1. Forex Market Insight

EUR/USD

The euro also took a hit after Gazprom said the Nord Stream 1 pipeline, which supplies gas from Russia to Europe via the Baltic Sea floor, would be closed for repairs from 31st August 2022 to 2nd September 2022.

Although the euro fell to parity against the dollar at one point and now continues to hover near parity, many investors have not given up on continuing to short the euro.

According to the Bank of New York Mellon, concerns about the deteriorating economic situation in Europe and increasing geopolitical risks.

Investors’ bearish sentiment towards the euro has now surpassed the levels seen in October 2020, when the effects of the new crown epidemic were wreaking havoc around the world.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.09999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9938 and 09864. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound fell 2.55% against the dollar last week to 1.1825, its biggest weekly loss since September 2020.

The Bank of England interest rate hike is expected to cool and the recession has become the two biggest negative for the pound. British Prime Minister candidate Truss said: “The UK recession is feared to be inevitable”.

Since the beginning of this year, prices in the UK have soared and inflation has severely squeezed the quality of life of the people. Some analysts believe that the UK inflation problem will continue to worsen until the end of this year.

The latest figures released by the Office for National Statistics show that the UK’s Consumer Price Index (CPI) rose by 10.1% year-on-year in July, the highest since February 1982, making the UK the first major developed economy to reach double-digit price rises.

Data on 16th August 2022 showed that real wage earnings of employed UK workers fell by 3% in the second quarter of this year, after allowing for inflation, the ninth consecutive month-on-month fall and the biggest fall in the wage earnings of UK residents in more than 20 years.

The International Monetary Fund warned in July this year that the UK would be the slowest growing of the G7’s richest economies by 2023.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1795-line today. If GBP runs below the 1.1795-line, it will pay attention to the suppression strength of the two positions of 1.1764 and 1.1733. If GBP runs above the 1.1795-line, then pay attention to the suppression strength of the two positions of 1.1853 and 1.1916.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell for a fifth straight session on Friday, 19th August 2022, marking the longest sustained round of declines since November last year, with gold’s appeal waning as the dollar strengthens and the US sees more interest rate hikes.

Technical Analysis:

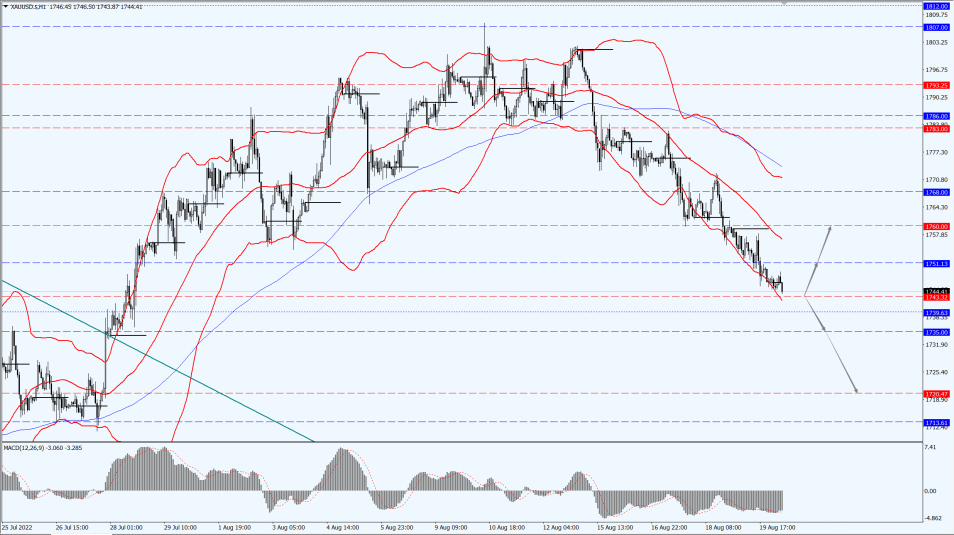

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1743-line today. If the gold price runs steadily below the 1743-line, then it will pay attention to the support strength of the 1735 and 1720 positions. If the gold price breaks above the 1743-line, then pay attention to the suppression strength of the two positions of the 1751 and 1760.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices were steady on Friday, 19th August 2022, but fell last week, weighed down by a stronger dollar and concerns that a slowing economy will weaken demand for crude.

Oil prices jumped briefly in choppy trading after Richmond Federal Reserve Bank President Balkin said the Fed would strike a balance between uncertainty about the path of interest rate hikes and their impact on the economy.

But crude oil pared gains as investor concerns about an impending interest rate hike resurfaced.

A stronger dollar hit a five-week high, which also limited crude gains as it made oil more expensive for buyers of other currencies.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 91.54-line today. If the oil price runs above the 91.54-line, then focus on the suppression strength of the two positions of 93.57 and 95.05. If the oil price runs below the 91.54-line, then pay attention to the support strength of the two positions of 88.02 and 85.72.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.