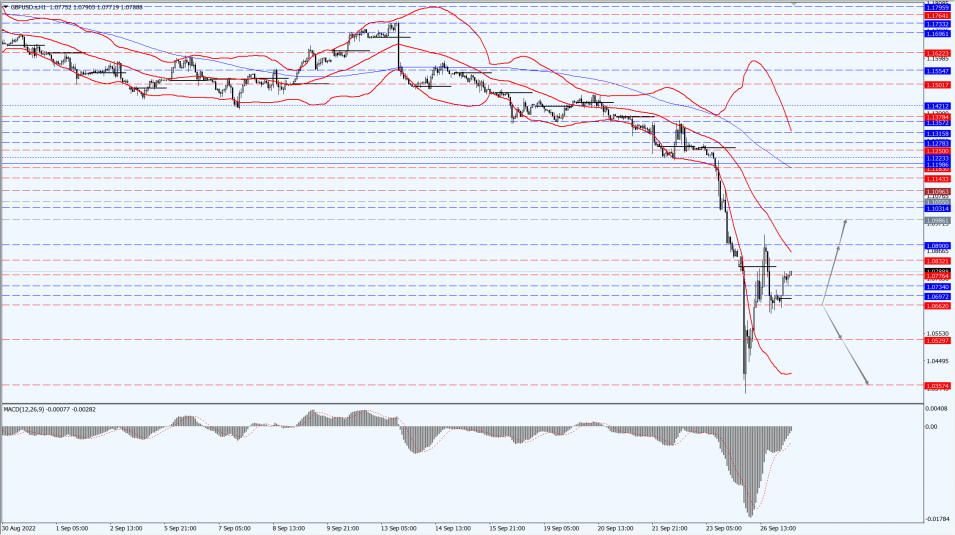

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.0662-line today. If GBP runs below the 1.0662-line, it will pay attention to the suppression strength of the two positions of 1.0529 and 1.0357. If GBP runs above the 1.0662-line, then pay attention to the suppression strength of the two positions of 1.0890 and 1.0986.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold has fallen more than $400, or more than 20%, since breaking through the key $2,000 per ounce level in March as major central banks raise interest rates.

In the physical gold market, data on Monday, 26th September 2022, showed that net gold imports by the big Asian country jumped nearly 40% in August to the most in more than four years.

Technical Analysis:

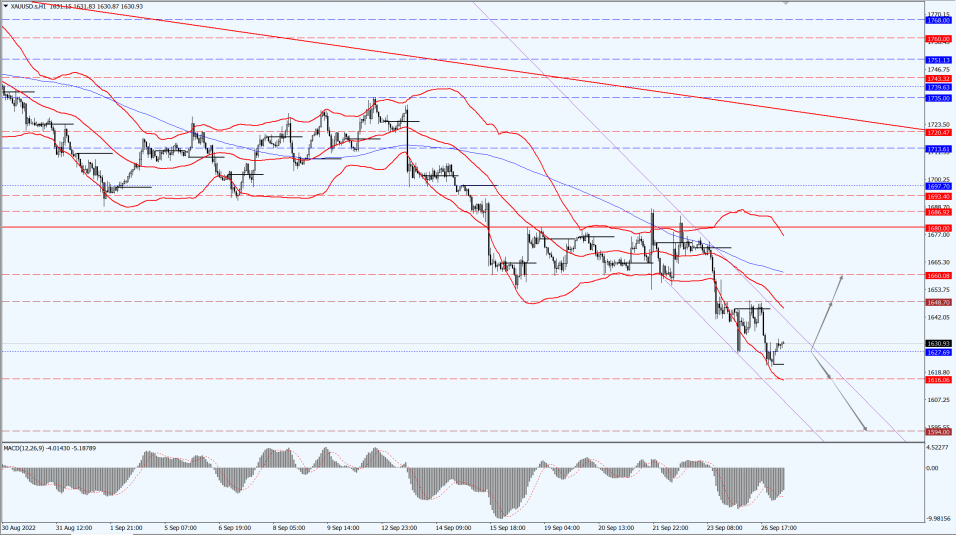

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1627-line today. If the gold price runs steadily below the 1627-line, then it will pay attention to the support strength of the 1616 and 1594 positions. If the gold price breaks above the 1627-line, then pay attention to the suppression strength of the two positions of the 1648 and 1660.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell $2 to close at a nine-month low in shaky trading Monday, 26th September 2022, weighed down by a stronger dollar as market participants awaited details of new sanctions against Russia.

Both contracts were up earlier in the session, after falling heavily by about 5% on Friday, 23rd September 2022. The dollar index hit a 20-year high, weighing on demand for dollar-denominated oil.

Luft data show that the strong dollar has had the biggest impact on oil prices in more than a year.

Technical Analysis:

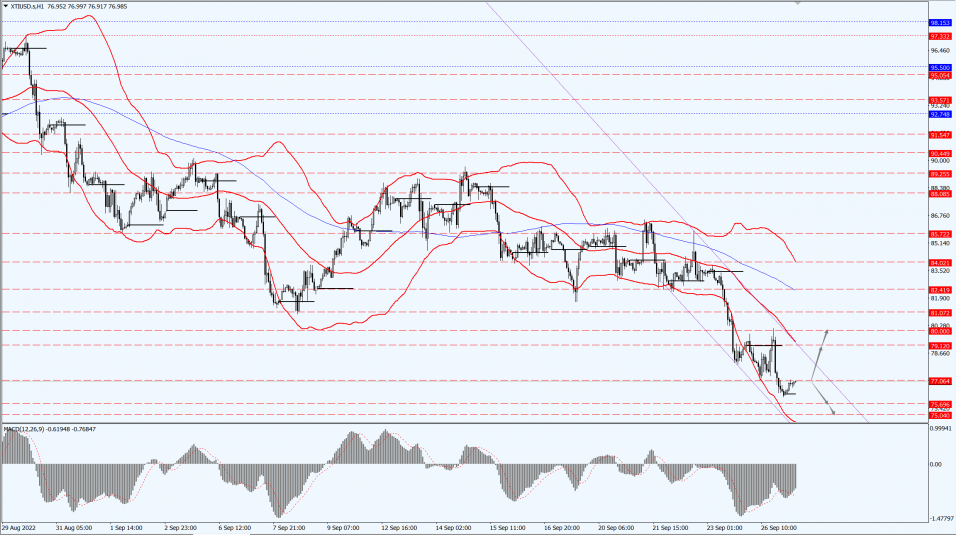

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 77.06-line today. If the oil price runs above the 77.06-line, then focus on the suppression strength of the two positions of 79.12 and 80.00. If the oil price runs below the 77.06-line, then pay attention to the support strength of the two positions of 75.69 and 75.04.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.