1. Forex Market Insight

EUR/USD

Unless the Europe Central Bank’s policy is tightened, the euro is likely to remain weaker for the rest of the year. The ECB’s trade-weighted euro exchange rate has fallen by more than 5% this year, and the ECB’s dovish stance, coupled with Europe’s greater exposure to the global manufacturing cycle and hesitancy to vaccinate people, have contributed to the euro’s poor performance. The only boost the euro may get before the end of the year is the ECB becoming “less moderate”.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we still pay attention to the 1.1250-line. If the euro runs steadily above the 1.1250-line, we will see the continuity of the euro’s rebound strength. At that time, we will pay attention to the suppression of the upper 1.1338 and 1.1378 positions. If the euro strength drops below the 1.1250-line, then we will pay attention to the support strength of the two positions at 1.1198 and 1.1183.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England is unlikely to proceed with a rate hike this month because of growing uncertainty about the existence of a new strain of Omicron.

A majority of the BoE’s Monetary Policy Committee is expected to decide at its Dec. 16 meeting that they need more time to assess the impact of Omicron and will vote to keep interest rates unchanged at the historically low level of 0.1 percent.

Economists are unsure how the Bank of England might react to the new information on the toxic strain of Omicron. Most economists expect the negative impact of Omicron on GDP to be modest.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is still mainly focused on the 1.3409-line today. If the pound runs below the 1.3409-line, pay attention to the support of the 1.3186-line. If the pound strength rises above the 1.3409-line, then pay attention to the suppression at the 1.3450 and 1.3522 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell slightly on Monday, 6th December 2021, as market concerns about Omicron cooled and the dollar index and U.S. stocks rose to put pressure on gold prices, but potential monetary easing and economic stimulus still helped support gold prices. On intraday, focus on Australia’s December interest rate resolution, the U.S. trade account, etc..

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold still maintains a bearish attitude toward the trend today. Therefore, today we still pay attention to the 1782-line. If the price of gold runs stably below 1782, then pay attention to the support at 1768 and 1760. If the price of gold rebounds to above the 1782-line again, then it will open up further room for rebound. At that time, pay attention to the suppression of the two positions at 1792 and 1804.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose by nearly 6% on Monday as reports of fairly mild early cases of the mutated strain of Omicron eased fears on pandemic prevention and blockades.

Saudi Arabia raised the price of crude oil sold to Asia and the U.S., and indirect talks between the U.S. and Iran on resuming the nuclear deal appeared to have stalled boosting oil prices.

Intraday focus on President Biden’s video call with Russian President Vladimir Putin, China’s trade account, and U.S. trade account. In addition, look out for the Wednesday 1:00 EIA releases monthly short-term energy outlook report, and the 5:30 U.S. API crude oil inventory change for the week ending Dec. 3.

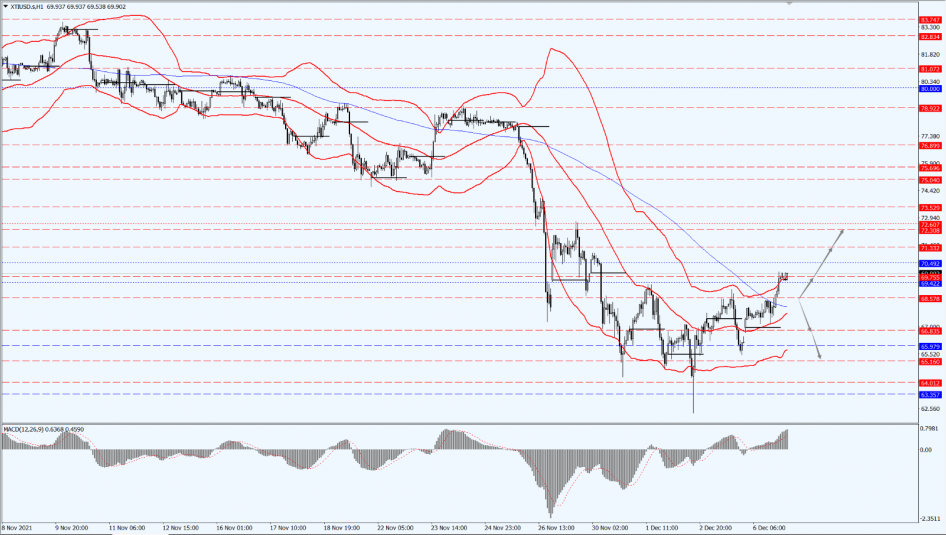

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 65.57-line. If the oil price runs above the 65.57-line, the pressure at 71.33 and 72.30 will be followed in turn. If the oil price drops below 65.57, it will open up further downward space. At that time, pay attention to the strength of support at the 66.83 and 65.16 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.