1. Forex Market Insight

EUR/USD

Senior Fed officials continue to put hawk, and data show that the U.S. economy has not fallen into recession, inflation has topped foreshadowing, boosting the dollar, but before the release of the U.S. non-farm payrolls this Friday, 5th August 2022, market sentiment is cautious, the dollar maintained in the rally high pull.

Among non-U.S. assets, European currencies are consolidating around key support, still waiting for clear direction.

As this week’s non-farm payrolls for the Fed’s interest rate resolution statement to data speak after the first heavy economic data, the market expects to seek clues from the future rate hikes, until then, market volatility may be cautious.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0190-line today. If EUR runs steadily below the 1.0190-line, then pay attention to the support strength of the two positions of 1.0116 and 0.9999. If the strength of EUR breaks above the 1.0190-line, then pay attention to the suppression strength of the two positions of 1.0277 and 1.0357.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD was down 0.8% at 1.2066.

The Bank of England (BoE) raised interest rates by 50 basis points last Thursday, the most in 27 years, despite warnings that a prolonged recession was looming as the central bank moved quickly to curb rising inflation.

BoE warned that the economy will start to shrink from the fourth quarter.

Technical Analysis:

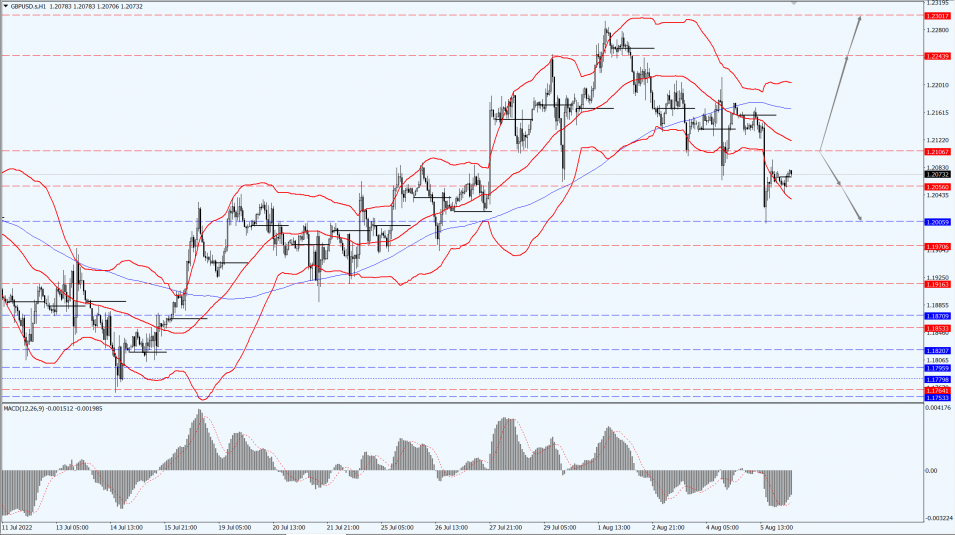

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2106-line today. If GBP runs below the 1.2106-line, it will pay attention to the suppression strength of the two positions of 1.2056 and 1.2005. If GBP runs above the 1.2106-line, then pay attention to the suppression strength of the two positions of 1.2243 and 1.2301.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices extended their losses on Friday, 5th August 2022, sliding nearly 1%.

An unexpectedly strong U.S. jobs report eased recession fears and dashed speculation that the Federal Reserve would abandon aggressive monetary tightening.

U.S. job growth unexpectedly accelerated in July, with jobs increasing to levels above those seen before the outbreak.

The unemployment rate fell to a pre-epidemic low of 3.5% from 3.6% in June.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1768-line today. If the gold price runs steadily below the 1768-line, then it will pay attention to the support strength of the 1760 and 1751 positions. If the gold price breaks above the 1768-line, then pay attention to the suppression strength of the two positions of the 1783 and 1793.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed higher on Friday, 5th August 2022, recovering some of the ground lost last week on strong U.S. job growth data, but closed last week at their lowest level since February on concerns that a recession could hit fuel demand.

Last week, oil traders were concerned about inflation, economic growth and demand, but signs of tight supply gave support to oil prices.

The number of active U.S. rigs fell seven to 598 in the week ended 5th August 2022, the first weekly decline in 10 weeks, energy services firm Baker Hughes said in its much-anticipated report on Friday, 5th August 2022.

Supply remains relatively tight and the near-month contract price remains higher than the far-month contract price, a market structure known as the inverse spread.

OPEC and its allies, which make up OPEC+, agreed last week to raise their oil production target by 100,000 barrels per day in September, but it was one of the smallest increases since the production quota system was introduced in 1982, data from the Organization of Petroleum Exporting Countries (OPEC) showed.

The U.S. Treasury Department said on Friday, 5th August 2022, that a senior official from the department will visit Indonesia and Singapore this week to discuss with counterpart officials possible price restrictions on Russian oil exports in response to the conflict between Russia and aggression against Ukraine.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 88.02-line today. If the oil price runs above the 88.02-line, then focus on the suppression strength of the two positions of 90.44 and 91.54. If the oil price runs below the 88.02-line, then pay attention to the support strength of the two positions of 85.72 and 83.74.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.