1. Forex Market Insight

EUR/USD

The euro posted a 0.3% loss against the dollar, ending up at 0.14% or 1.1772.

With this, short-term investors pulled out of dollar longs after the release of the German business confidence data, even though the indicator fell more than economists have expected in August.

In addition, the European Treasury yields rose after Luis de Guindos, Vice-President of the European Central Bank (ECB), said that the central bank is expected to raise economic growth expectations.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, the euro remains its focus on the 1.1773-line. If the euro’s strength sits above the 1.1773-line, it will open up a greater upside potential. At that time, pay attention to the two positions, 1.1795 and 1.1820 of the suppression strength. If the euro falls under the pressure of 1.1773, then pay attention to the two positions,1.1753 and 1.1728 for support.

GBP Intraday Trend Analysis

Fundamental Analysis:

The British government is considering Covid booster vaccine shots for most vulnerable groups.

A recent study in the U.K. shows that the effectiveness of Pfizer’s Covid-19 vaccine dropped from 88% to 74% within six months of vaccination, while the effectiveness of the AstraZeneca vaccine dropped from 77% to 67% after four to five months.

In response, the study’s lead researcher said a vaccine booster program needs to be discussed soon. The U.K. government is considering offering a third dose of the vaccine to the elderly and high-risk groups and is awaiting data as a basis for this decision.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

Yesterday, the British pound rose again and approached the target level of 1.3777. Today, the main focus is on the suppression of the 1.3777-line. If the pound falls under pressure near the 1.3777-line, attention should be paid on the support at 1.3721 and 1.3669. If the pound’s strength breaks above 1.3777, then it will open up a further upside potential. At that time, pay attention to the suppression of the two positions at 1.3816 and 1.3841.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

As the U.S. Treasury yields moved higher, gold prices accelerated their decline after falling below the key support level of $1,800, while spot gold fell by 0.67%.

Upon this, the Jackson Hole meeting is set for this Thursday,26th August 2021, and will be going on until Saturday,28th August 2021, coupled with the Fed Chairman Jerome Powell’s speech on Friday, 27th August 2021.

According to an agency survey, three-quarters of economists expect the symposium or the Fed’s 21st – 22nd September policy meeting to when the signal the tapering will begin.

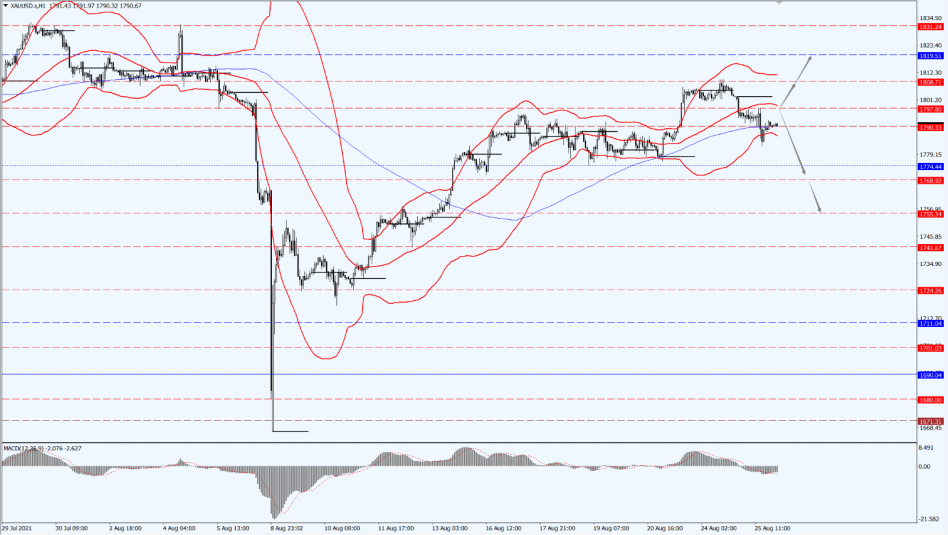

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Yesterday, the price of gold fluctuated downwards. Today, on the price of gold, pay attention to the 1797-line. If the price of gold runs below the 1797-line, then pay attention to the support at 1768 and 1755 below. If the gold price rises above the 1797-line again, then attention should be paid to the 1808 and 1819-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose all the way, for the third consecutive day, with the WTI crude oil futures rising by 1.2% to a high in more than a week.

The U.S. Energy Information Administration (EIA) reported that the U.S. crude oil supply fell to its lowest level since January 2020, while refined oil stocks rose slightly.

U.S. Cushing Crude Oil Inventories stocks rose for the first time since early June, while gasoline stocks fell by 2.24 million barrels last week. The decline in crude stocks coincided with an increase in net oil imports, constituting a bullish signal. This indicates that the Delta strain will not affect oil demand, at least not for crude oil and gasoline.

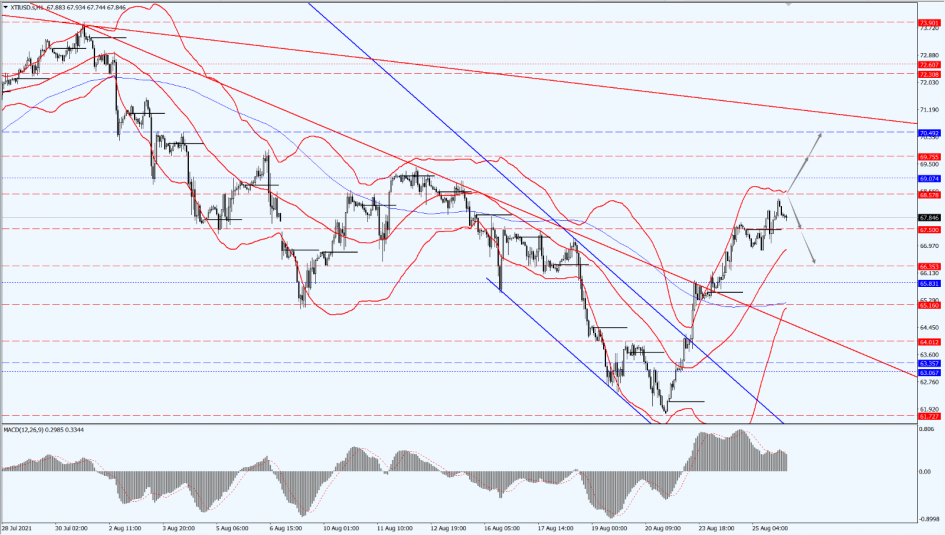

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Yesterday, oil prices continued to rise and approached the target level of 68.57. Today, focus on the 68.57-line. If the oil price breaks above the 68.57-line, it will open up a further upside potential. At that time, we will pay attention to the suppression at 69.75 and 70.49 in turn. If the oil price falls below 67.50, it will open up further room for a callback. At that time, pay attention to the 66.35-line of support.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.